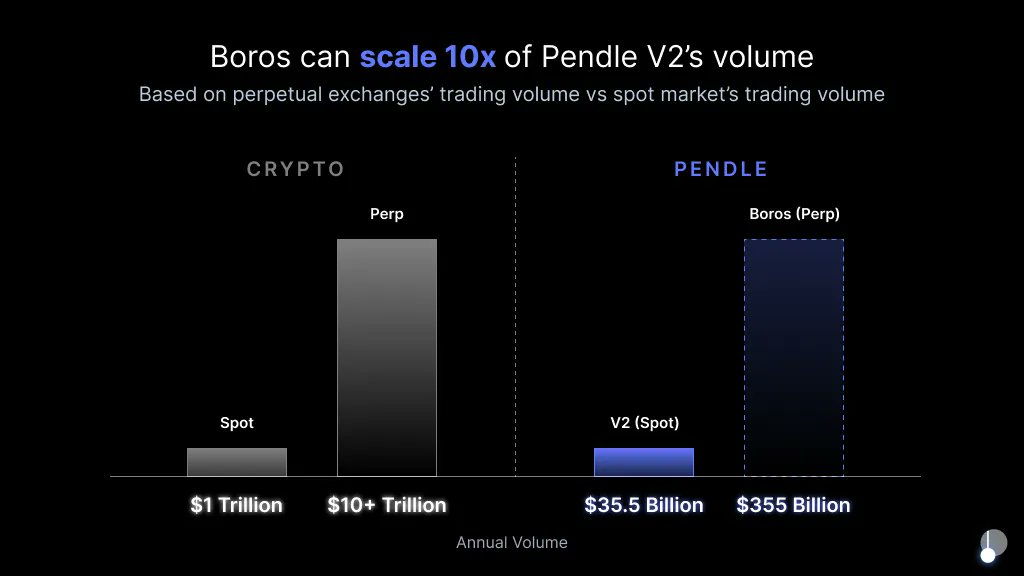

⚡️As a new product of Pendle, Boros breaks the limitations of Pendle V2 and starts with the funding rate of the perpetual market as the first bullet, which can also infinitely accommodate more on-chain and off-chain asset transactions in the future, providing users with the initiative to grasp the market, rather than passively bearing various fluctuations and ups and downs.

Spoiler alert, the invitation mechanism that Grandma was asked about 300,000 times in Pendle will also be implemented in Pineapple.

@boros_fi by @pendle_fi

Good article worth sharing:

👀Boros – this time directly at the heart of the sustainable market

@pendle_fi have been deeply involved in fixed income and yield trading, but this time, they are targeting a larger, more active, and more "wild" market than ever: the funding rate market for perpetual contracts.

This is the upcoming launch of @boros_fi, a new platform launched by Pendle with the goal of bringing better management of funding rates and extending the concept of fixed income to the world of leveraged trading.

▶️What is Boros?

To put it simply, Boros is a leverage-based earnings trading platform, which exists in parallel with Pendle V2, not as a replacement, but as a supplement. You can think of it as Pendle's Next Generation Lab (V3), but in the end it's about opening up a new possibility:

- It supports leveraged yield trading, allowing you to do more with less

- Its initial core application is the tokenization of funding rates, that is, the "floating interest on perpetual contract positions" into tradable assets

- It supports on-chain and off-chain revenue streams, such as DeFi yield, LIBOR, or traditional financial interest rates such as mortgage rates

- It will also be extended to non-EVM chains, such as Solana, to make Pendle even more extensive

In layman's terms, what Boros wants to do is to make every "funding rate" can be locked, traded, and managed - no longer the state of "only accepting market fluctuations", but actively grasping it.

▶️ Why is Boros worth paying attention to?

The funding rate is a hugely influential variable in the crypto market, but in the past few people were able to actually "trade" it, and most people just passively accepted it.

In the PERP market in particular, there are $150 billion to $200 billion in daily trading volume, and the benefits and costs behind these transactions almost all revolve around funding rates – one party pays, the other earns.

The problem is that this rate is very volatile and there is no effective hedging mechanism. For example, not long ago, the annualized funding rate of some $TRUMP perpetual trading pairs soared to 20,000%, and long positions were eaten up by accident. Another example is @ethena_labs a protocol that relies on the support of PERP returns, once the funding rate fluctuates significantly, the stability of the entire model will be affected.

That's where Boros comes in – it provides solutions to these types of risks and uncertainties:

- Convert a floating funding rate into a fixed income or expense

- Lock in a predictable return structure for your perp holdings

- Actively hedge the upside or downside risk of funding rates

Whether you're engaged in arbitrage, shorting, carry strategies, or protocols built on top of perp returns, Boros gives you stronger yield control tools to take money efficiency and risk management to the next level.

▶️ All of this, eventually, flows back into $PENDLE

Don't forget, vePENDLE holders are the direct beneficiaries of the Pendle protocol earnings.

Last year, vePENDLE holders earned around 40% on average and more than $6 million in airdrops. As Boros brings new volumes, new demand, and new users, this reshoring mechanism will become stronger.

▶️ And that's just the beginning: Citadels + Boros is the new frontier of Pendle

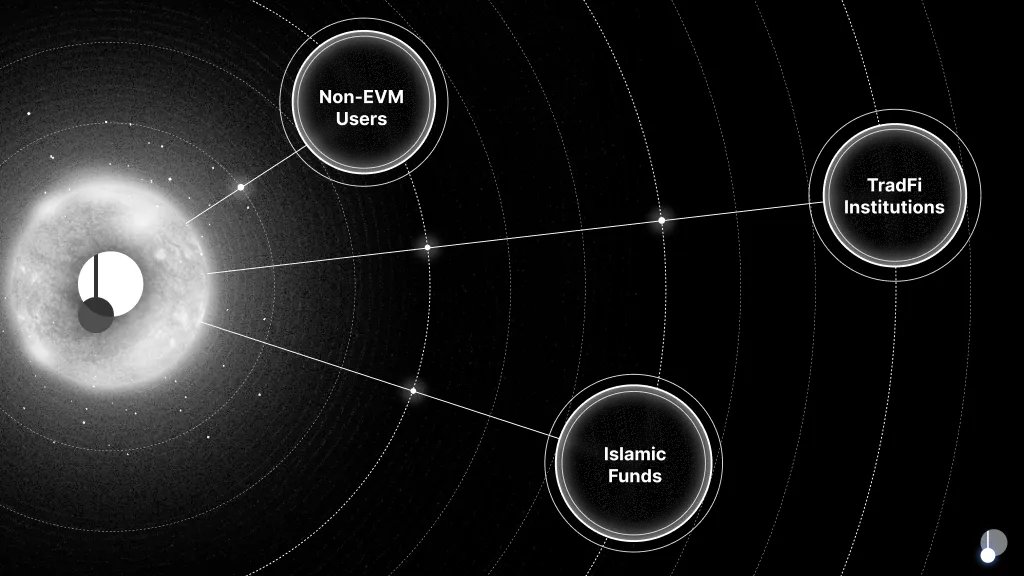

Boros is a new fulcrum for Pendle, and Citadels, Pendle's roadmap for cross-chain and compliance expansion. The team is building distributed "fortresses" around three types of markets:

- Non-EVM chains: e.g. $SOL, $TON, to expand Pendle to new user groups

- Traditional Finance (TradFi): Connect institutional clients through KYC products and SPVs

- Islamic Financial Markets: Launched Shariah-compliant fixed income products to connect to the global Islamic capital market of over US$3.9 trillion

The goal is clear: Pendle is there wherever the revenue comes from.

53.53K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.