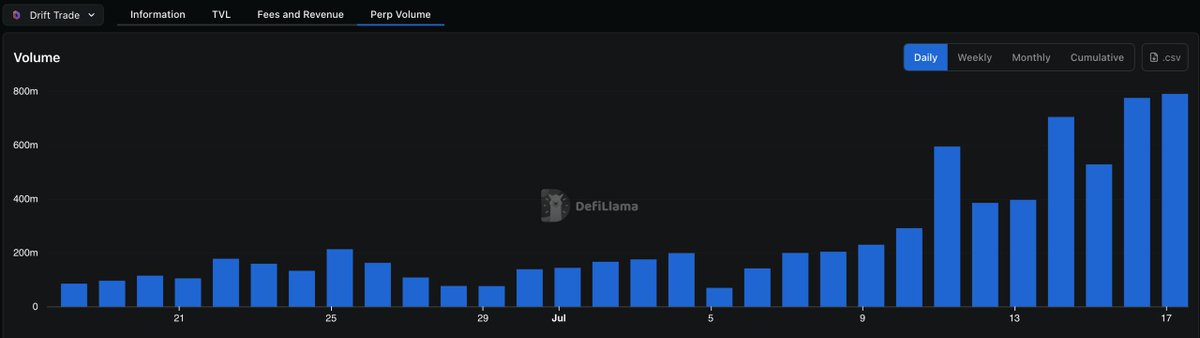

Drift volume has 10x’d over the past few weeks.

We’re regularly clearing over $800M a day, with open interest >2x to $400M, making us the second largest perp DEX by OI.

What’s been happening under the hood?

1. Our protocol-owned AMM is now highly competitive.

There’s been a lot of work done on AMM liquidity and natively on-chain market makers, and the numbers are speaking for themselves.

AMM fills have gone from under 30% to 70% of all fills on Drift.

This confirms what we’ve believed for a long time: on-chain coded matching logic can outperform traditional CLOBs. The average fill on majors is now just 1–3bps which is CEX-level liquidity, all on chain, all on Solana.

2. We’ve started onboarding new market makers and taker firms

We've already onboarded 10+ new trading firms and are onboarding more MMs as we speak. Even after launching our zero-fee BTC campaign, usage across fee-paying markets has grown, and protocol revenue is trending up.

All this has led to tighter spreads, better fills, and just more activity across the board. If you’re a trading desk/MM, now’s the time to be on Drift.

3. Our OI metrics are showing true retail activity, not just taker volumes

The strength of our Open Interest ($400M+) isn’t just driven solely by takers playing zero-fee markets. It's showing real, sticky retail demand, with a growing user base that is using the platform at scale.

4. Performance upgrades on the product

Behind the scenes, the team’s been heads down on product performance.

We're actively testing auto-confirm on @phantom, reworking our onboarding to one step, building a cleaner mobile web UX for @Phantom, @solflare, and , users. We have also been keeping our ears to the ground and are continously responding to every single user's feedback.

All to achieve a simple goal: make Drift the fastest, smoothest trading experience in DeFi.

And there’s A LOT more coming:

• Isolated perp positions support in a single sub-account

• Take profit / stop loss upgrades

• A compute-optimised MM oracle built specifically for our AMM

• Drift Builder Codes: revenue sharing for ecosystem partners

• Drift Foundation’s Builder Fund: grants and support to accelerate mobile frontends

• Drift Liquidity Provider (DLP) token, giving users a way to earn yield by supplying liquidity to the protocol

Everything is compounding.

We’re building the most performant on-chain exchange and it’s already starting to show in the numbers.

We'll keep pushing because we’re not here to be second best.

Floodgates will be opened. We are in wartime mode.

We will be #1.

46.16K

240

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.