Why corporate Bitcoin plays are outperforming spot BTC – a thread from Lyn Alden's brilliant insights! 🧵👇

Many big institutional funds can't directly buy Bitcoin or even spot ETFs due to legal mandates. But they can buy publicly traded companies that hold BTC on their balance sheets.

This makes "treasury stocks" like MicroStrategy the only compliant way for massive capital pools to get Bitcoin exposure. It's a key bridge! 🌉

Supply of these BTC-holding companies is limited. This scarcity, combined with institutional demand, creates amplified price action.

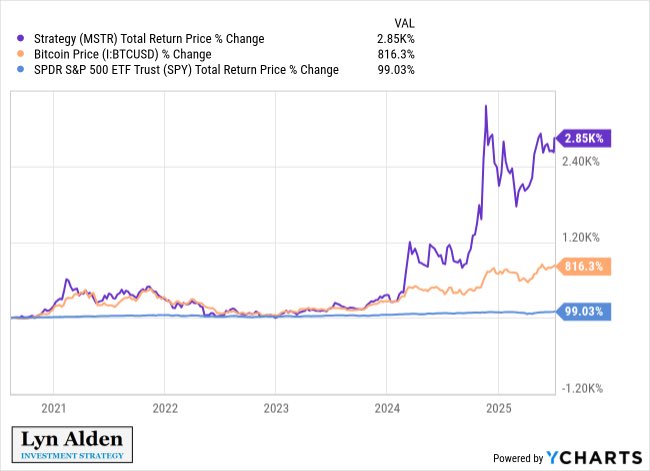

Case in point: Since 2021, MicroStrategy is up 2,850% vs. Bitcoin's 816% (both crushing the S&P's 99%). Talk about outperformance! 🚀

These companies aren't just buying Bitcoin; they're funding it with long-dated corporate debt. This strategy allows them to ride out volatility without forced liquidations, unlike typical leveraged plays.

Think of it as layered exposure:

* Direct BTC on their balance sheet

* Their operating business as a stability buffer

* Debt-funded stacking as smart leverage

This combo drives enhanced returns beyond what spot Bitcoin alone delivers.

Lyn Alden argues this is crucial for Bitcoin's adoption: it needs to be a widely held investment before it can be a widely accepted currency. Treasury stocks and bonds are vital stepping stones on this path.

Today's dual-engine adoption model:

* ✅ Mandate-friendly exposure via treasury corporations.

* 🚀 Durable leverage through corporate bonds.

* 🌍 Both normalizing Bitcoin in traditional finance.

Treasury stocks/bonds are a bridge, not the final destination. They pull in otherwise restricted capital, boost awareness, and amplify cycles. Ultimately, their purpose is to guide more people (and balance sheets) towards holding the real thing. #Bitcoin #Crypto #InstitutionalAdoption

You agree?

Show original

3.16K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.