Good morning, and God bless, #Team42!

Today’s Key Macro Question(s): Did the bond market break @realDonaldTrump?

Yesterday, the S&P 500 and NASDAQ 100 melted up +9.5% and +12%, respectively—their best days since Oct-08—after @POTUS postponed the greater than 10% portion of reciprocal tariffs by 90 days. This comes amid a further hike in the aggregate China tariff rate to 125%.

Part of the reason markets rallied so hard yesterday was that this was the first time anyone thought the “art of the deal” could actually work to realign global trade with relatively minimal disruption—ourselves included. We’ve been squarely in the “Trump 2.0 = a high probability ‘kitchen sinking’ of the US economy” camp since we authored the view last fall.

What if the “art of the deal” actually works—at least temporarily— because most of the major countries will eventually negotiate what appear to be favorable trade deals and pledged investments for the US over the next 90 days (or longer if there is a second extension due to “progress”)?

That outcome represents a significant curtailment of left tail risk, rendering it incredibly bullish for risk assets and Treasury bonds alike (more on that later). In this still-bad-in-absolute-terms-but-improving-in-rate-of-change-terms scenario, bears could at best hope for a retest of the lows as the market gains more certainty around contours of the pending sharp economic slowdown.

A retest of the lows likely represents the worst-case scenario despite the persistence of @DOGE, restricted immigration, historically elevated policy uncertainty, and tough comps net yet fully priced by markets that were myopically focused on tariffs for a large percentage of the decline. Why? Because even if all this became obvious enough to allow companies and investors to properly reset sales and earnings expectations, we can’t see that process creating more downside than the lows observed heading into this week. The combination of all that is still not as bad as a global trade war.

Regarding the now-delayed trade war, who's to say most countries won’t be accused of suckering President Trump into trade deals and commitments that they subsequently renege on when we read about this 4-5yrs from now?

How did the Phase One China deal work out? USMCA anyone? If I’m running a foreign commerce ministry, I would be among the first in line to say, “yes” to most/all the Trump administration's demands while immediately breaking ground on an elaborate list of excuses for planned delays throughout implementation. If it takes roughly three years to build an auto factory, you might be able to stretch out the planning and capital raising phases to the midterms and pivot to some legislative and/or legal challenges after that. Enter President @CoryBooker?

That was a joke, btw. You already know how I feel about him:

But what do I know? I’m just thinking out loud regarding the other side of the “art of the deal”.

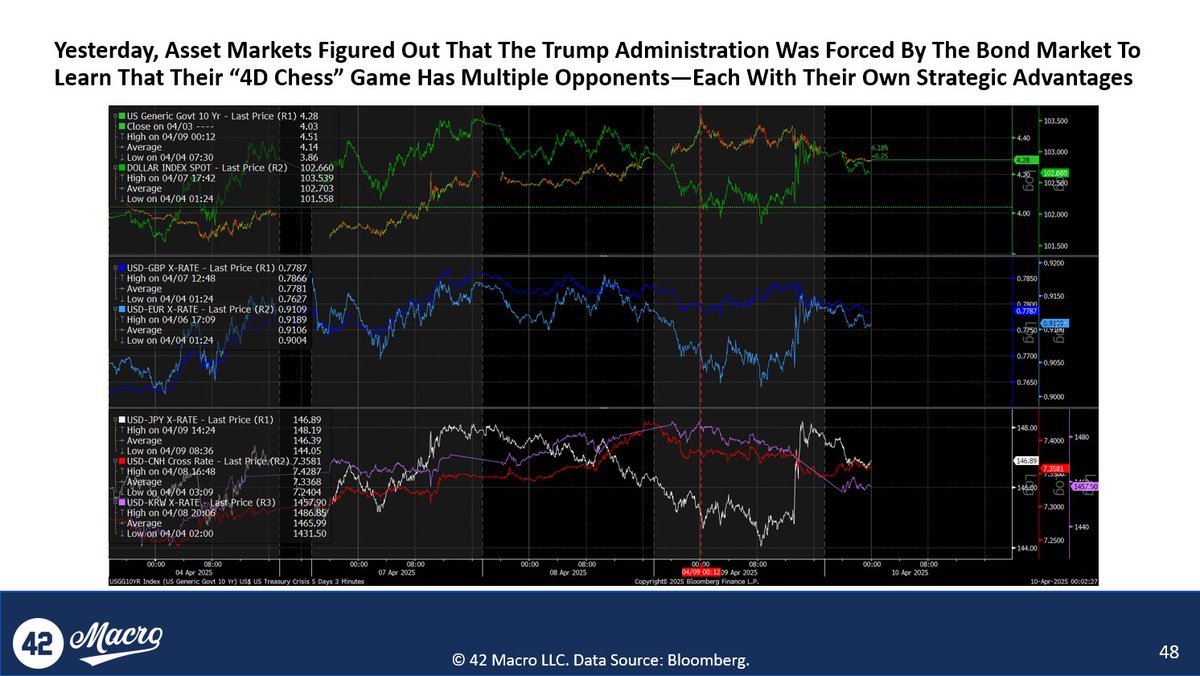

Since President Trump is allegedly playing 4D chess, another “other side” of the deal that we must consider is the potential check imposed upon Trump’s king by the global bond market—specifically the fire sale of Treasury bonds this week from a low of 3.87% on the Nominal 10yr to a high of 4.51% yesterday.

If the Trump administration’s assumed strategic advantage is “countries running trade deficits can’t lose trade wars" is true—and we think it is—then, by definition “countries running capital account deficits can’t win capital wars” must also be true because CA + KA = 0.

Perhaps the international negotiators sitting across the table from @realDonaldTrump, @SecScottBessent, @howardlutnick, and the economic advisory contingent featuring @jamiesongreer, @SteveMiran, and @RealPNavarro have a strategic advantage of their own: $8.5 trillion in marketable Treasuries (30% of the total) that they are willing to dump to prove a point.

The worst-case scenario for asset markets is that our foreign creditors spend the next 90 days playing hardball with a man who believes he was spared from an assassin’s bullet to restructure global trade imbalances. By then, it will be obvious the US economy is likely headed for or in at least a technical recession—if not an actual recession.

The latter outcome likely represents downside to the down-30-to-down-40-percent range for the S&P 500 based on the asymmetry in the positioning cycle our Positioning Model observed at the all-time high in the $SPY in February—which was essentially on par with Feb-20 before the 34% decline in the S&P 500 that would likely have been far worse if not for historic monetary and fiscal policy intervention.

That the high print of 4.51% was reached shortly after midnight in New York, 5:12am in London, 6:12am in Frankfurt, 1:12pm in Tokyo and Seoul, and 12:12pm in Beijing is supportive of this view. Also supportive is the fact that the US dollar was declining in lockstep with Treasury bonds during the final half of the three-day move—indicating price-insensitive capital repatriation by foreign creditor nations.

The fact that the euro, Japanese yen, and British pound each featured the most exaggerated increases vs. the USD during this period—in that order—makes sense when you consider that the Eurozone, Japan, and UK represent three of the four largest foreign creditors to the Treasury market at $1.8tn (first), $.1tn (second), and $740bn (fourth), respectively. The Chinese yuan depreciated throughout, as Beijing is clearly seeking to offset the cost of tariffs and fend off an economic downturn via currency devaluation, among other things.

All told, the fact that the “Trump put” was exercised—or at a minimum rolled to July 9—due to stress in the Treasury bond market has both positive and negative implications.

On the positive side, it clears the way for, at worst, a retest of the lows in the interim and, at best, a sustained uptrend from here. On the negative side, it is confirmation of the growing, geopolitically driven supply-demand imbalance we have been warning about in the Treasury bond market. @42Macro clients, refer to slides 56-84 our Apr-25 Macro Scouting Report Presentation from last Friday for more details.

Eventually, this supply-demand imbalance will break markets and no policymaker outside of the Fed Chair will be able to fix it—and any solution will likely come at a tremendous cost to low-to-middle income consumers and small businesses in purchasing power and wealth inequality terms.

Refer to our note yesterday for why we believe the best method for investors to safely navigate these Fourth Turning polycrisis dynamics is via the use of proven risk management overlays like KISS and Dr. Mo. Trust me—as a renowned global macro expert, there are far too many dimensions of scenario analysis to handicap to properly position portfolios for these interconnected risks using fundamental research alone.

@42Macro clients, remember what we have consistently coached you on all year: 1) bear markets are at least twice as hard to risk manage as bull markets are “easy”; and 2) the distribution of probable economic outcomes is as wide as most investors have ever seen, so be ready to pivot if/when KISS and Dr. Mo pivot.

Odds are you’ll thank them later even if you/we do not trust or fully understand why in the moment. The market is smarter than we are and someone always knows something (e.g., "THIS IS A GREAT TIME TO BUY!!! DJT").

If you found this note helpful, please like and share. Thank you!

Consistently making money and protecting gains in financial markets require a lot of time, expertise, and computational power. Investors partner with 42 Macro because we do the heavy lifting and answer the hard questions for them. See for yourself:

Have a great day!

-Skipper

520

77.77K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.