The dual governance proposed in @hasufl '22 is finally about to be implemented.

stETH holders can express their willingness to exit the protocol by depositing stETH, wstETH, and stETH into a specific escrow contract. Once the locked amount exceeds a certain threshold, the Ragequit mechanism will be triggered.

Lido will directly suspend the execution of any governance proposals until all stETH in escrow has been redeemed as ETH.

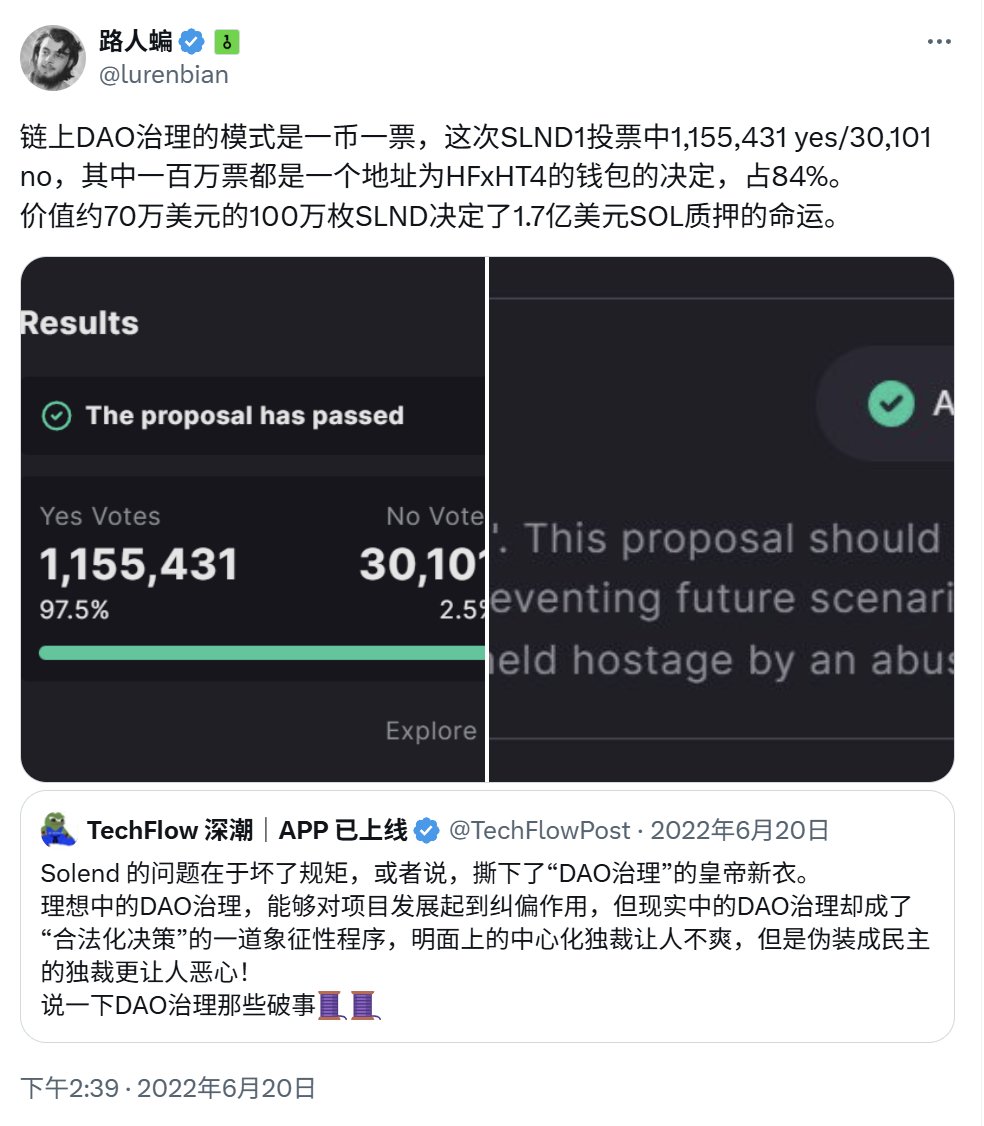

This mechanism design ensures the "creditor's rights > equity" at a superficial level and to a certain extent, which can effectively prevent the problem that arose in the @save_finance of the year - large coin holders use their own equity/governance rights to attack the reasonable rights and interests of large TVL investors in extreme cases.

Dual Governance: Coming Soon

Years in the making, Lido DAO contributors are proud to present an outline for the upcoming release of Dual Governance featuring design & code choices, parameters, deployment & rollout.

51.07K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.