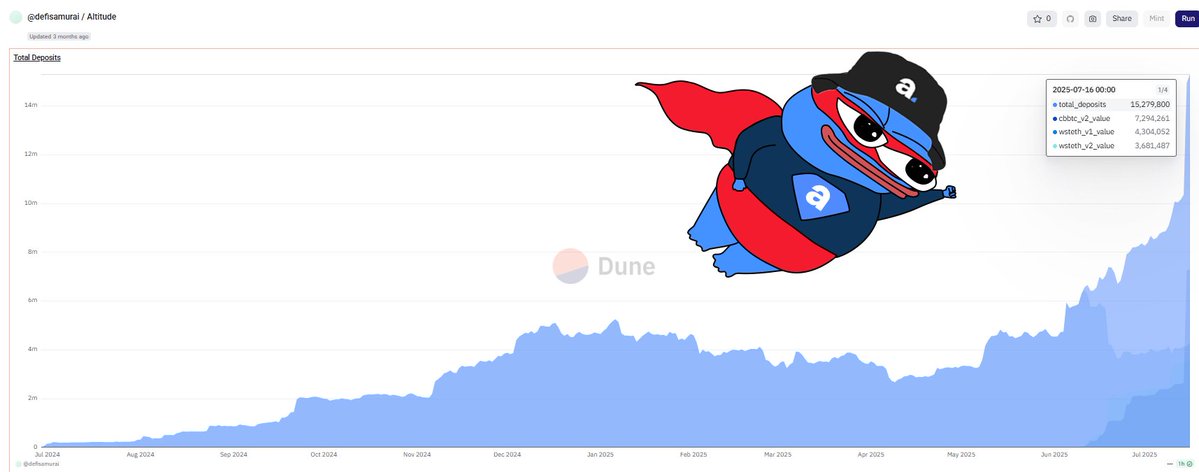

First, congratulations to @AltitudeFi_ for reaching $15M in productive deposits.

This isn't just TVL; your funds are actively generating yield instead of being locked up, allowing you to relax.

Now, how can you maximize this further?

Here are some strategies to consider (NFA + DYOR):

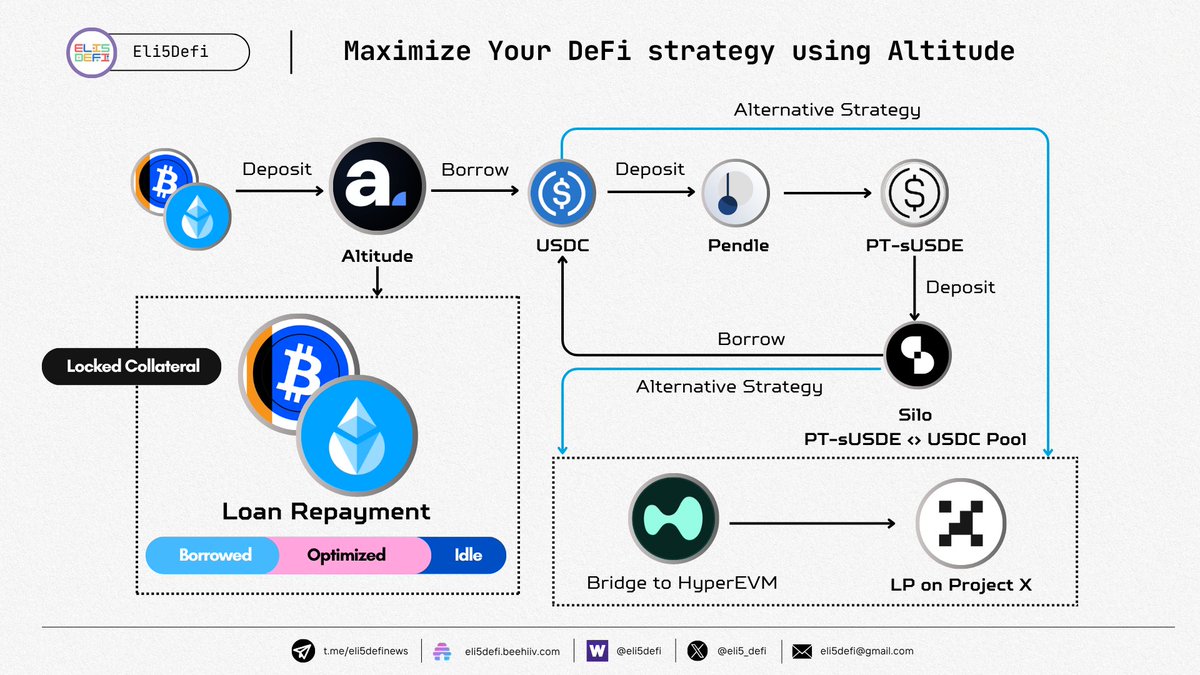

First Option:

- Supply cbBTC or wstETH to Altitude

- Borrow USDC (50-60% LTV is the safest for me)

- Deposit that USDC into @pendle_fi to earn ~14.5% fixed APY with @ethena_labs PT-sUSDE

- Head over to @SiloFinance, deposit PT-sUSDE, and borrow USDC

- Rinse and repeat

Second Option or Continuation:

- Bridge your USDC to USD₮0 on HyperEVM via @RelayProtocol

- Create an LP on @prjx_hl to earn trading fees and points

By implementing these strategies, you can not only maximize your APY but also unlock infinite composability while your underlying collateral in Altitude is repaid from the generated yield.

We’ve reached $15 million in $BTC and $ETH deposits, meaning we’ve tripled our total deposits since the launch of our public vaults.

It’s clear more people are starting to embrace the idea of smart loans - lower liquidation risk through automation, low LTVs, and idle capital put to work.

Borrow against your long-term bags and access some of the best borrowing rates in the market, all while leveraging established DeFi infrastructure like @Aave, @MorphoLabs, @pendle_fi, and more.

6.65K

56

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.