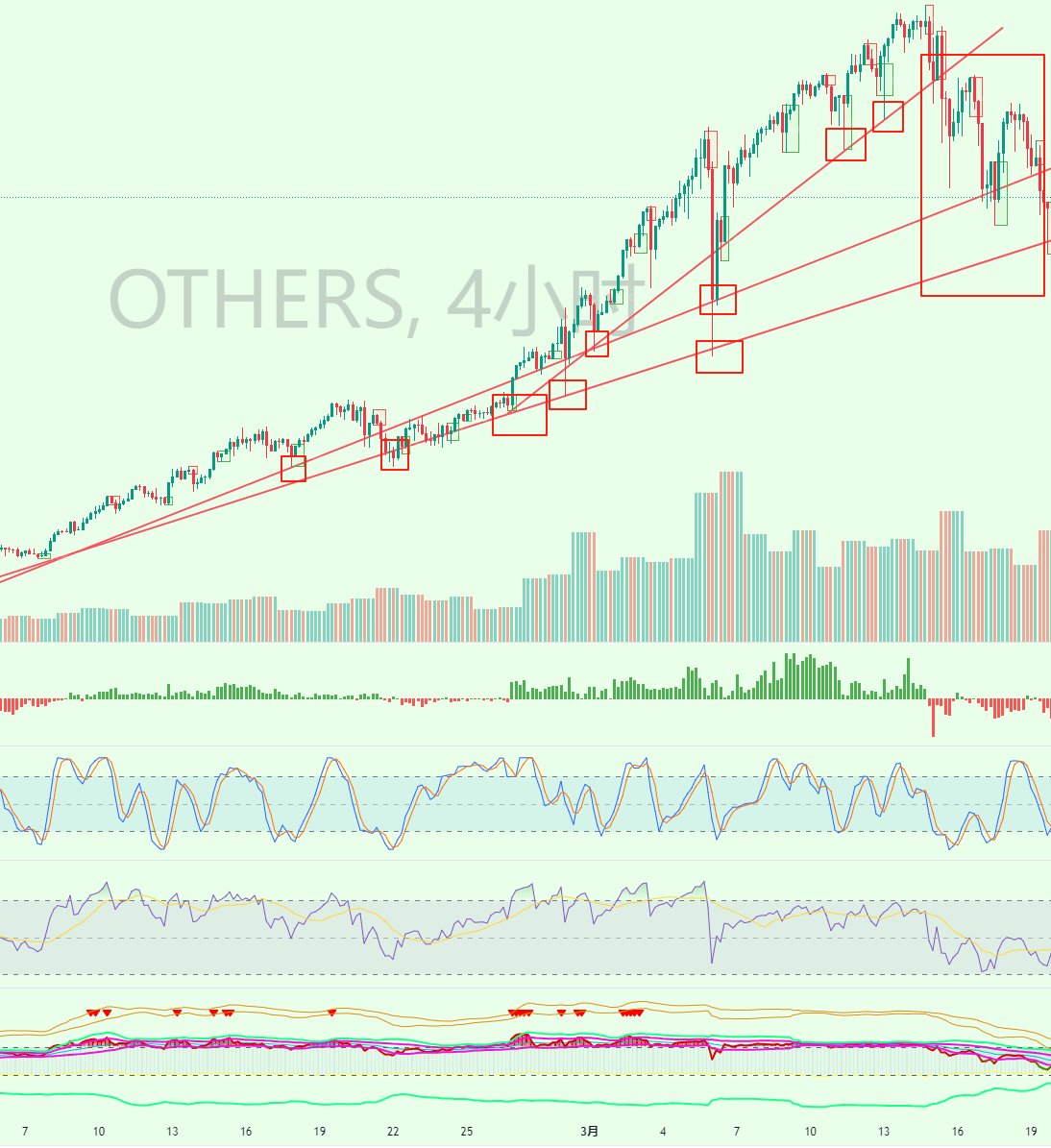

The rise in February-March last year (corresponding to the BTC rebound after the January dip - 73777)

The last segment of the rise significantly deviated from the original trajectory.

The acceleration phase is the last segment and also the most profitable one.

It is also the most dangerous segment - after the rise, a major correction is inevitable.

Many people refer to this as a tail-end market.

However, this tail may account for 50% of the entire rise (goldfish tail market).

To engage in this segment, one must have psychological expectations.

In the end, if it doesn't work out, you can call Sister Wa "Mom."

$OTHERS

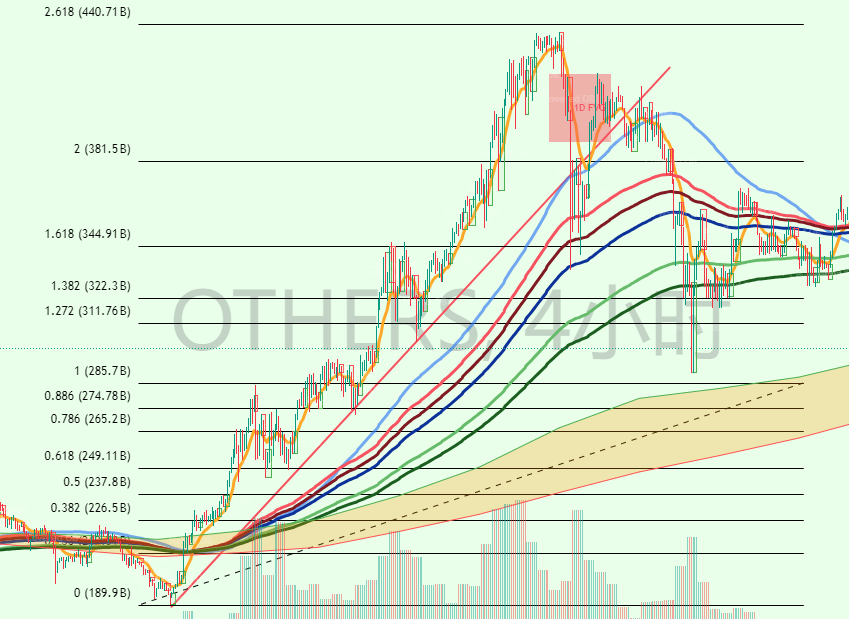

I currently set 378b as the target price for this round of increase.

Comparing it to the trend of the market in November.

This increase is indeed not as rapid as in November, but it's better than nothing.

The acceleration phase (deviating from the original slope) is the final surge, and when the surge ends, it will be followed by a decline.

This article is sponsored by #BCGAME|@bcgame @bcgamecoin

12.72K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.