Job's not finished. $HYPE $STOCK

"The Blockchain To House All Finance"

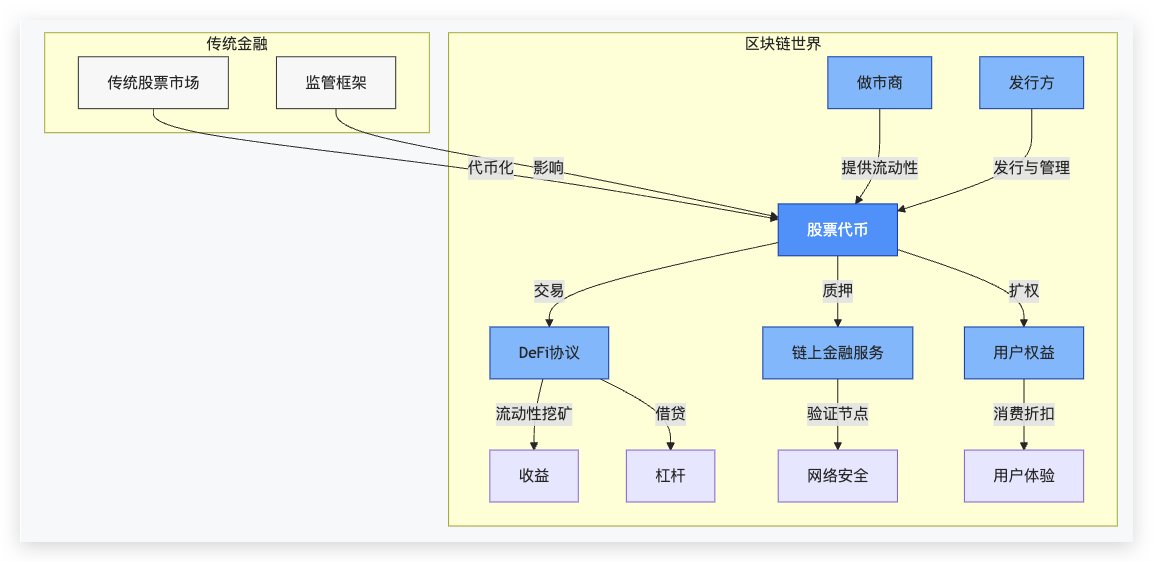

Hyperliquid's goal is to be an on-chain all-asset platform that goes beyond the native assets of cryptocurrencies. After driving the development of trading Native BTC on Hyperliquid, Unit now has its sights set on tokenized STOs for shares.

Stock tokenization is not a new concept, Coinbase has been proposing it since 2020. At the time, the plan was shelved due to an unfriendly regulatory environment for the crypto industry and a lawsuit filed by the SEC. In January, the head of Base, Jesse, proposed to deploy the Coinbase token on the Base chain, and in February, the SEC dropped the lawsuit against Coinbase, marking a shift in regulatory attitude. It's a cliché to talk about security tokenized STOs, and Mint Ventures recently talked a lot about @xuxiaopengmint and @mindaoyang on the podcast, which was very exciting and inspiring.

A few takeaways and remaining doubts

1. The demand for traditional stocks by crypto users is not necessarily strong. In the past few cycles, the trading volume of synthetic stock assets such as FTX/Mirror has not been high. Even the $COIN tokens that have recently been issued early on Base are facing the problem of de-pegging due to insufficient liquidity.

After all, it still depends on people. Has there been any change in crypto players this cycle?

With BTC's Votality and the gradual stockization of its assets, it can be observed that players seem to be more receptive to Tradfi. P juniors mentioned U.S. stocks and treasury bonds a lot more times, far different from the last cycle of meme players after making money attitude, the last round of the cycle is more disdainful of tradfi, this round due to the spirit of crypto deceived money value projects and meme projects are broken, everyone is more pragmatic, where there is money to make it, it is over, so the acceptance is much higher. On CT, we can also see that more people have allocated their assets to US stocks/Hong Kong stocks, and there have been many changes in thinking.

If you can save the exchange rate wear and legal risk between USDT <-> fiat currencies (and sufficient liquidity), you can directly buy stocks such as $MSTR $HoneySnow Group with the money you make in the crypto world, would you be willing? I think this demand is still weak, wait and see.

2. @mindaoyang mentioned the concept of so-called "stock expansion" when he was a guest at Mint Ventures, for example, will Coinbase be used to empower $COIN with Basechain after it has issued an STO? Let the stock go from the previous "shareholder warrant" to a utility asset. This requires that if it is a company that actively issues STO to have the motivation to empower, if it is just an ordinary on-chain asset mapping, just like the previous rounds of attempts, is there really a demand? Is it a pseudo-demand?

If Hyperliquid takes the lead in aggregating into a powerful asset trading platform on the STO, various Defi protocols can be developed on top of it to form a new asset value circulation, and this value may have more possibilities due to the existence of Web2 companies interacting with real-world value.

Perhaps with the relaxation of this round of regulation, we will see new and different things in the next four years, everything on the chain, siphoning everything.

Show original

11

5.33K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.