Riding the Stablecoin Wave.

How Aegis is Reshaping Finance at the Crossroads of Bitcoin and Stablecoins. 🧵

Think your stablecoins are safe? Think again.

The system's cracked, exposing risks tied to shaky banks and opaque reserves.

The Flawed Promise of Programmable Money

The idea of programmable money is powerful, promising innovations far beyond legacy systems. Stablecoins should be the key, acting as digital cash that automates finance.

However, the execution via current stablecoins is often flawed, burdened by centralization risks and a lack of true transparency. Billions in assets are tied to the fate of traditional banks, creating hidden risks that have already triggered shocking de-pegs.

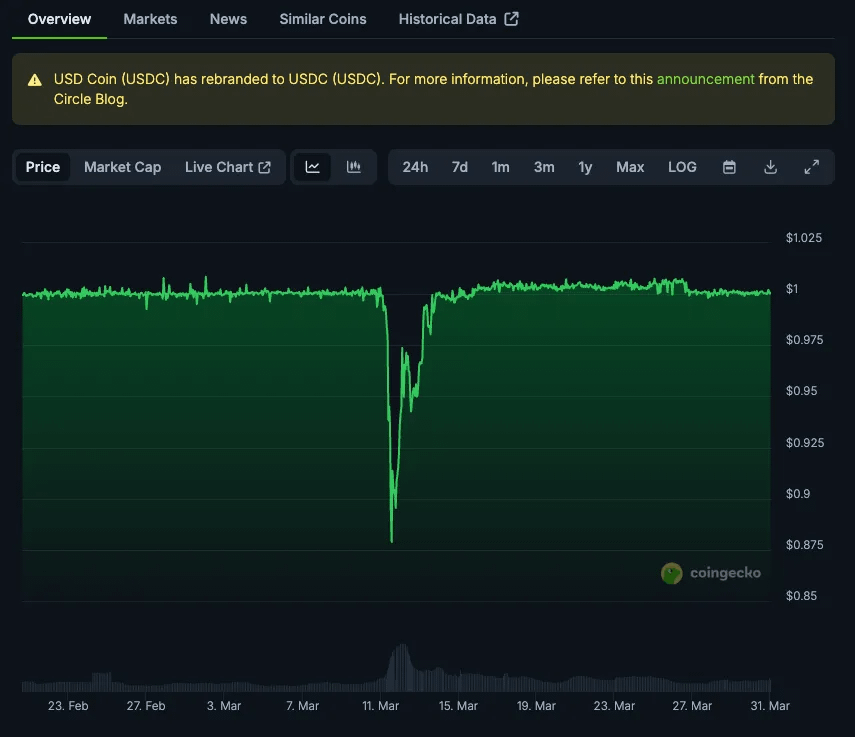

The Cracks in Centralized Stability

Most major stablecoins rely heavily on traditional banking infrastructure. We saw the danger vividly in March 2023 when USDC depegged to $0.87.

The trigger?

The collapse of Silicon Valley Bank (SVB), where Circle held $3.3 billion, or around 8% of its reserves. This starkly illustrated the counterparty risk: the stablecoin's stability was tied to that of a traditional bank.

Similar wobbles occurred during the FTX collapse, highlighting that stablecoins dependent on centralized rails inherit their risks. Users face potential fund freezes or redemption issues dictated by these central entities.

More recently, the $FDUSD depeg in early April 2025 showed how mere allegations about reserve adequacy, amplified by market influencers, could trigger instability and significant value loss.

Beyond these specific depeg events, users also face persistent risks from opaque reserve management and the potential for censorship or asset freezes.

Aegis: Resilient & Transparent by Design

The team behind Aegis understands these problems well. And to counter that, they're delivering a stablecoin (yUSD) that is not only programmable but fundamentally more resilient and transparent, thanks to its unique $BTC-backed architecture.

Aegis is at the confluence of two of the hottest narratives in the space right now:

• Bitcoin DeFi (BTCFi): Unlocking Bitcoin's colossal $1.7 trillion market cap for DeFi.

• Stablecoin Utility: Their undeniable role as stable, programmable digital cash, already tackling a multi-trillion-dollar global market.

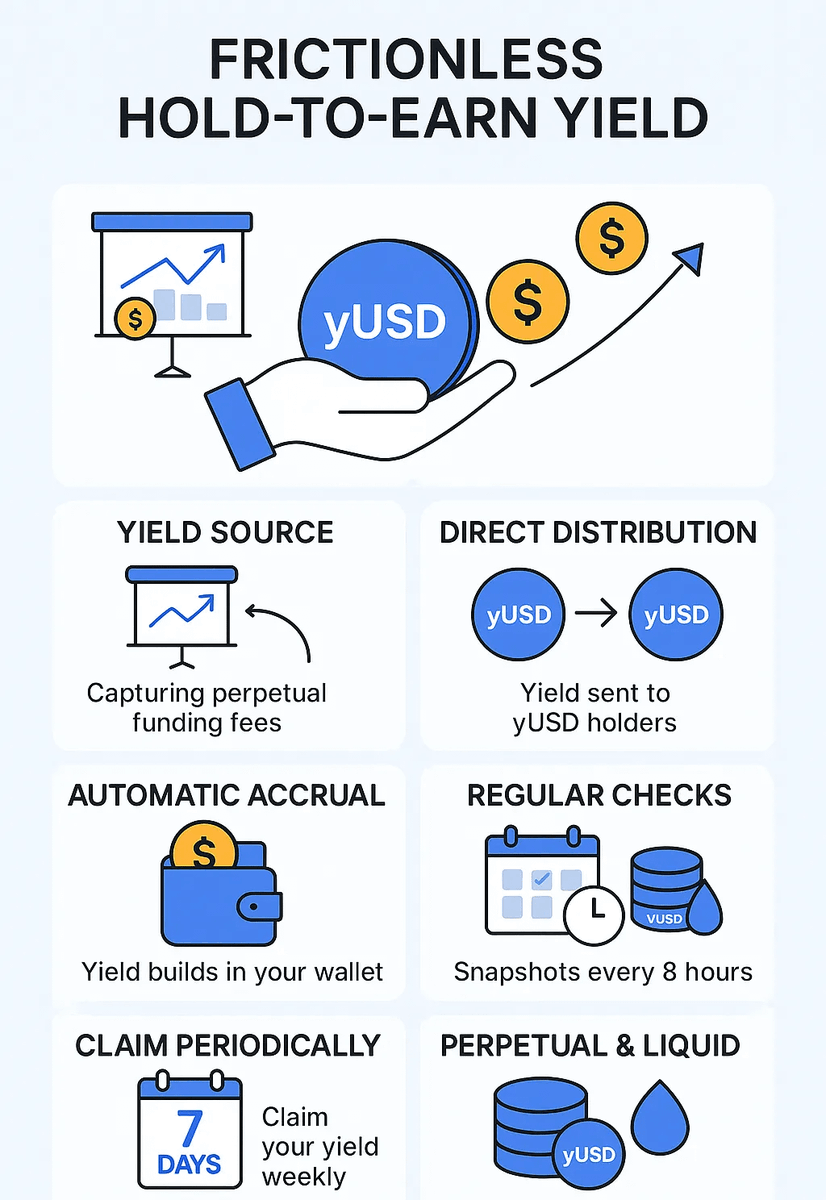

yUSD: Decentralized Yield Meets Bitcoin Security

Aegis introduces yUSD: the transparent stablecoin that pays you simply to hold it, fundamentally redesigning trust and simplicity in DeFi.

In essence, Aegis holds Bitcoin as collateral and stabilizes yUSD by selling Bitcoin-M perpetual contracts equal to exposure.

→ Here is how that works:

Aegis employs a delta-neutral hedging strategy to maintain yUSD's peg, which differs fundamentally from traditional centralized stablecoins.

→ It utilizes Bitcoin-Margined (Coin-M) perpetual contracts—derivatives collateralized and settled directly in Bitcoin, not USD or other stablecoins.

Unlike centralized stablecoins reliant on reserves held in traditional banks (exposing them to bank failures like SVB), Aegis's technical architecture provides distinct advantages:

🔹 Bitcoin-Native Collateral: Stability is directly backed by Bitcoin held by the protocol, not external bank deposits or potentially unstable third-party stablecoins.

🔹 Decoupled Risk: yUSD is insulated from traditional banking system crises and the counterparty risks associated with centralized reserve holders.

🔹 Operational Independence: The mechanism avoids reliance on external financial intermediaries for core stability, protecting users from issues like external fund freezes or redemption halts.

Why @aegis_im is building the future of BTC-backed stablecoins

Two narratives are reshaping crypto:

• The explosion of BTCFi, unlocking Bitcoin's vast potential.

• The rise of stablecoins as essential digital cash.

Restaked BTC (a proxy we’re using to show interest in BTCFi) has grown to $5.87B+ (inclusive of the restaked BTC in Babylon) in TVL in a year. This is a mere 0.3% of the overall BTC market cap!

Similarly, stablecoins today have a market cap of $239B, with the biggest stablecoin, USDT, having a market cap third only to Bitcoin and Ethereum. No wonder stablecoins are the very backbone on which the crypto industry stands.

Aegis strategically operates at this convergence. They harness Bitcoin's security to build yUSD – a resilient, yield-bearing stablecoin designed for the future of finance.

Within just a few months of launch, Aegis has reached a peak TVL of $16M. This highlights the growing interest in yUSD and what it offers its users.

Your Guide to Earning Rewards with the Aegis Points System

Aegis rewards early users through a transparent points program.

0.2% of the total $AEG supply will be distributed weekly to points participants.

Offchain Tasks (Socials, Referrals & More)

Step 1: Complete Social Tasks (Easy 5x Wins!)

👉 Get points for following on X, joining Telegram, and Discord.

👉 Earn more points by interacting with their posts on X.

Step 2: Refer Friends use the referral system

👉 Earn 10% of the points generated by your referrals.

Onchain Tasks (Holding & Providing Liquidity - Ethereum & BNB Chain)

Step 1: Hold yUSD

👉 Get 15 points per yUSD held, per day.

Step 2: Provide Liquidity

👉 Earn 30 points per dollar ($) of liquidity provided, per day.

👉 @eulerfinance pools are offering 3x points and are filling up quickly.

Eligible Pools:

👉 $YUSD/ $USDT on Uniswap

👉 $YUSD/ $USDC on Uniswap

*Coming Soon* @pendle_fi integration is coming to $AEG

Remember to check out Aegis Vaults on various protocols. They recently launched one on @EulerFinance. Check it out:

The Future is Decentralized, Yielding, and Built on Bitcoin

The convergence of BTCFi and stablecoins is a monumental shift. Aegis is strategically positioned, addressing stablecoin shortcomings with Bitcoin's power.

With its unique hold-to-earn yield and robust, BTC-backed hedging, yUSD offers a glimpse into a future where stablecoins are truly decentralized, transparent, and secure.

Show original

6.9K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.