A Paradigm Shift in ETH: When Wall Street Rediscovered Ethereum

Written by Sunny, Messari Research

Compiled by Alex Liu, Foresight News

Over the past few years, traditional finance (TradFi) has gradually lost the source of its growth narrative. Artificial intelligence has been over-provisioned, and software companies are no longer as imaginative as they were in the 2000s and 2010s.

For growth investors who are raising money to bet on disruptive innovation narratives, the reality is that AI asset valuations are generally inflated, and other "growth stories" are hard to tell new ideas. FAANG stocks, which were once in the limelight, have now gradually transformed into mediocre "compound interest stocks" that pursue profit maximization. The median price-to-sales ratio (enterprise value / sales) for software companies has fallen below 2x.

As a result, cryptocurrencies are back in the spotlight.

Bitcoin breaks new all-time highs; U.S. President "Strongly Touted" Crypto Assets at a Press Conference; A series of regulatory tailwinds have provided the asset class with an opportunity to return to mainstream for the first time since 2021.

Unlike NFTs and Dogecoin in the previous cycle, this one focuses on digital gold, stablecoins, "tokenization" and payment system reform. Stripe and Robinhood have announced that the next phase of focus will be on crypto; Coinbase Successfully Included in the S&P 500 Index; Circle presents a sexy enough growth narrative to the capital markets that investors are once again ignoring valuation multiples and focusing on potential stories.

But what does it all have to do with ETH?

For crypto natives, the battle for smart contract platforms has long been divided: Solana, Hyperliquid, and a myriad of high-performance new chains and rollup platforms all pose a real threat to Ethereum's dominance.

We know that Ethereum hasn't really solved the value capture problem yet, and we know that it's facing structural challenges.

But Wall Street is not aware of this. In fact, most Wall Street practitioners know almost nothing about Solana. In terms of popularity, old currencies such as XRP, LTC, LINK, ADA, DOGE, etc., may have more presence in their hearts than SOL. After all, these people have almost completely faded out of the crypto market over the past few years.

What they do know is that ETH is "lindy" - standing the test of time; It has been tested for market volatility many times; For a long time, it was the main "beta" target outside of Bitcoin. What they see is that ETH is currently the only two crypto assets that currently own spot ETFs. Their preference is for "value depressions" where valuations are relatively cheap and catalysts are about to be ushered in.

In their eyes, Coinbase, Kraken, and Robinhood have all chosen to build their products on Ethereum. With a little due diligence, they know that Ethereum has the largest stablecoin pool on the chain. They start doing "moon calculations" – and then they will find that Bitcoin has reached new highs, while Ethereum is still more than 30% away from its 2021 highs.

For them, this "relative undervaluation" is not a risk, but an opportunity. They prefer to buy an asset that is still low and has a clear price target rather than chasing a coin that is "too late" on the chart.

And they, probably, have already entered. Compliance restrictions on institutional investments are no longer a big issue. As long as there is enough incentive, any fund can strive for an allocation of crypto assets. Although Crypto Twitter (CT) has repeatedly vowed to "never touch ETH again" over the past year, from the market performance this year, ETH has outperformed other mainstream assets for more than a month.

So far, SOL/ETH is down nearly 9% for the year; After bottoming out in May, Ethereum's market capitalization began its longest rally since mid-2023.

So the question arises: if the entire crypto community considers ETH to be a "cursed coin", how can it still outperform?

The answer is: it's attracting new buyers.

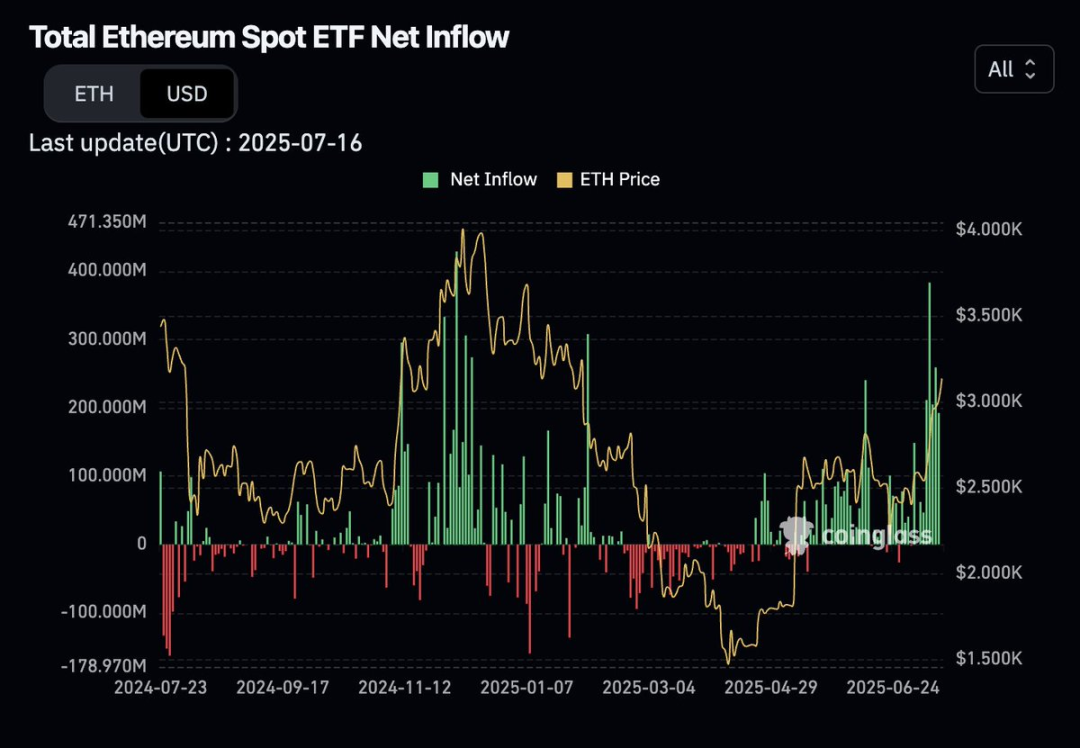

Since March, the net inflow data of Ethereum spot ETFs has been in a "up only" mode.

(Source: Coinglass)

Ethereum's share price that mimics MicroStrategy's model is taking off, injecting structural leverage into the market.

At the same time, there may also be some crypto-native users who realize that they are under-allocated and start transferring funds from BTC and SOL, which have risen sharply in the past two years.

To be clear, we're not saying that the Ethereum ecosystem has solved its problems. Rather, ETH is an asset that is beginning to gradually "decouple" from the Ethereum network.

External buyers are reshaping the market's narrative on ETH, shifting from a "downside is set" to a "valuation revaluation". Sooner or later, the bears will be squeezed, and the native funds may also join the chase at that point, and eventually we may have a round of ETH-centric market frenzy, and at some point we will reach a climactic top.

If this happens, ETH's all-time high may not be far off.

Recommended Reading:

The price is firm, and the four main "buys" of ETH are sorted out in one article

Entering the battlefield of coin stocks, Robinhood wants to be the NASDAQ of the crypto world