Resolv正式拉入的我观察潜力列表

一句话总结Resolv:增强版的链上Ethena,稳定币的最大Alpha标

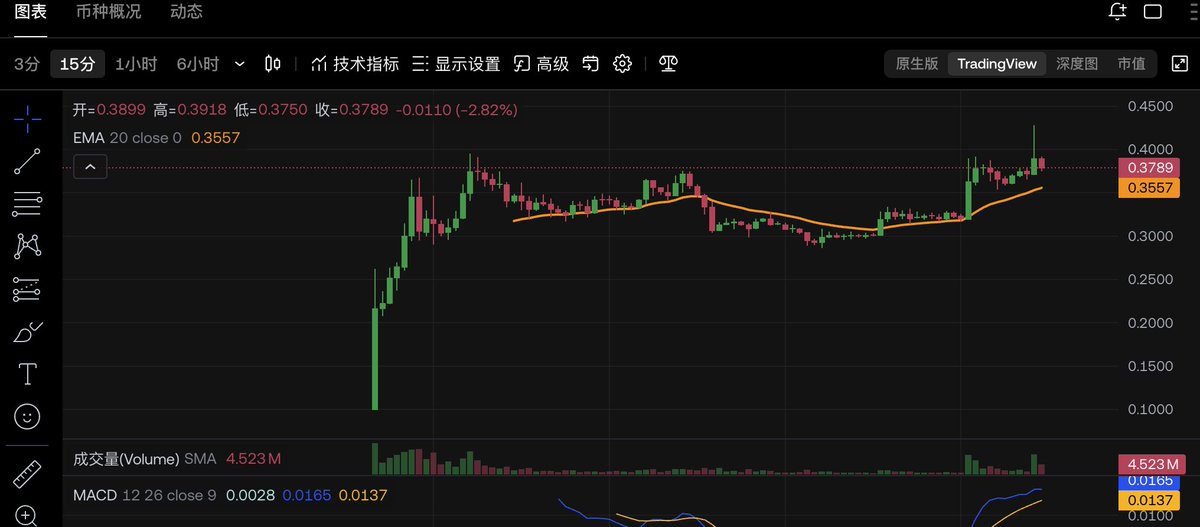

目前Resolv价格为0.38美金,流通市值5000万美金(低估值),FDV3.8亿。同比下同类项目Ethena,Ethena流通市值22亿,FDV54亿,当然Ethena tvl也更高,主要是说明赛道天花板比较高,也就是想象力比较大。

投资背景上,coinbase、Delphi都投了,还有Gumi Cryptos,Gumi是老牌Web3 VC,在稳定币、结构性金融、基础设施领域出手极为谨慎,对于稳定币而言确实要看投资背景,因为稳定币需要场景拓展,需要背书和资方推动

为啥看好Resolv未来价格?

1、稳定币赛道太诱惑了,比如最近usdc母公司Circle上市,这些都是传统派,即不用币圈资产抵押,不与币圈共享利益。新派就是Ethena,采用delta中性策略保持稳定,利益让渡币圈用户

而 @ResolvLabs 则是Ethena的增强优化版,由 ETH/BTC 衍生持仓和 RLP(风控保险池)共同支撑,而Ethena只有一个单代币模型(USDe),所有风险和回报都流入稳定币持有者

2、整体估值比较低,这是这轮投资的最大好处,这一轮确实去掉了币圈过去vc盘的庞大泡沫,所以这轮上所的vc项目都是低估值上线,这提供了一个很好的安全底线。Resolv最大的好处恰恰是有Ethena这样的先行者作为锚点,Ethena FDV是54亿,而Resolv仅仅只有3.8亿,不到Ethena十分之一,安全底线和潜力估值都极适合去做价投

说下Resolv的基本面本身,协议手续费分润计划还未上线,若落地将大幅提升内在价值;与USR的捆绑增长,USR发行越多,治理价值越高,这个在可见的时间内,USR稳步增长是大概率事件

但6月27日将迎来一轮投资人和流动性提供者的小额解锁(约 1.3% 总量),需关注市场反应,择机参与

将Resolv拉入的我观察潜力列表核心原因就是相对比较低的估值提供了安全底线,和可预见的USR捆绑增长带来的代币价格上涨,以及Ethena的成功作为一个参考锚点和样板,非常适合长线去埋伏

66

35.67K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.