Trading Moment: The market has entered a phase of shrinking volume and volatility, and Hayes bets on BTC to rise to $110,000

1.Market Watch

Keywords: BNB, ETH, BTC

The BSC ecosystem and the Solana ecosystem continue to compete for on-chain popularity, CZ began to promote ecological projects, and used BNB to go long mubarak in APX Finance. As a result, APX and mubarak soared. It is worth noting that Wintermute may become a market maker for the BSC-based meme coin mubarak, withdrawing a total of 6.04 million tokens from Gate in the past four days.

The Solana ecosystem can't sit still, and Moonshot has quietly launched three new MEME tokens, TITCOIN, FAT, and ROUTINE, which have not moved for a long time. Trump shouted TRUMP and complained that his portrait was too ugly, and then the Downald token appeared on the Solana chain, with a market cap of about $14.5 million. Bitcoin ended last week on a positive note, closing at around $86,000, but market views remain divided. In terms of the short-term outlook, Ryan Lee, chief analyst at Bitget Research, pointed out over the weekend that $85,000 would be a key psychological threshold, and if the closing price of the week fails to break through this level, bitcoin prices could face further downward pressure next week. In terms of the medium-term outlook, BitMEX co-founder Arthur Hayes offered a "rise and then fall" view, expecting bitcoin to test $110,000 first before recovering to $76,500. However, trader Eugene said that the market has entered the fifth stage, which is characterised by long losses, currency price consolidation, and shrinking volume and volatility. At this stage, some of the stronger altcoins have reached the bottom, but it is still uncertain if the bottom has been reached for most assets.

Regulatory developments have also been in the spotlight, with Senator Cynthia Lummis' Bitcoin Act of 2025 calling for the U.S. to receive 1 million bitcoins over five years, or about 5% of the total supply. Thursday's SEC chairman's eligibility hearing is worth keeping an eye on, and it may involve cryptocurrency-related content. Matthew Sigel, director of digital asset research at VanEck, mentioned that Bloomberg legal analysts see a 30% chance that the federal government will buy bitcoin this year.

At the macroeconomic level, the market is keeping a close eye on a number of key indicators. Nexo analyst Iliya Kalchev stressed that consumer confidence, Q4 GDP, jobless claims, and upcoming PCE inflation data will all influence the Fed's decision to cut interest rates. At its March 18-19 meeting, the Fed signalled that it would ignore short-term inflationary pressures to lay the groundwork for possible future easing. Nicolai Sondergaard, a research analyst at Nansen, said global tariff concerns will continue to weigh on markets until tariff-related issues are resolved between April 2 and July.

2. Key data (as of 13:30 HKT on March 24)

-

Bitcoin: $86,928.38 (-7.13% for the year), daily spot trading volume of $17.58 billion

-

Ethereum: $2,050.00 (-38.54% for the year), daily spot trading volume of $9.255 billion

-

Greed Fear: 45 (Neutral)

-

Average GAS: BTC 1.47 sat/vB, ETH 0.43 Gwei

-

Market Share: BTC 60.7%, ETH 8.7%

-

Upbit's 24-hour trading volume: AUCTION, XRP, W, ZETA, BTC

-

24-hour BTC long-short ratio: 1.0496

-

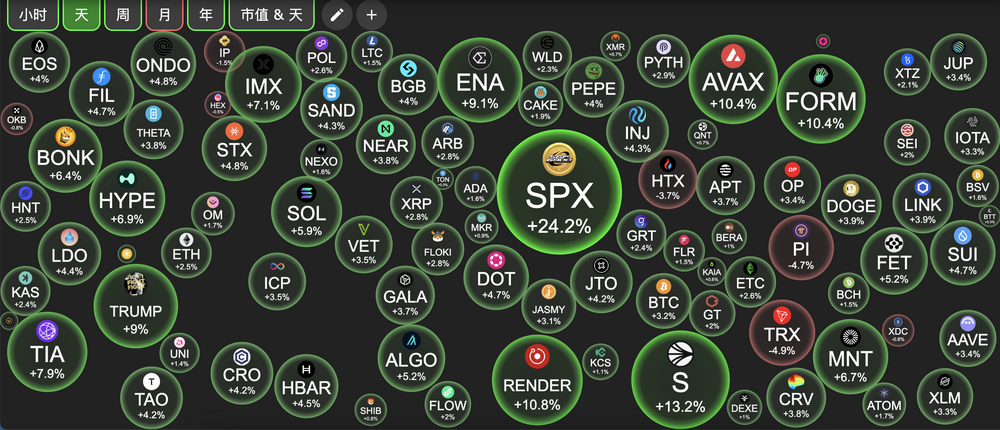

Sector change: AI sector up 5.57%, DePIN sector up 4.73%

-

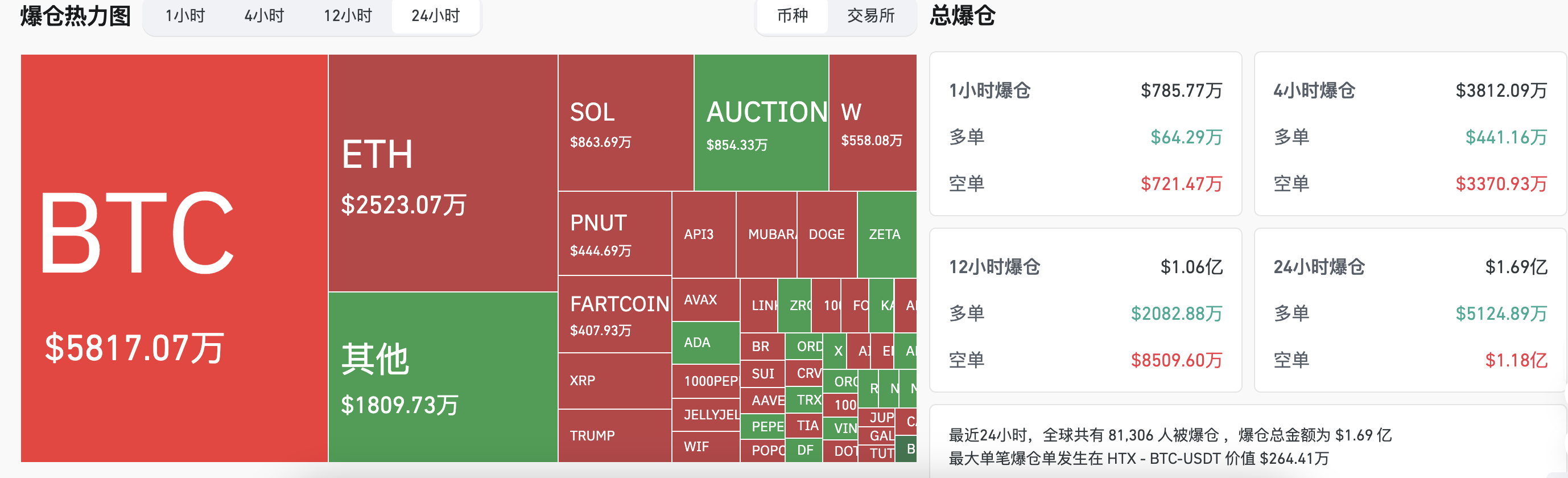

24-hour liquidation data: A total of 81,306 people around the world were liquidated, with a total liquidation amount of $169 million, of which BTC liquidated $58.17 million and ETH liquidated $25.23 million

3.ETF Flows (as of March 21st EST)

-

Bitcoin ETF: $83.09 million

-

Ethereum ETF: -$18.63 million

4. Today's preview

-

Arcium, a confidential computing network, will launch a community round on CoinList, with a total token supply of 1 billion (SPL standard)

-

Berachain officially launched PoL (Proof of Liquidity), governance has entered the first phase, the incentive mechanism will begin to take effect, and the new reward pool will be emitted

-

Sky Governance will reduce the Sky savings interest rate to 4.5%.

-

Binance, Huobi HTX List Nillion (NIL) Spot Trading Pair

-

Babylon Genesis Pre-Launch Meetup: Taipei (feat. Zeus Network) will be held on March 24, 2025

-

Bithumb intends to terminate its interest in Bitcoin Gold (BTG) and VALOR tokens supported

the top 500 gainers by market capitalisation today: BugsCoin (BGSC) up 36.16%, Mubarak up 26.52%, Ankr (ANKR) up 25.43%, SPX6900 up 23.01%, and StormX (STMX) up 22.63%.

5. Hot News

-

Preview of the Week | Walrus plans to launch mainnet; The Berachain Foundation will launch PoL on March 24, and governance has entered the first phase

-

This week's macro outlook: the market expects the Fed to be more dovish, and stagflation doubts still need to be solved

-

Data: ALT, VENOM, YGG and other tokens will usher in large unlocks, of which ALT unlocks are worth about $9.8 million

-

Michael Saylor released information about Bitcoin Tracker again, or will disclose the increase data next week

-

GoPlus: All frozen funds have been transferred to the company's account and a "buyback plan" has been launched

-

Analyst: BUSD was once the third largest stablecoin by market capitalisation, and the current market capitalisation on the Ethereum chain is only about $50 million

-

Wintermute may have become a market maker for the meme coin mubarak

-

Suspected Binance Wallet employee made a profit of more than $110,000 by trading UUU on the BSC chain

-

Movement: movedrop will be launched in April

-

Trader Eugene: Stronger altcoins have reached the bottom, But it's still unclear whether the bottom of most assets has arrived

-

Data: US Bitcoin ETF bought 8,775 BTC this week, miners output only 3,150 BTC

-

Open House Group, a listed real estate company in Japan, announced that it will accept XRP, SOL and DOGE payments

-

Analysis: Bitcoin momentum shows short-term potential, However, due to the low trading volume, it still tends to be bearish for the long term