The csUSDL YT-Pendle stablecoin strategy

csUSDL is a yield-bearing stablecoin that combines real-world yield (T-Bills) with onchain lending via Morpho Blue. Base APY is Tbill + lending yield, so currently 3.75%.

However, it is when we combine it with Pendle’s YT and the upcoming airdrop that makes this strategy exciting.

So, the tl; dr of Pendle is that they allow you to split a yield-bearing token into two tokens, YT and PT.

YT --> Yield Token

PT --> Principal Token

When someone "buys" YT, they're essentially buying all of the underlying yield that is generated by the token, and more recently, in the case of the points meta, holders of YT accrue all the yield AND points.

What is a YT?

When a user looks at YT, there are two main concepts an investor has to have in mind:

-The underlying APY: The Yield the holder is entitled to earn.

-The Fixed APY (Or implied APY): The Yield the YT holder will have to pay.

However, not all scenarios include the YT point multiplier in the underlying APY price. This means one buys the YT at an apparently non-attractive price since the main point boosting system is not considered.

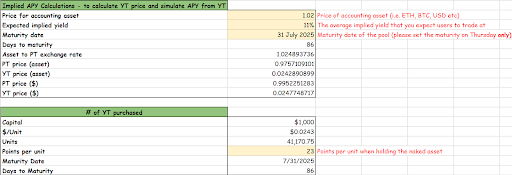

Imagine we have $1,000 available to invest in YT of csUSDL.

The Fixed/Implied Yield of csUSDL is 11%, and the Underlying APY is 3,75%. Thus, if the prospective investor purchases PT, the APY will be 11%, and the APY for YT will be apparent at 3,75%.

The current YT unit price is ~$0,024, and therefore, with $1,000, I can purchase 41,170 YT-csUSDL.

But you might think, wouldn’t it be more capital efficient to lock the 11% in real yield?”

This is where the point reward system comes into play. The 7% spread between both APYs is based on speculation about the potential SHIFT value (airdrop) that will be distributed based on the number of Shift points collected by YT holders.

As announced by Coinshift, each YT gives the holder 23 points daily until maturity.

If the holder holds YT until maturity, the user is expected to get 81,435,740 points. This seems like a lot, so what is the expected value of these points?

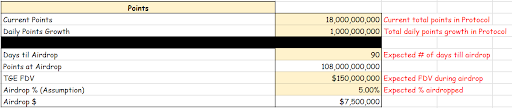

We have to consider three major variables: the Total Amount of Points at Airdrop, TGE FDV, and Airdrop Percentage.

Total Amount of Points at Airdrop: To calculate this variable, we know that there are currently 18,000,000,000 points in the Protocol, there is a daily points growth of 1,000,000,000, and the a

irdrop should occur in approx. 86 days.

As a result, the total amount of points is estimated to be 108B.

TGE FDV: The expected FDV is $150,000,000.

Airdrop Percentage: 5%

It is essential to mention that all of these are merely expectations. Based on such variables, the price per point in $ should be (150,000,000*0,05) /108,000,000,000 = $0.0000694.

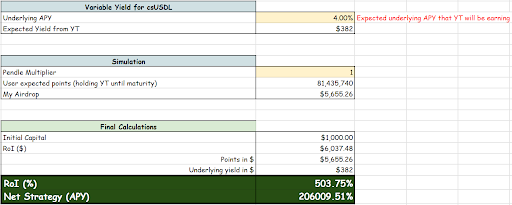

Assuming the holder holds it until maturity, the expected return on the YT investment can be calculated based on the above.

YT potential return value:

Underlying APY: should be around 4%, around $382 (with compounding).

Expected Point Airdrop: 81,435,740 * 0.0000694 = $5,655.26.

Total Return: $6037.48

This is a 500% play in less than 3 months.

The best part? Even if we assume that the variables are too “generous”, such as the TGE FDV, and cut it in half, to $75,000,000 FDV, it is still expecting a 220% play.

Remember that $150,000,000 FDV is based on the latest Coinshift fundraising valuation, so it should be a firm price anchor.

Why is YT the real underdog in the csUSDL case?

Apart from the above reasoning (fair FDV, balanced airdrop reward per point, and a great point multiplier), most power users are mostly focused on “safe returns” and look for high-yield opportunities on stablecoins.

As a consequence, there is a potential higher demand for PTs.

Consequently, PT buy pressure pushes Implied APY down > making YTs cheaper > YT investors may invest in YT for the potential rewards at a lower price.

Ultimately, the YTs can also be seen as a bet on Coinshift and the "market getting better", which means favourable conditions for @0xCoinshift to thrive.

There is currently sufficient liquidity for YT at an Implied Yield near 10%, making the YT strategy seriously attractive. Been working with the Coinshift chads for a year now, and can definitely recommend you check out what they're doing and this stablecoin strategy.

Show original

41.41K

467

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.