Up 30%, How Does the Berachain V2 Proposal Boost $BERA Value Capture?

Written by: TechFlow

The crypto market is gradually picking up, with BTC and ETH leading the gains. However, the prices of the main coins of many L1 public chains have not been able to rebound simultaneously, which is a far cry from the previous 100-chain war as an Ethereum killer.

Currently, L1s are more or less facing the challenge of "main currency marginalization": circulation unlocking, token dilution, and weak narratives, making it difficult for these main coins to capture the value of ecological growth.

As an innovative EVM-compatible public chain, Berachain has a place in the public chain ecosystem with its unique Proof of Liquidity (PoL) mechanism, but the three-coin model also makes its main currency BERA insufficient in terms of value capture, and its market capitalization is currently only $270 million.

$BERA The current situation is not only due to traditional tokenomics issues (such as unlocking pressure), but also from the lack of narrative and product applications.

If $BERA were just a tool for paying for on-chain gas, there would naturally be much less room for imagination in its narrative. However, a recent PoL V2 version proposal in Berachain's official community may provide an opportunity for $BERA to turn the situation around narratively and functionally:

By redistributing 33% of PoL incentives, it aims to transform $BERA from a marginalized gas token into a core yield asset.

Following the proposal's release on July 15, the $BERA price surged 23% to surpass $2.5 in 24 hours, and the market has interpreted it as positive and responded.

Beyond the short-term effects, can PoL V2 bring long-term value to $BERA? Can it reshape the status of the main currency through incentives and attract institutions and users to participate?

The original PoL $BERA the hidden dilemma of value

To answer the above questions, we need to first understand the situation of the main coin $BERA under Berachain's current PoL model.

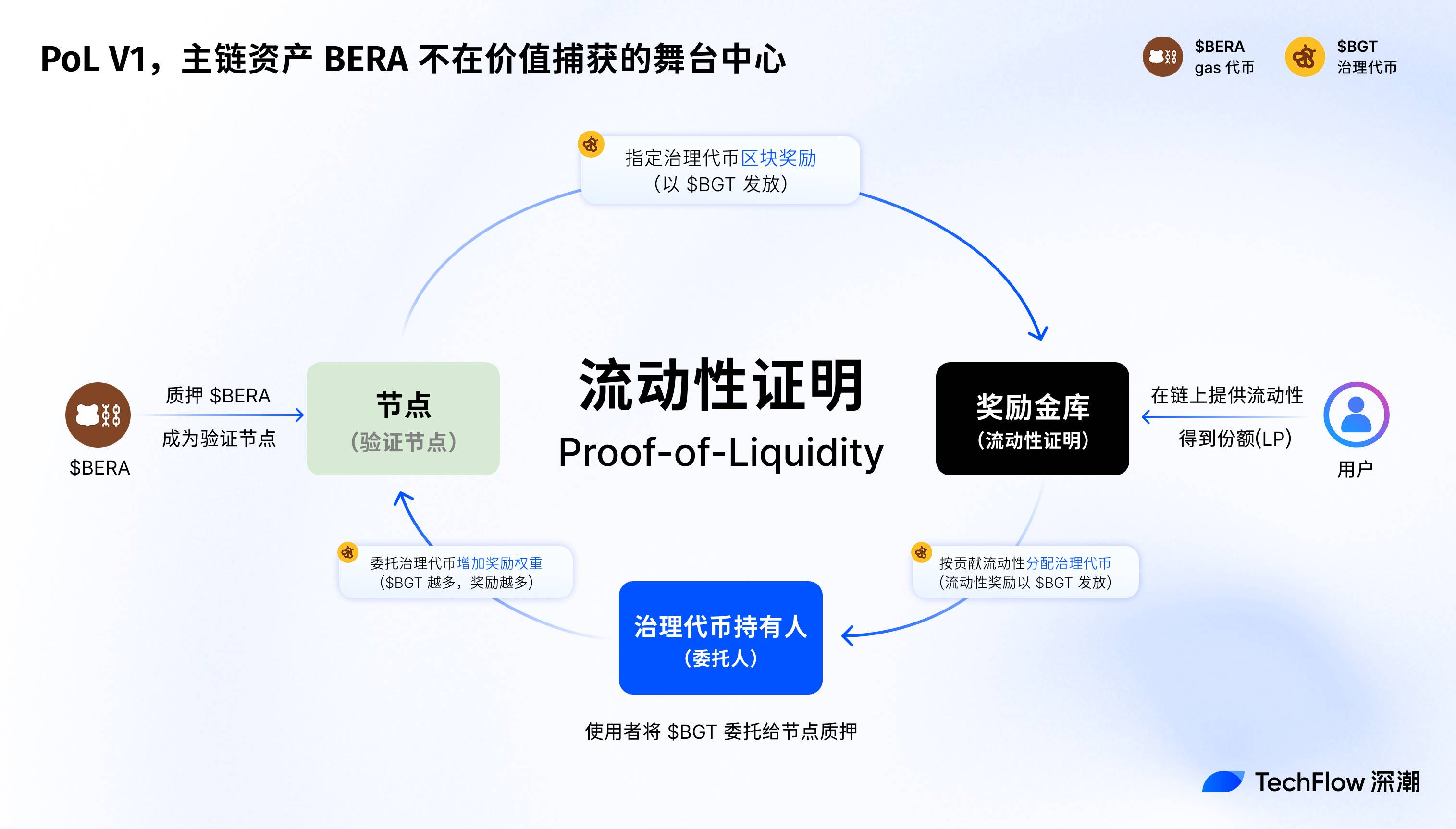

Berachain's original Proof of Liquidity (PoL V1) mechanism is essentially an economic consensus design that enhances network security and ecological prosperity by incentivizing liquidity providers (LPs) and dApps to develop.

Unlike traditional PoS, PoL utilizes a three-coin model ($BERA, $BGT, $HONEY) to distribute block rewards to validators and ecosystem participants through bribe auctions.

Among them, $BERA serves as the gas token and network base asset, $BGT is responsible for governance and staking rewards, and $HONEY serves as a stablecoin to support liquidity.

Since its mainnet launch on February 6, 2025, PoL has driven the growth of Berachain's TVL, reaching $3 billion at its peak at the end of March this year.

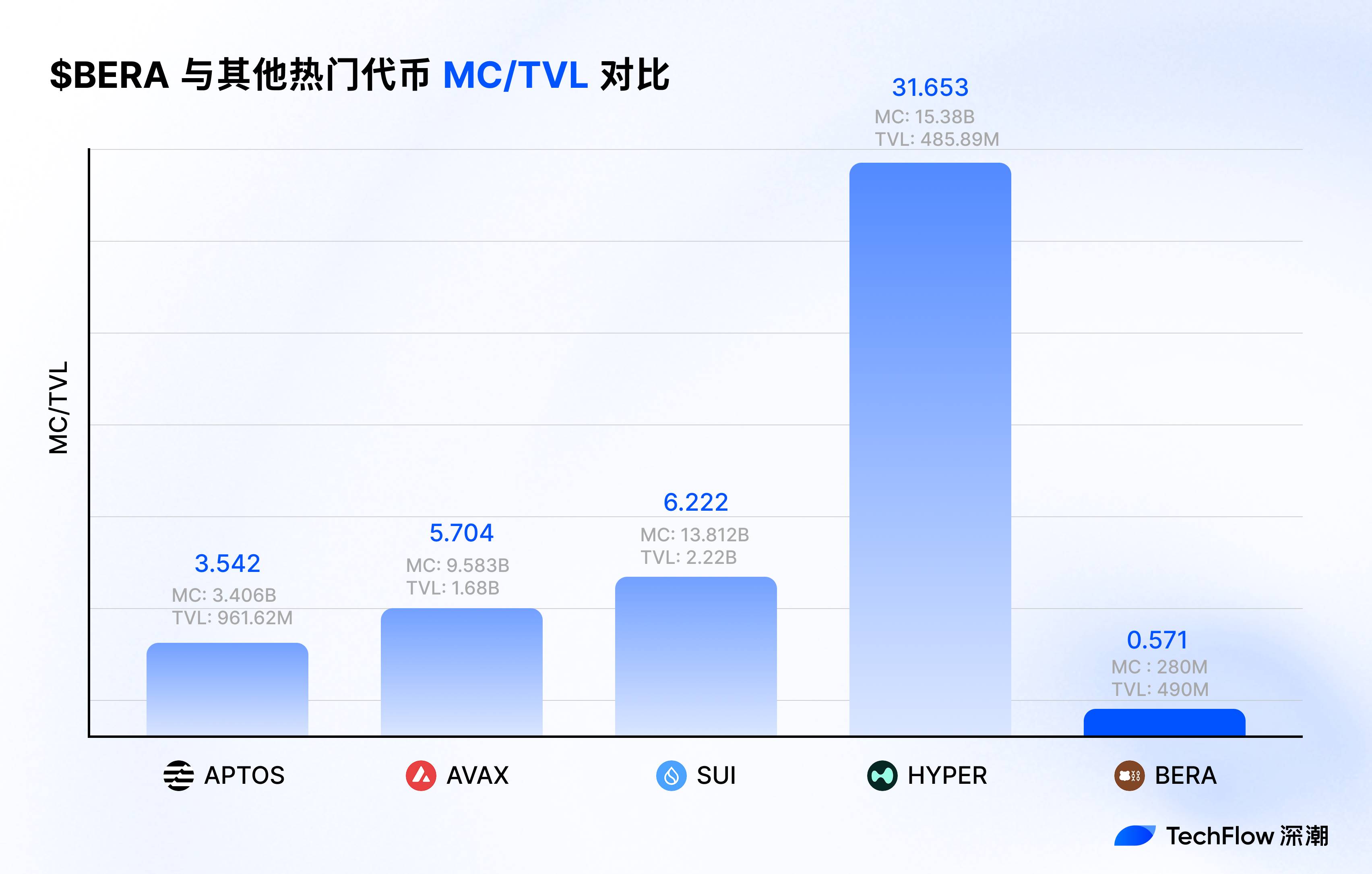

Correspondingly, the market capitalization of the main currency BERA during the same period was only $900 million, and the MC/TVL ratio was less than one-third, $BERA did not seem to have gained better market performance from berachain's ecological appeal.

What is the problem?

Looking back at the original design of PoL, the author believes that it was an arrangement that was subordinate to the overall interests, and the distribution of incentives and mechanism constraints led to the dilution of BERA's value.

In order to strive for more ecological activity, the original PoL has designed a clever bribery and emission mechanism in the structure, which serves the overall development of Berachain as a whole, but $BERA, as a main chain asset, does not get the same development opportunities, which is reflected in:

-

LPs capture the full staking rewards and distribute them with $BGT through the PoL bribery mechanism, while $BERA is only used for gas payments and lacks an independent source of income.

-

Bribery incentives are prioritized for $BGT holders, ignoring the needs of $BERA stakers and indirectly reducing $BERA market demand.

-

PoL V1's reward vault mechanism focuses liquidity incentives on dApps rather than mainnet asset $BERA.

Overall, Berachain can be popular, ecological energy fire, and meme 2 can create energy but $BERA are not popular, and "main currency upgrade" has become a top priority to enhance the influence of public chains in the next stage.

V2 proposal to make $BERA a a core asset in the ecosystem

Understanding the issue of the original PoL limiting BERA value capture, let's take a look at the changes brought about by the PoL V2 proposal.

In conclusion, PoL V2 focuses more on incentive redistribution and functional expansion, attempting to transform $BERA from a marginalized gas token to a core asset in the ecosystem.

Specifically, PoL V2 introduces the following key changes:

-

Incentive redistribution:

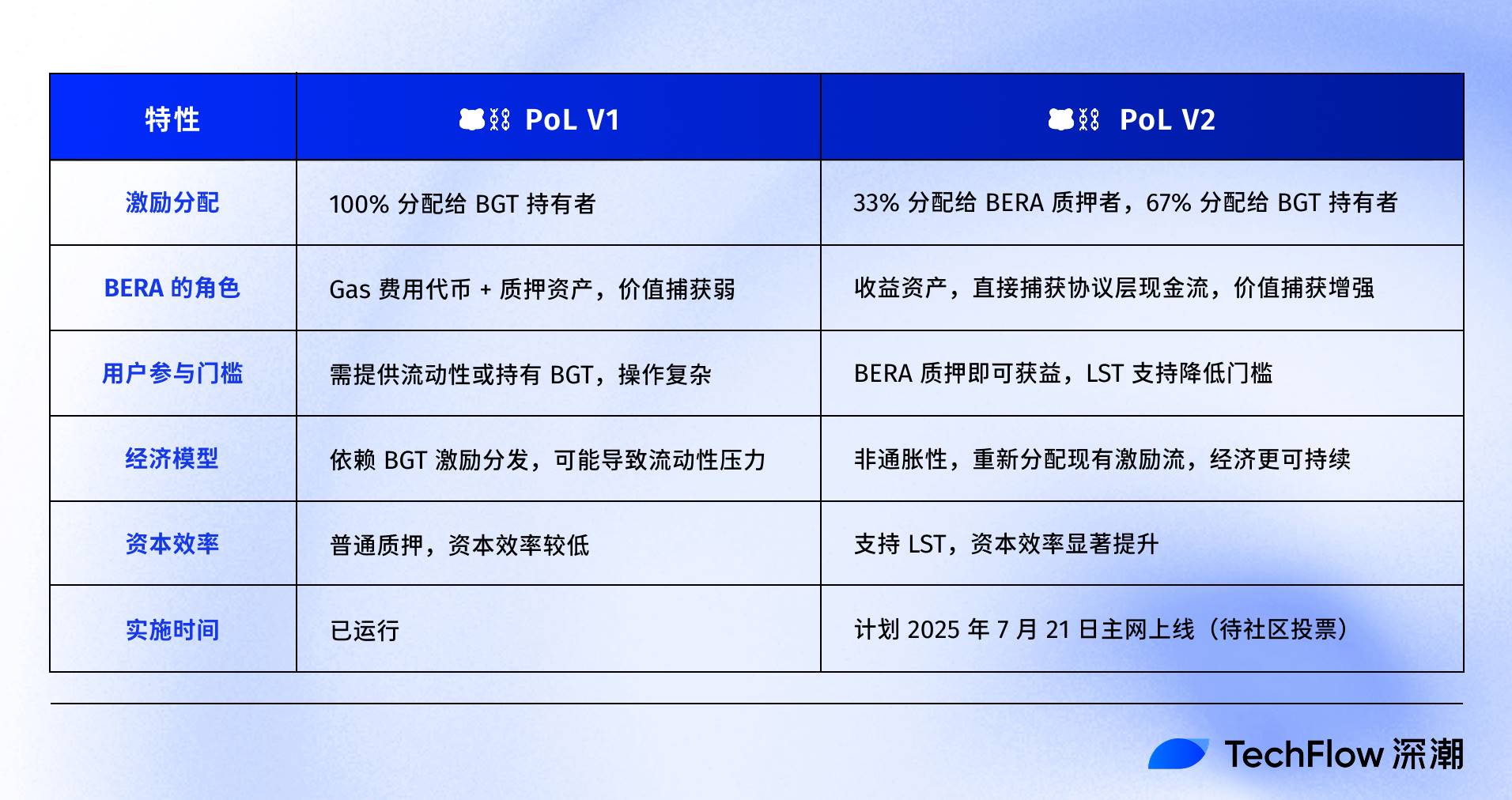

PoL V2 redistributes 33% of DApp bribe incentives (bribe incentives) from BGT (governance token) holders to BERA stakers.

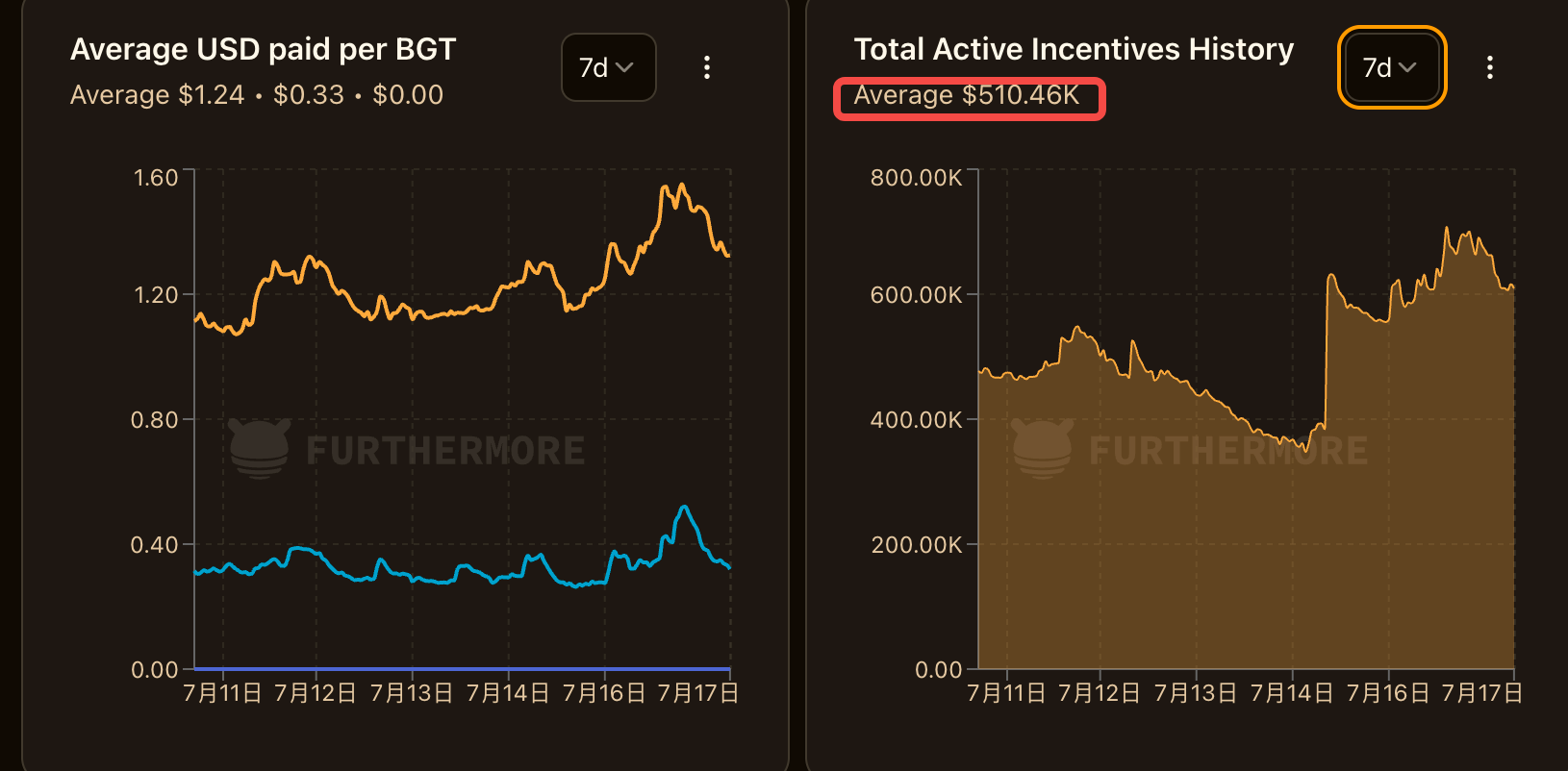

According to furthermore data, Berachain has received a total incentive of about $500,000 per day in the past 7 days, which means that one-third of it (i.e., $150,000) will be directly injected into BERA's staking pool, creating continuous buying pressure on BERA to a certain extent.

The remaining 67% of the incentives continue to be distributed to BGT holders, maintaining their liquidity incentive leverage and ensuring that the rights and interests of existing stakeholders are not compromised.

Note that this is equivalent to providing additional income to BERA holders in disguise, and the way to provide it is not simply to issue additional BERA, but to redistribute the cash flow in the agreement through structural adjustment to avoid the risk of BERA inflation.

-

Functional module extension:

PoL V2 supports liquid staking tokens (LST,), allowing BERA stakers to earn validator rewards while taking out their staked tokens to further earn PoL incentive yields. This significantly improves BERA's capital efficiency.

BERA stakers can directly profit from yields from on-chain protocols like BEX without engaging in complex DeFi strategies or holding BGT, lowering the barrier to participation.

We can also use a table to clearly compare the differences between V2 and V1 versions of PoL:

In contrast, PoL V1 is more like a tailor-made stage for $BGT, with most of the rewards flowing to it, $BERA can only silently pay gas fees, and the value growth is indirectly driven by the ecosystem.

V2 puts $BERA center stage, simplifying the process of earning rewards with new reward distribution and bond tools.

Value capture, or value capture

Value capture is a high-frequency word in the crypto industry, but for BERA, where exactly is it anchored?

As BERA transitions from a single gas token to a core interest-bearing asset in the ecosystem, the anchoring of value will actually undergo subtle changes. And this change is hidden in the mental positioning and ecology.

The core upgrade of PoL V2 lies in giving BERA the ability to directly capture cash flow at the protocol layer, similar to how BERA has protocol dividend rights, thereby reshaping its price logic.

We can calculate a theoretical account.

Assuming that the V2 proposal is passed, by distributing 33% of the DApp bribe incentives to BERA stakers, the previous data mentioned that there is a total incentive of about $500,000 per day, which means that one-third of it (i.e., $150,000 per day, about 1.1 million per week) becomes the income from staking BERA.

PoL V2 gives BERA a yield stream similar to "protocol dividends", which means that holding BERA is equivalent to sharing the real income generated by the entire ecosystem, and buying pressure will be formed under the positioning of interest-bearing assets. Obviously, the price of BERA is also influenced by token unlocks, and the actual multiple may change based on TVL growth, adoption rates, or market cycles. But if the local currency is not limited to paying gas and has more productive functions, there is clearly more room for growth based on the current token performance of BERA.

For comparison, if other public chains are put together, BERA's current MC/TVL ratio appears more promising.

Moreover, BERA's positioning as an interest-bearing asset could spark a broader market imagination.

Externally, companies like MicroStrategy have demonstrated a strategic interest in holding crypto assets by stockpiling Bitcoin. SharpLink and others have started stockpiling Ethereum, and the core reason is that ETH is a "productive asset".

If PoL V2 gives BERA a stable income stream and a non-inflationary design, making it an interest-bearing asset, it also gives a suitable environment for the current "currency and stock gameplay".

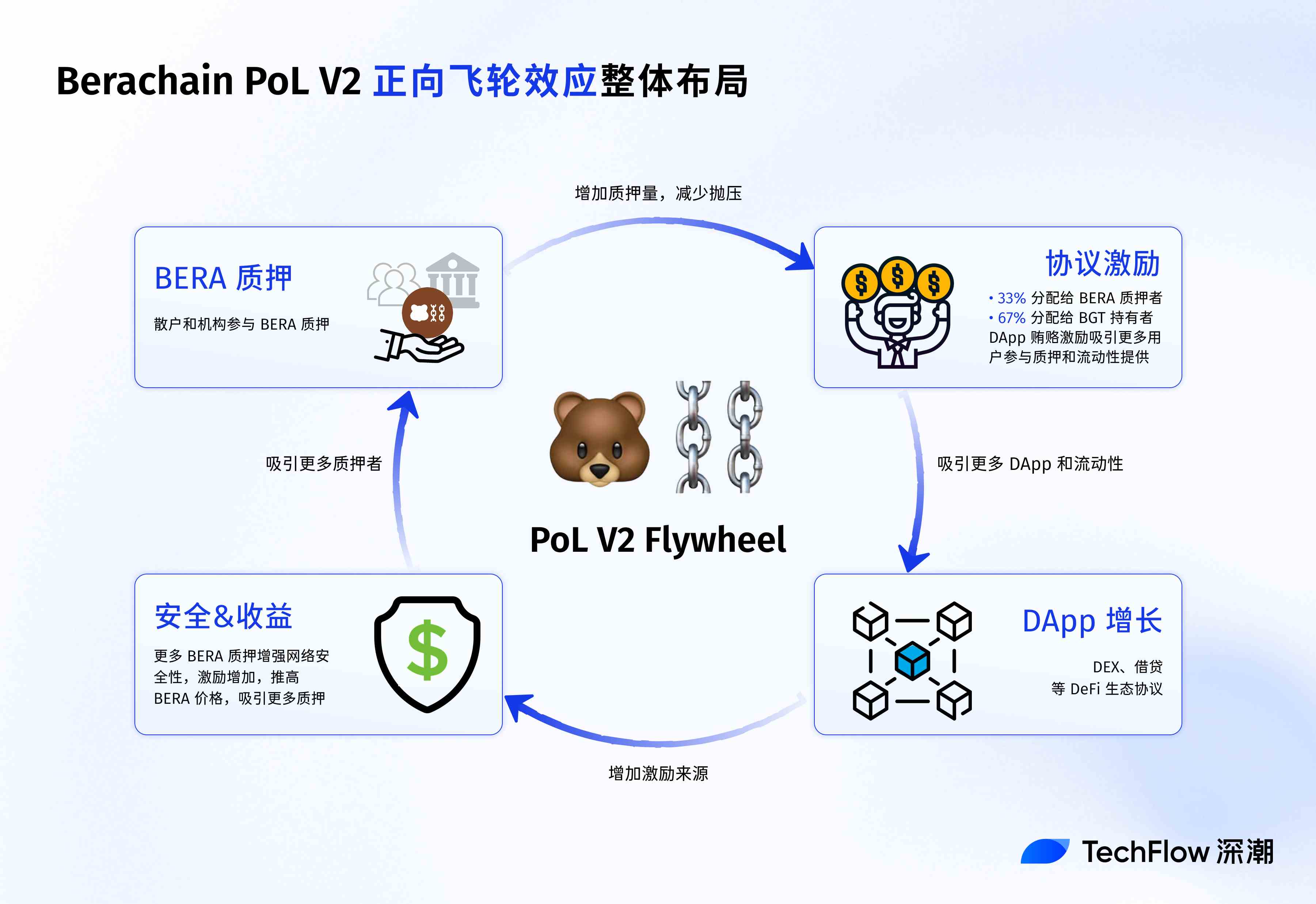

From the perspective of Berachain's ecosystem, PoL V2 has given rise to a positive flywheel mechanism.

Firstly, the income of BERA stakers attracts more long-term holders, increasing token lock-up and reducing market selling pressure.

Secondly, stable BERA prices and higher network security attract more developers to deploy DApps, further increasing sources of bribery incentives. In turn, more incentives flow to BERA and BGT holders, forming a closed loop of "staking-incentives-DApp growth".

For example, the trading volume of BEX (Berachain's core DEX) may grow due to incentive optimization, thereby driving up the usage rate of HONEY (the native stablecoin) and strengthening the stickiness of the entire ecosystem.

Compared to other Layer 1s that rely on additional tokens to incentivize users, Berachain's model is closer to "protocol dividends", providing long-term stability for the ecosystem.

Finally, from the user level, the value capture impact of PoL V2 has its own focus for different groups.

For retail investors, BERA staking offers a low-risk return path similar to "crypto savings," attracting more long-term holders. For DeFi players, the introduction of LSTs means greater capital efficiency and strategic flexibility, such as using LSTs in BEX to provide liquidity while stacking PoL incentives.

For institutional users, BERA's interest-bearing attributes and non-inflationary design make it a potential strategic reserve asset, similar to stablecoins or high-yield bonds.

The V2 proposal for the current PoL was released on July 15, 2025, on the Berachain public forum, and is currently in the community feedback phase with a deadline of July 20, 2025.

If approved by a majority, the mainnet will launch the proposal on July 21, 2025, when the changes to BERA's value capture will be reflected.

However, it should be reminded that the development of any public chain and the appreciation of its token cannot be solved by a single proposal alone. The crypto market has come to this point, and pure concept hype has been falsified, and projects with practical applications, income, and good fundamentals can stand out in the second half of the fight.

As a complement to the PoL V2 mechanism, when the ecosystem is more active, the yield around BERA will rise. Because more protocols bidding for BGT means higher bribes, which means better BERA staking yields.

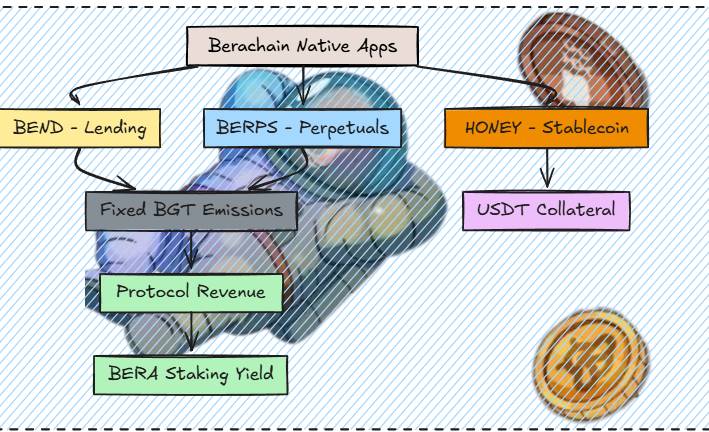

Next, we can see more Bera native DeFi protocols launched one after another, such as the native lending protocol Bend will be launched in 4 weeks; Berp has been confirmed to be launched as a contract DEX and is still under development; Honey will expand more stablecoins as collateral and will also be launched within 3 weeks, making it even more useful as a stablecoin than before.

(Image source: @0xRavenium).

In addition, the new Berahub page has also been launched recently, with upgraded UI design, a new asset portfolio page, and one-click operation of Vault. It is convenient for users to explore the explore page of the Berachain ecosystem and participate in various PoL yield opportunities, no longer limited to providing liquidity.

Perhaps the projects themselves have gradually realized that the public chain must first make itself valuable before the ecology can be valuable.

With "revenue-driven main coin", Berachain's new proposal is off to a good start.