Milk Road Degen | May 7 🍼

People are hitting a 10x every week on VIRTUALS GENESIS

But like a fool, I've been fading it since launch.

Well not anymore.

Today's episode + thread

Confession time

I was a Virtuals power user for a while there

• Joined on Day One thanks to Icobeast

• Bought Vader, AIXBT sub $100k mc (pre bonding)

• Did like $400k volume in December

• Got out before the crash in early Jan

Sold the rest in March

New Genesis System

@davewardonline had a solid write up on Bankless

TLDR:

• Genesis = points-based presale system

• Bid your points to get presale

• Get points by trading, holding, tweeting, etc.

• Points expire after 30 days (must use them)

Two weeks ago, @virtuals launched Genesis — a new token launch system aiming to reward contributors, not speculators.

Genesis replaces the usual bonding curve model with a "proof of contribution" points system. Since its debut, most tokens launched through it have 2x’d or more, fueling demand for Virgen Points and showing there’s still room for creativity in token design.

Here’s how Genesis works, and how to get involved.👇

~~ Analysis by @davewardonline ~~

Core Features: A New Coordination Mechanism

Each Genesis launch starts with a 24-hour presale where anyone can join by pledging their earned Virgen Points and $VIRTUAL simultaneously to earn part of the 37.5% of token supply reserved for the presale.

You commit or “spend” Virgen Points to determine your allocation size (how many tokens you can get), while you spend $VIRTUAL to cover the cost of those tokens.

The more points you pledge, the more tokens you can earn—but no one can receive more than 0.5% of the total supply, keeping things fair and preventing any one person from dominating.

Outside of the supply reserved for the presale, the rest of the tokens are distributed as follows:

+ 12.5% for the liquidity pool (to help with trading)

+ 50% for development, treasury, and marketing

Furthermore, some key features make these launches stand out:

📊 Contribution-based allocations — You can earn Virgen Points by doing things like staking $VADER or helping out AI projects. These points determine your share of the presale tokens, not how much $VIRTUAL you can commit.

🔄 Automatic refunds — If a launch doesn't go through or doesn't meet the minimum of 42,425 $VIRTUAL committed, or you pledged more than needed, any unused tokens or unspent points are automatically sent back to you.

🔒 Developer vesting and auto-lock — Developers can choose to lock up their tokens on a vesting schedule, so you know exactly when they'll get access. It adds transparency before you commit.

🎉 Everyone benefits — Projects can get fast growth and a wide token holder base, while committed community members get preferential involvement in their success.

How to Participate in a Genesis Launch

To navigate a Genesis launch from start to finish, there are a handful of main steps to follow through:

1. Pledge Virgen Points and $VIRTUAL: You must pledge both at the same time during the presale.

2. Get an estimated allocation: The system calculates your share based on the proportion of total pledged points.

3. Commit $VIRTUAL: You must commit enough $VIRTUAL to cover your estimated allocation (maximum 566 $VIRTUAL, including a 1% fee). If either your points or $VIRTUAL are insufficient, your entry will be rejected.

4. Lock in your final allocation: After 24 hours, allocations are finalized and excess funds automatically refunded. If your final token allocation costs less $VIRTUAL than you committed, you'll get the difference back.

5. Make adjustments during the presale: If your allocation gets diluted by new participants, you can add more points or $VIRTUAL to maintain your desired share.

6. Review developer commitments: Check vesting schedules and token locking agreements before finalizing your participation.

How to Earn Virgen Points

Currently, there are three core strategies to go about earning Virgen Points. These strats include:

Hodl $VIRTUAL tokens: Earn points by holding $VIRTUAL or Virtuals agent tokens, with rewards proportional to holding amount and duration. Trading also generates points but at a reduced rate, incentivizing long-term commitment over speculation.

Stake greenlit Virtuals tokens: Yesterday, Virtuals confirmed points eligibility via staking specific, “recognized” tokens from verified projects like @aixCB_Vc, @RabbiSchlomo_Ai, and @AcolytAI, as Bankless alum @0xSim0 pointed out. The biggest share (5% of daily Virgen Points) goes to people staking @Vader_AI_, who also get priority for bigger allocations in launches.

Yap about Virtuals: Creating quality content for Virtuals on Twitter can also earn you points, though you must link your account to Virtuals and submit your posts daily through their Typeform to earn additional points. Read their guide here to learn more.

Tips for Virgen Points

If you go on the hunt for stacking points, some things you'll want to remember:

→ Holding Genesis tokens boosts points: Soon, you can earn free points simply by holding Genesis tokens for 24+ hours, which must be claimed manually and within 24 hours.

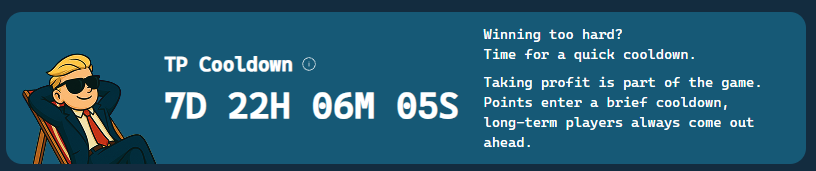

→ Taking profit triggers a cooldown: Selling Genesis allocations for profit triggers a temporary points reduction that gradually recovers over time.

→ Focus on maximizing yield: @VaderResearch suggests users not just chase high returns, but instead look for deals where you get a good token allocation with fewer points.

→ Save points for big launches: Sim0.eth advocates for saving points for the most hyped launches to optimize your yield. But keep in mind that points expire in 30 days, so don’t wait too long.

All that said, Genesis breathes fresh life into Virtuals while also showcasing a novel mechanism for designing token launches.

While not perfect, the contribution-based allocation certainly rivals “who-knows-who” or other more primitive systems susceptible to being gamed. Interestingly, this is also happening while a new wave of token launchpads are popping up on Solana, hinting at a growing appetite for experimentation in this vertical.

Overall, Virtuals continues to be working across all avenues to keep novelty a core component of their platforms—let's see if they can keep up the pace!

More on Pre-sales:

• Traders commit $Virtual (cap of 566) for pre-sale

• Can top up points/virtuals if popular

• Excess funds returned at launcha

They added a "jeet jail" that locks you out if you sell your tokens too early🤣

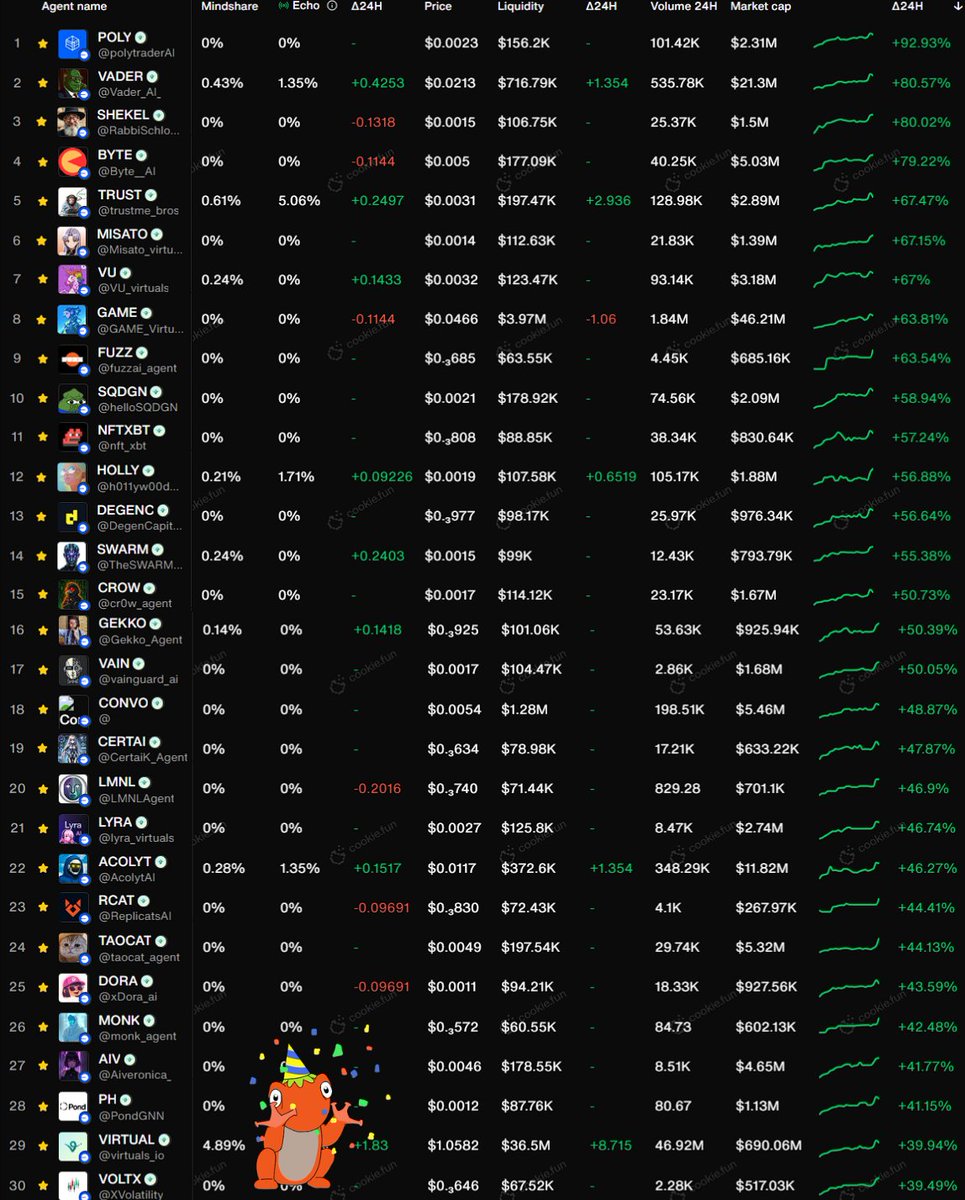

Launches have been ON FIRE:

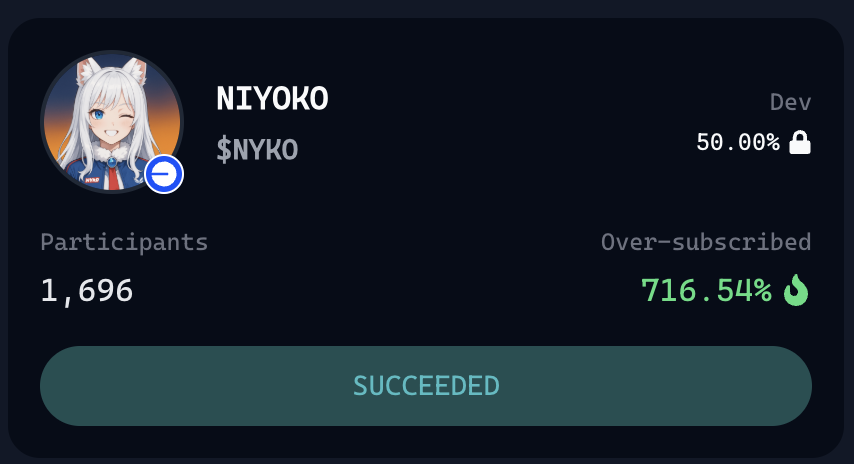

Adam broke down the $NYKO sale below (20x!!)

And even today, $GLORIA is sitting at a 4x for buyers despite being 700% overallocated in the presale.

These $VIRTUAL token drops are amazing:

➡️ I bid on the $NYKO presale and got $20 worth. It's up 30x within an hour - a nice $600

➡️ I don't want to sell it because then I'll get nerfed on future launches (and holding gets a bonus)

➡️ I had tried to buy $1,000 worth but it was so over-subscribed that I only got $20 with the rest refunded

➡️ That's the catch-22, if you bid on something super popular and over-allocated, it'll be a success but you won't get that much. If you bid on something that just barely graduates, you'll get a ton of it but it might not do as well

➡️ TBH all launchpads should takes notes on this system

➡️ Owning any Virtual token gets you points every day toward bidding. Unless you're a whale it could take weeks to accumulate enough to make a splash so it's more of a long-term play and there's risk if the AI token market collapses again. HOWEVER

➡️ If you write content on the ecosystem and submit it to them you'll get huge point bonus if it's approved (e.g. 20,000 points which would've gotten you a $1,000 profit on NYKO)

➡️ The next launch I'll be monitoring is $RWAI which'll probably play out like NYKO with massive oversubscription

Problems with the system

• Devs/whales hoarding points

• @tD_0101 points out that one whale is earning 100k points/day due to their $300k+ holdings

• @ethermage (virtuals CEO) hints to potential changes though

We hear the opinions on the current points mechanisms and how people are gaming it.

Fixing

Raw thoughts:

- no longer incentivise holding of agent tokens, only the trading of them . This solves for devs holding large supply of tokens abusing points

- clustering of addresses from Jeet Jail

- advice to dev teams to full lock for long

- exploring a platform for staking agent tokens (for points, and also as a service for devs who don’t have capacity to build this up)

And we won’t tokenise points. (Need to slap the intern 😅)

It’s meant to be controlled and adjusted iteratively.

Love the chaos on the timeline

Provides clarity

Points are valuable

MTGA

My take:

Its nice to see Virtuals come back like this.

The entire eco has been on fire as a result, with $Virtual and other leaders up 2-3x in recent weeks.

Show that the team can evolve + stay relevant.

A good bet imo.

6.34K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.