Alpha WORLD is about to be launched: AIOT will be supported for the first time, can structured staking reshape the value pattern of Alpha projects?

According to official information, Alpha WORLD, a Web3 digital financial platform, will be launched soon and will be the first to support the participation of $AIOT (OKZOO native token) holders.

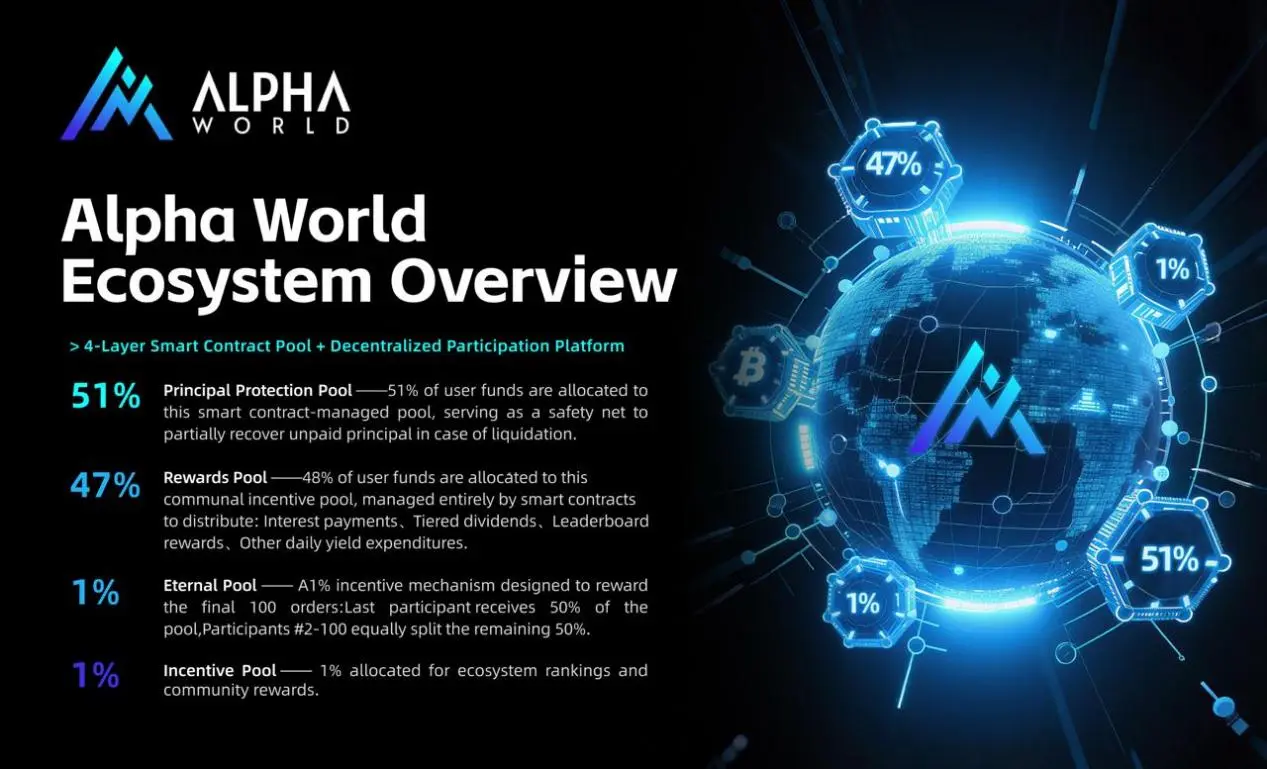

Alpha WORLD is not a traditional IDO platform, but tries to solve the core pain point of the current Launchpad market by introducing a structured financial participation mechanism and in-depth community binding. Its core innovation lies in shifting the focus from "fundraising before the project launches" to "value stability and community consensus growth after the project goes live".

1. Project Basic InformationProject

Name: Alpha WORLD

Core Positioning: A Web3 digital financial platform for the Binance Alpha ecosystem, aiming to activate early-stage project liquidity and community participation.

Project Mission: To transform the project from "passive display" to "active empowerment", and users from spectators to participants, contributors, and governors.

Initial access asset: $AIOT (OKZOO native token, listed on Binance).

Initial public chain: BNB Chain (BSC).

2. Market Pain Points and Alpha

WORLD's SolutionsCurrent Web3 projects, especially early-stage Alpha projects, are generally facing the curse of "the peak of the sale", even Binance Alpha is no exception. Alpha WORLD seems to have been born to solve this series of cascading problems:

Marketpain points:

- Value overdraft: Most projects are sold off on a large scale after they go online, causing prices to plummet, loss of confidence, and difficulty in long-term construction.

- Weak community consensus: User participation mostly stays at the low-quality speculative level, and lacks a stable mechanism and structured interaction model for early co-construction with project parties.

- Project homogeneity: The project mechanics on Launchpad converge and lack differentiation, making it difficult to build a real moat.

Alpha WORLD's solution:

- Structured fund release: For "smashing the market when it goes online", the platform has designed a staking contract pool and a lock-up mechanism with a random period (1 – 49 days) to manage asset liquidity through a stable and predictable rhythm, greatly alleviating short-term selling pressure.

- In-depth participation incentives: In response to the "low community activity", the platform has introduced recommendation incentives, behavioural rights and interests, and platform governance consensus (a DAO will be launched in the future) to deeply bind the interests of users to the platform and project ecology.

- Differentiated project model: For "project homogeneity", the platform allows each connected asset to have an independent contract pool and cycle model, providing the possibility of customisation for the project party.