Miners are cashing in. Exchanges are running dry.

Read below what that means for you ⏬️:

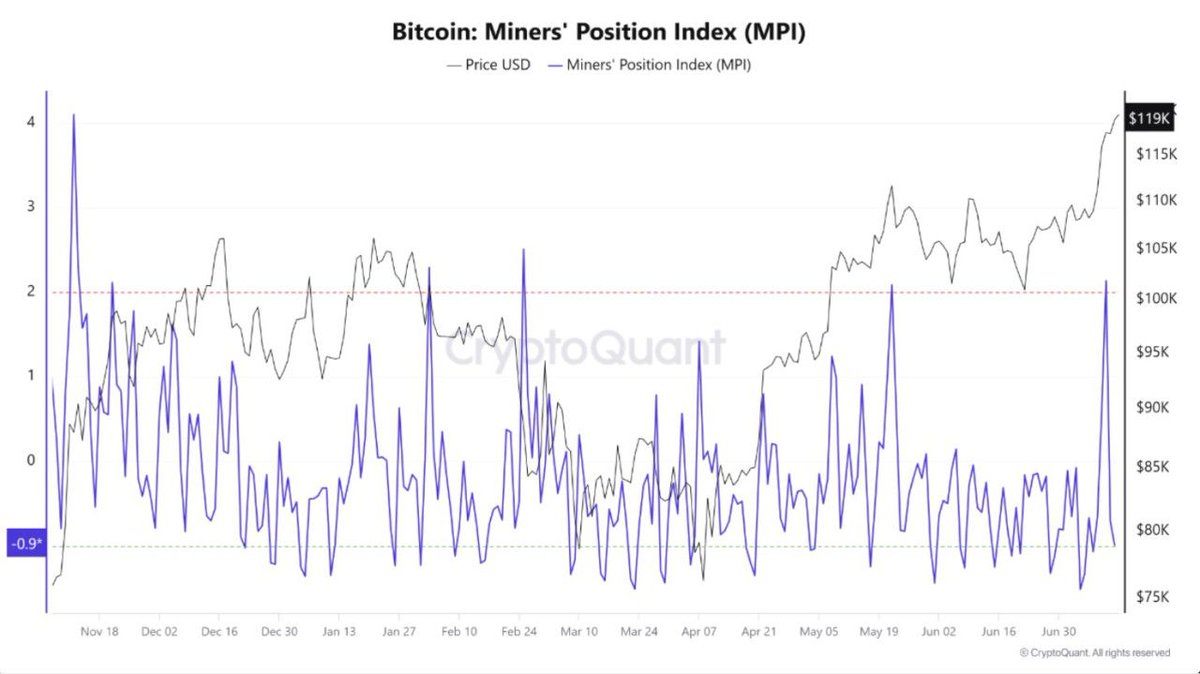

🔶 Miners are taking chips off the table

→ Miner Position Index went briefly above 2.0 yesterday

→ That means miners are selling more BTC than usual relative to their 1 year average

Why does this matter?

→ Miners sell to cover costs when prices are high and they sense demand strength.

→ This is not bearish for me, it's validation. They're selling into strength. No one feels the pulse of crypto better than miners.

The network is still booming:

→ $3.5B in BTC realized by miners

→ Hashrate hit all time high: 562 EH/s

→ This means they’re upgrading, and not exiting.

Miners are selling because they can, not because they need to.

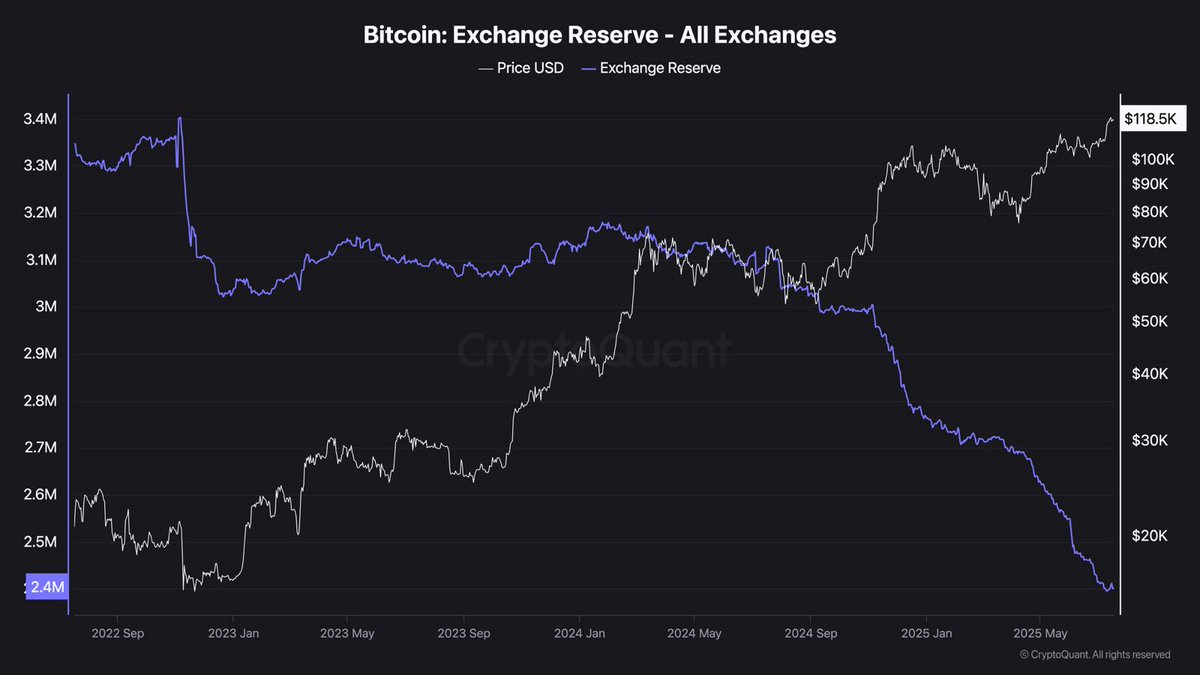

🔷 Exchange Reserves: 8 Year Low

Let this sink in:

→ Only 2.15 million BTC left on exchanges

→ Lowest since 2017

→ Net outflows led by Kraken and Coinbase, two of the top fiat onramps

This is strategic accumulation in real time.

When whales and institutions buy, they move coins off exchanges into deep cold storage.

That’s conviction. That’s long term belief. That’s how supply shocks begin.

Here’s what you need to know:

• In 2021, exchange reserves were over 2.8M BTC

• Now we’re down to 2.15M BTC

• That’s a 23.2% drop in liquid supply on exchanges in 4 years

• ETF demand alone is consuming 3–5x the daily mined supply

This is the setup.

→ Miners are confident enough to sell

→ Buyers are confident enough to withdraw

That’s absorption.

And there’s not enough Bitcoin left to satisfy what’s coming.

$150K is next.

This is how Bitcoin moves before it really moves.

Brace for vertical.

Show original

25.13K

272

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.