And then the second installment of the reward... Directly removed comp-eth... 😂

The uni that came to me was sold.,There's time to review how I got 1000% annualized uni.。

At the beginning of the subsidy war of unichain, there was a defi OG mining stablecoin counter mine + creating a low-rate pool to earn transaction fees, @Super4DeFi @Cody_DeFi @cmdefi gave me, a defi elementary school student, a deep shock. In addition to admiration, I also began to study the subsidy logic and method of unichain.

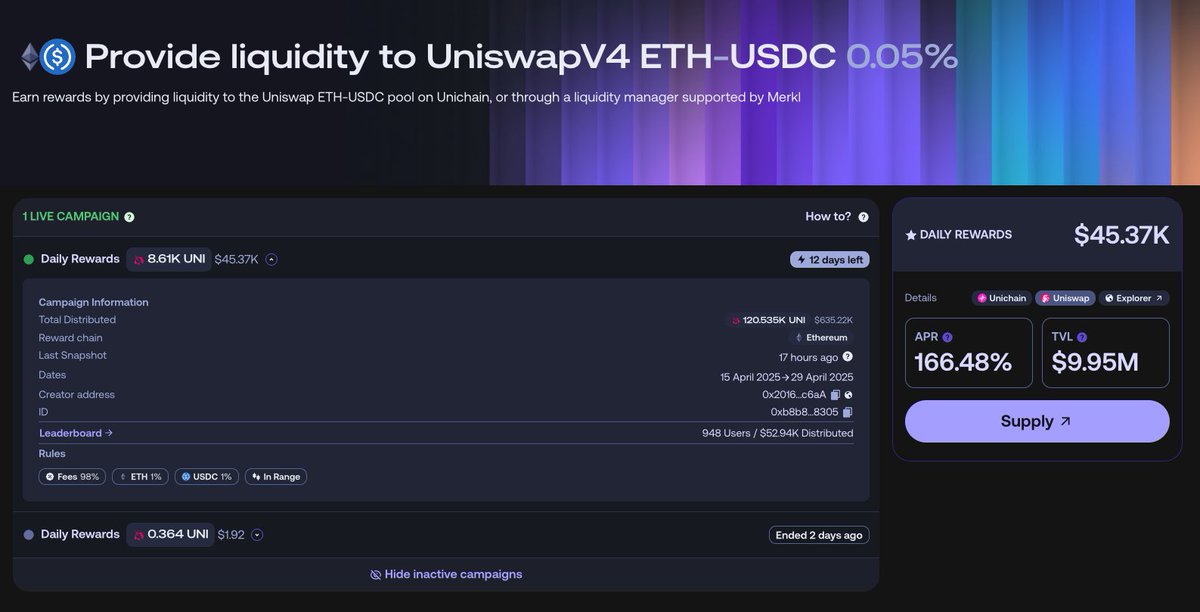

Under the guidance of a god-level I, I found that 98% of Unichain's subsidies are shared based on the transaction fees obtained by the address. In other words, as long as you get a large enough percentage of the transaction fee, then you will get the majority of the UNI subsidy.

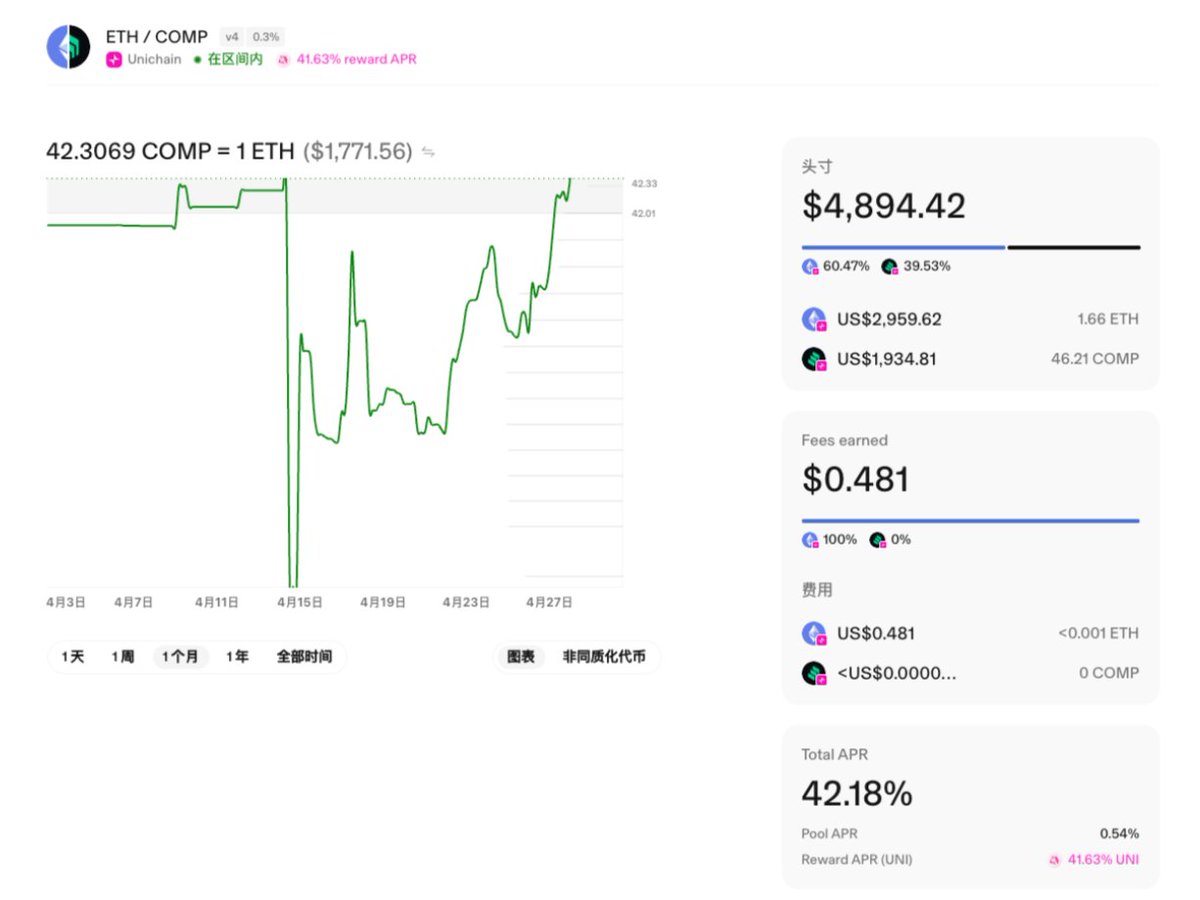

Let's take the ETH-COMP pool as an example, the APR of FEE is 0.54%, while the APR of UNI subsidy is 41.63%. Assuming that the transaction fee for a certain period of time is 1 yuan, you can also get a subsidy of about 1k uni!

Roughly calculated, the subsidy leverage leveraged by the commission is at least 77 times!!

And according to the test, Unichain takes a snapshot every four hours in the form of a subsidy. That is to say, before the snapshot, add the liquidity in the narrowest range, and then brush the trading volume, and in the case of no one else entering the market, you can get an ultra-high annualized uni subsidy with a very low gratuitous loss + a small amount of fee loss! At the beginning I was dizzy and dizzy, and the daily chemical was 10%!!

It's a pity that some people later discovered this bug and started to enter the game, and the brush game slowly turned into a last-hour fee control war, such as the address I picked up:

We brushed so much that the trading volume in the last hour increased significantly, and finally it may be discovered by the official, and in the end, the Xiangxiang mine only lasted for 5 days, and the rules were changed.

People who really play DeFi can get extremely high returns with very low risk, even without caring about the size of the funds.

If you want to make money in the casino, in addition to becoming a top player, you can also try to lend users money or wool from the casino and the project party. After all, the latter is stable happiness.

22.86K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.