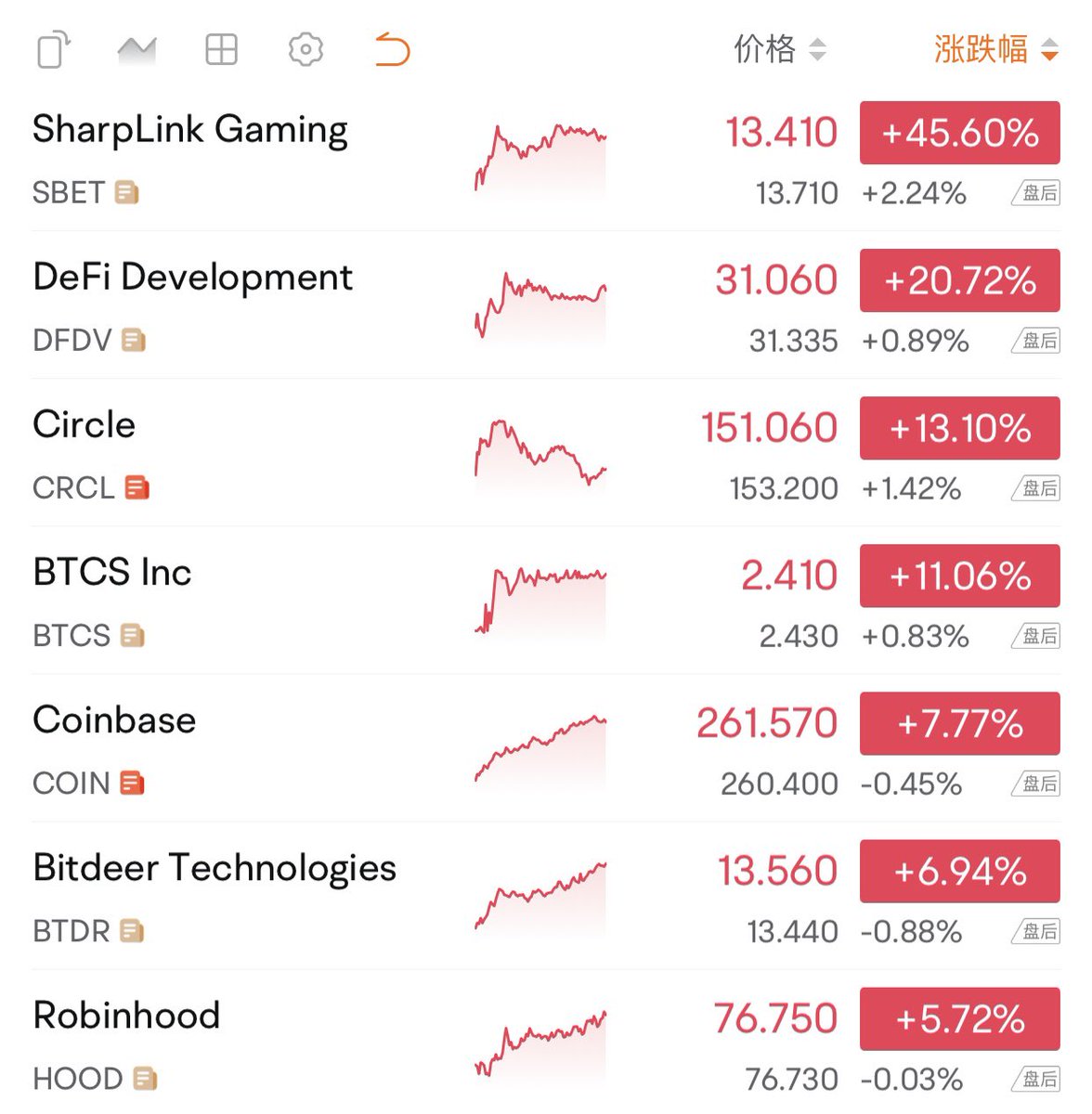

币市山寨季在美股,是一个尴尬的现状。其实回看过去两年半加密的财富效应其实很差,不说大饼,小币里跑赢英伟达没有几个,更不用说还有$pltr、$app,币股里$coin、$mstr、$hood。短时间脉冲一波没有意义,更重要的是经过调整后还能再回去,但是币市很多币(当下火热的美股币股不少股票可能也会如此)脉冲一波就再也回不去了。从资产的角度来看,除了收益率,还需要去看持续性和确定性。

53

30.45K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.