This is seriously one of the most exciting launches we’ve had on Starknet in a long time.

We’re finally getting a Hyperliquid-style Perp DEX, without leaving public Starknet:

> Up to 100x leverage on 50+ crypto pairs & TradFi assets

> Community vault (currently yielding 23% in USDC, nfa dyor)

> EVM users can trade on Starknet using their favorite wallets

> Built by ex-Revolut team with a bold long-term vision

Is this the missing piece to kick off Starknet’s DeFi renaissance?

Either way, the timing couldn’t be better, just in time for the upcoming BTCFi season.

As previously announced, Extended is migrating from StarkEx to Starknet. The migration process will begin in the first half of July 2025, with the exact start date to be communicated separately.

This tweet answers four key questions:

1. Why migrate?

2. What does the migration mean for users?

3. Why Starknet?

4. What’s the long-term vision?

In the thread, I’ll also walk through what the migration process will look like from a user’s perspective.

1. Why migrate?

Originally built on StarkEx, a ZK-based scalability solution by @StarkWareLtd, Extended has been limited to perpetuals. As we expand our product suite beyond perps — into unified margin with integrated lending markets and spot trading — we need a more composable and scalable foundation.

2. What does the migration mean for users?

Users will experience no disruption to their trading experience after migrating to the Starknet instance.

Starknet functions purely as a settlement layer, with all chain-specific logic fully abstracted:

• EVM users won’t need to set up a Starknet wallet

• Near-instant deposits and withdrawals will be supported across six major EVM-compatible chains

3. Why Starknet?

When choosing a settlement layer, we focused on four key factors:

• Security: A Stage 1 ZK-rollup with fast L2 and rollup finality (hours vs days on optimistic L2s)

• Performance: ~2 sec transaction confirmation and ~$0.00005 average user operation cost

• Longevity: StarkWare has been building through multiple market cycles for 7+ years

• Vision alignment: Starknet is aiming to be the first L2 to settle on both Bitcoin and Ethereum, enabling Extended to natively support BTC and its yield-bearing wrappers as a collateral — a leap toward deeper liquidity and broader capital efficiency

4. What's the long-term vision?

We’ll be sharing more details soon, but in a nutshell, Extended is building an open financial ecosystem powered by global unified margin, enabling users to deploy their crypto assets in the most capital-efficient way.

The first phase of this roadmap focuses on integrating native lending and spot markets into Extended. This will allow users to post any supported asset — including yield-bearing ones — as collateral, and earn additional yield through the integrated lending layer.

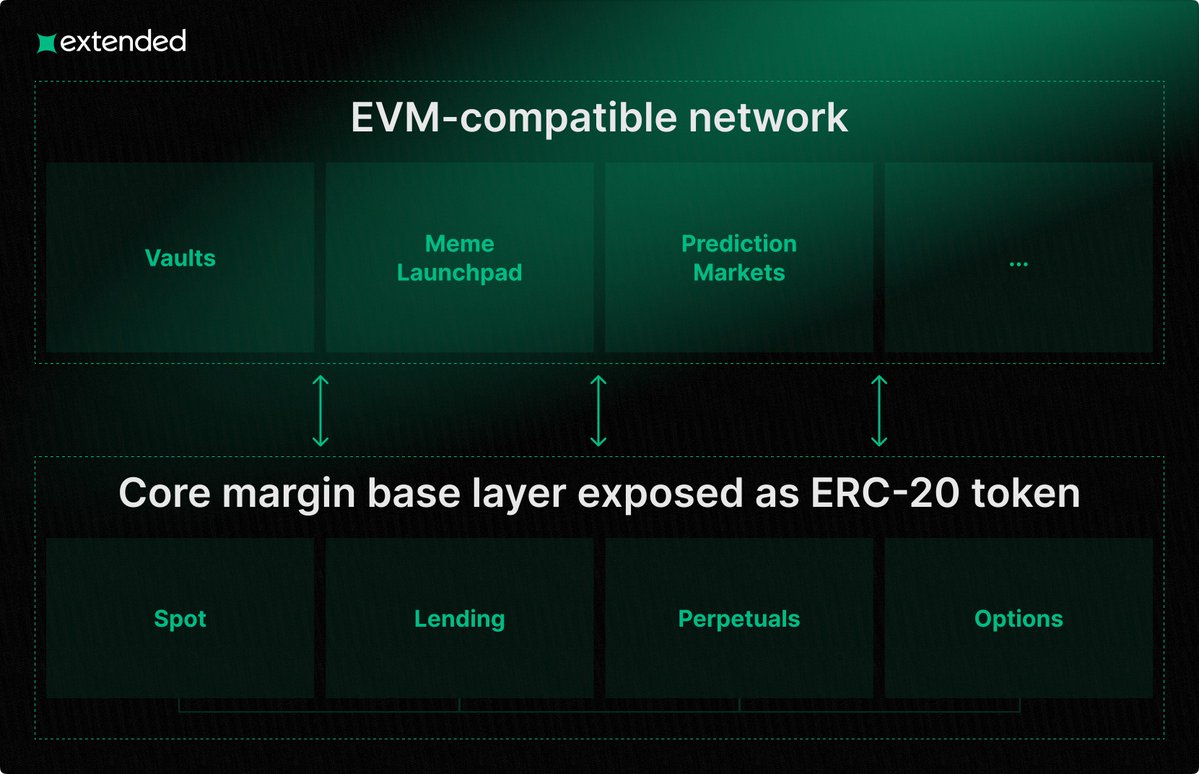

The longer-term ambition is to build an EVM-compatible network on top of Starknet, where unified margin logic is embedded directly into the base layer and exposed as an ERC-20 token accessible to all applications on the network.

For more details on the four topics above, please refer to

35

4.83K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.