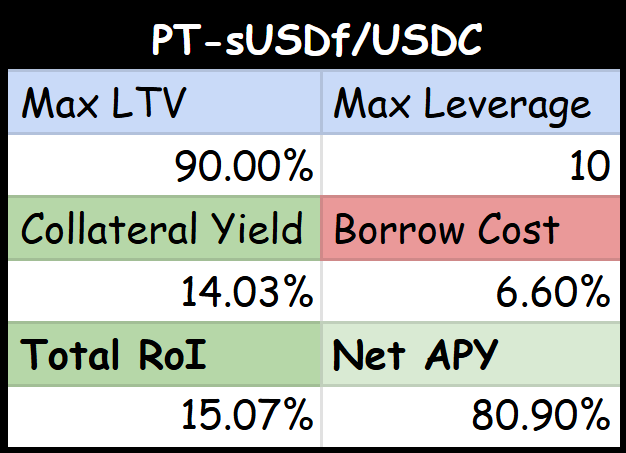

A fresh $2m USDC has been added to the PT-sUSDf market, bringing borrow costs to 6.6% APR

Meanwhile, PT-sUSDf fixed rates have shot up to 14% APY (+9% WoW)

Assuming borrow rates stay stable, PT-sUSDf/USDC loops are looking at a HEFTY 80.9% APY (15% RoI over 68 days)

Great thing about PTs is even if implied yields go down, entering no lets you lock in that sweet 14% APY.

The market uses a fundamental oracle + USDf:USDC so liquidation risk is VERY low.

Check it out here:

😘😘😘

1.74K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.