Virtuals Genesis' recent data analysis: the average income of IPOs is 32 times, and the degree of oversubscription is strongly correlated with returns

By The Smart Ape

Compiler: Deep Tide TechFlow

It's uncertain how long the boom will last, but @virtuals_io's Genesis project is undoubtedly one of the most profitable options right now.

They seem to have cracked the wealth code, bringing in amazing gains (x100, x60, etc.) and unexpectedly stable.

The following is a detailed gameplay analysis:

A month ago, Virtuals launched "Genesis Launches", which is essentially a $VIRTUAL-based AI agent launchpad.

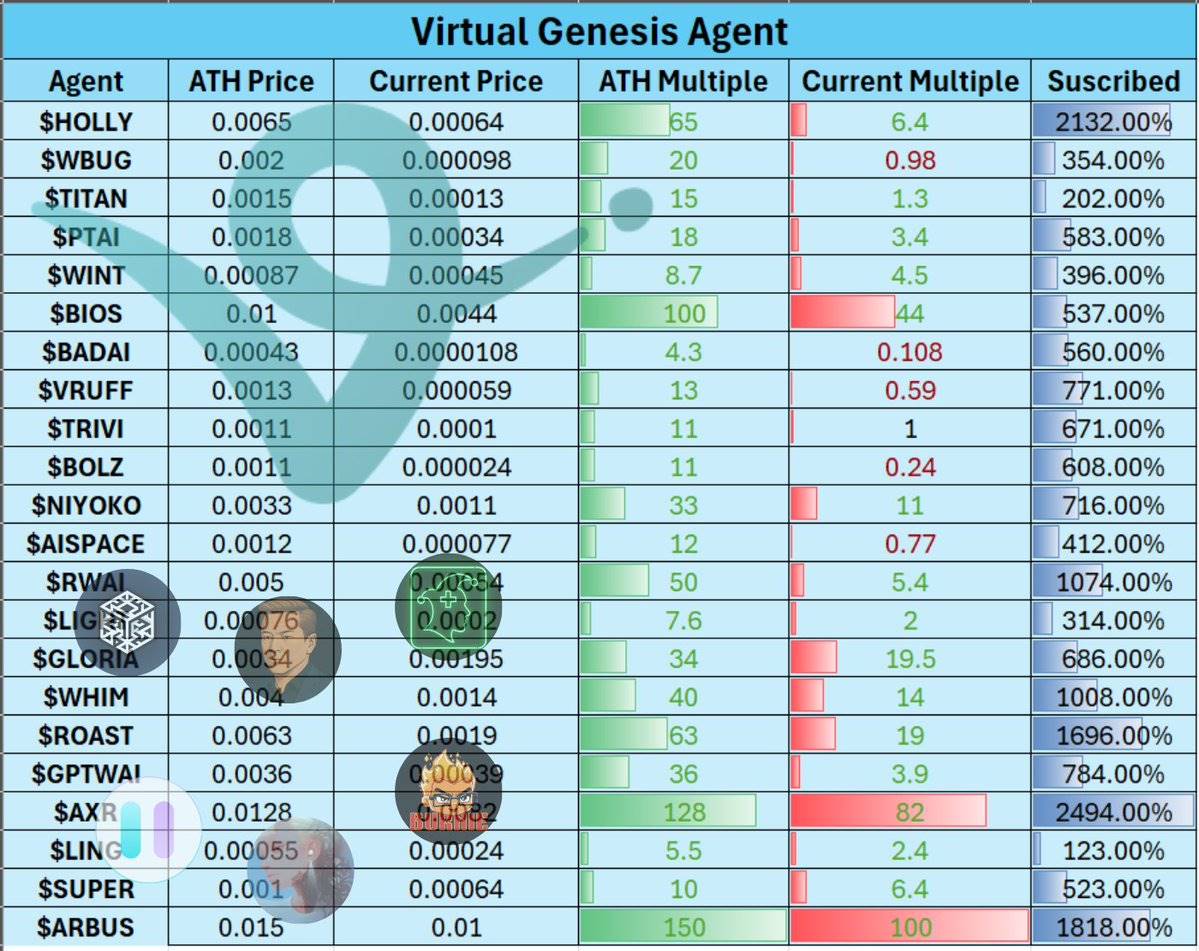

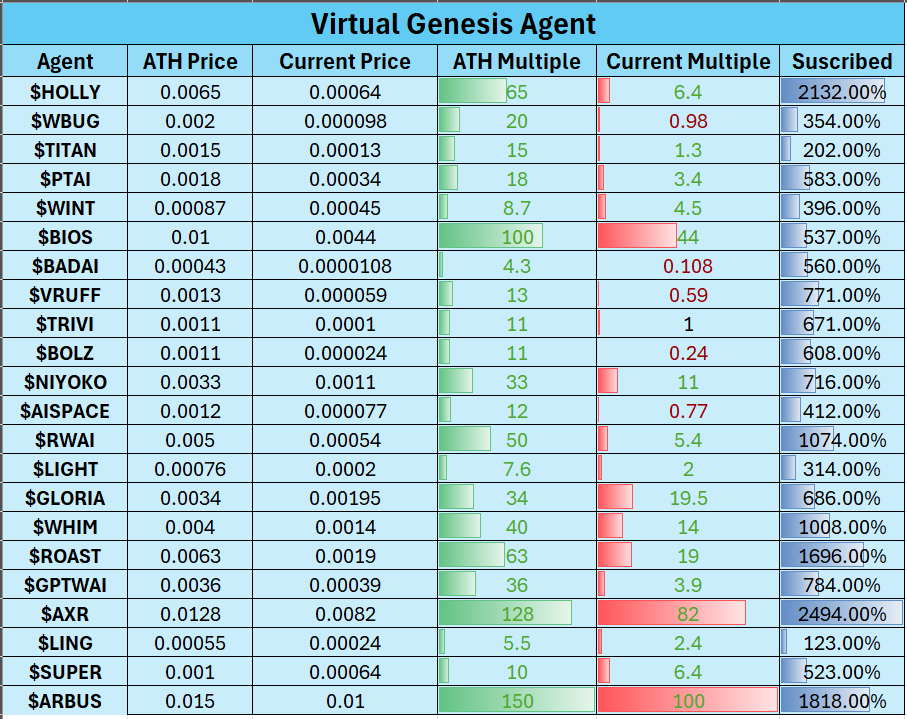

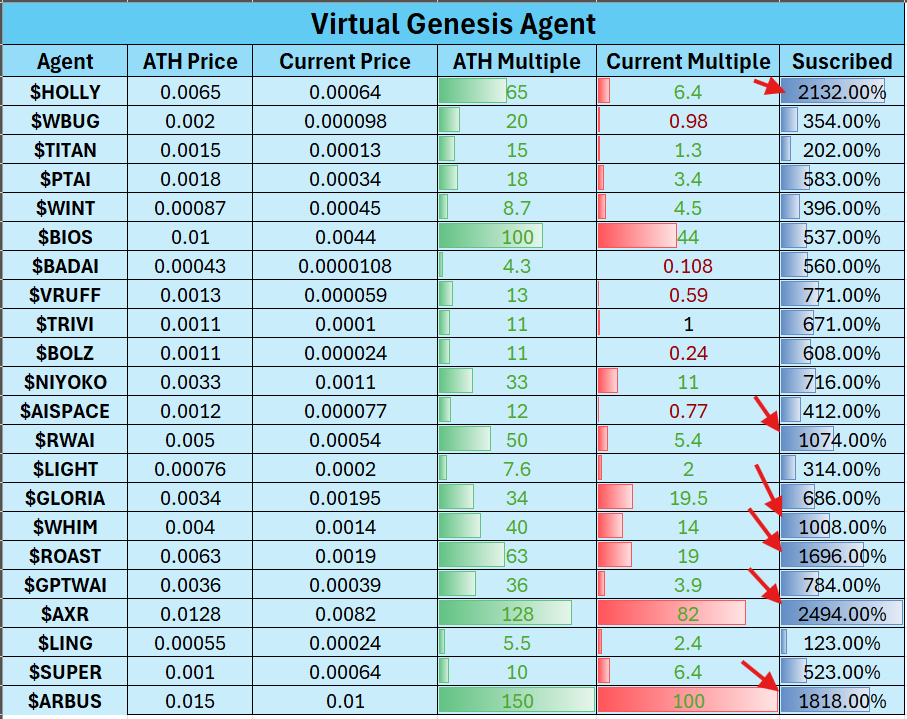

So far, about 24 AI agency projects have gone live, and almost all of them have brought amazing returns, ranging from x4 to x128, with an average of x32.

To be considered a successful launch, a project needs to raise at least 112K $VIRTUAL (which is the minimum standard). There is no cap, and some projects are even oversubscribed by more than 2000%.

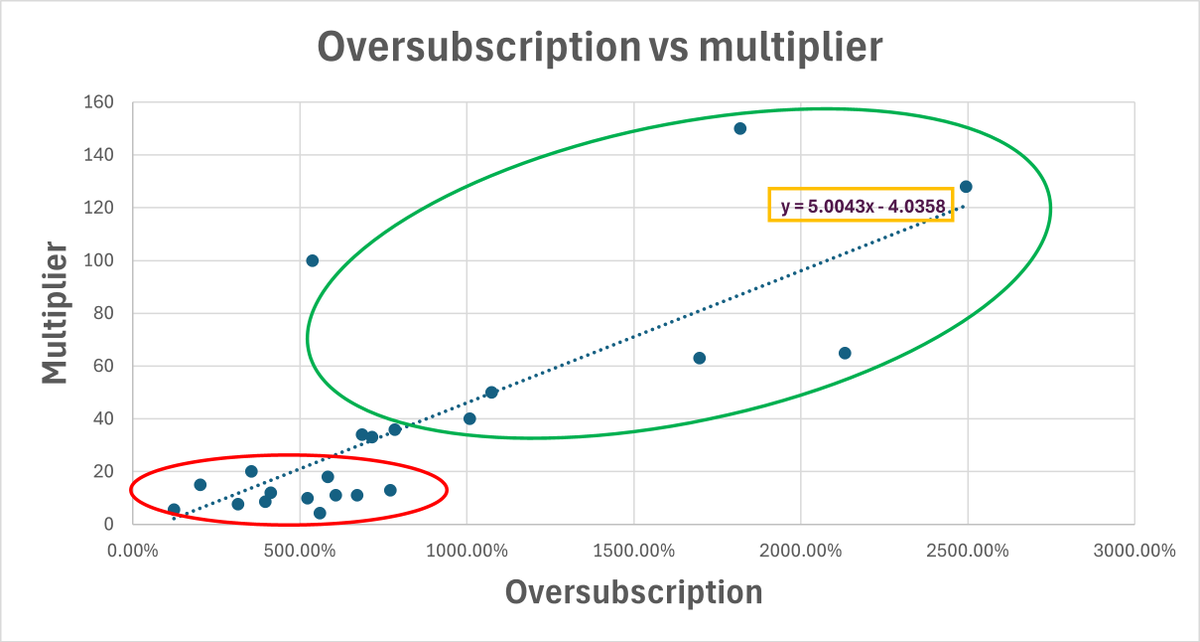

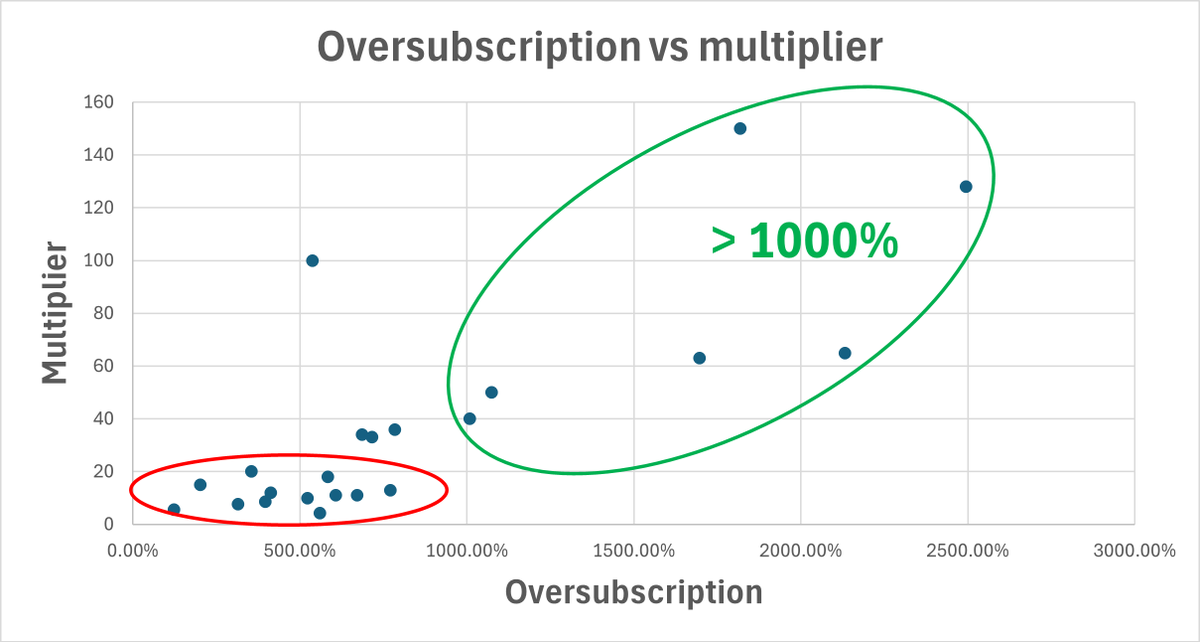

The data shows that there is a strong correlation between the oversubscription ratio (which is publicly available) and the pre-sale multiple.

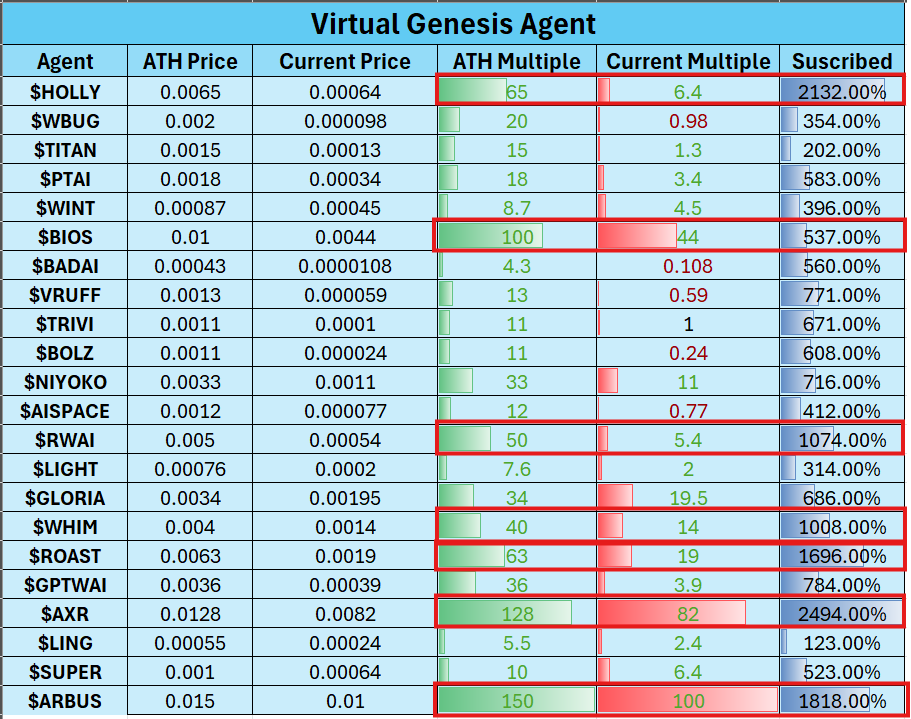

Any project that is oversubscribed by more than 1000% brings great returns.

As can be clearly seen from the chart, there is an almost linear relationship between the subscription ratio and the return multiple.

The logic is also simple: 1000%+ oversubscription means extremely high demand.

Since the presale supply is fixed, the high subscription ratio means that buyers will end up with fewer tokens.

Many people are unhappy with the small allotment and may continue to buy when the project goes live, including those who missed the presale altogether.

Even if you maximize your allocation, an increase in the number of participants will still dilute your allocation.

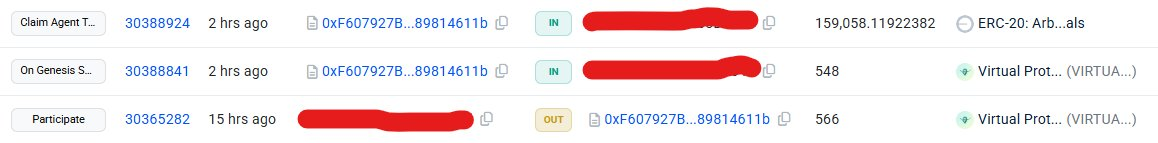

For example, in the recent $ARBUS presale, I put in the entire 566 $VIRTUAL, but in the end it only took 18 $VIRTUAL and the rest was returned.

If the number of participants was smaller, I could have gotten a larger share of tokens.

Cons: More heat = smaller allocation, even if you have a lot of points.

Pros: All tokens are 100% unlocked at launch.

You can sell it right away, but there's a "catch" here

If you choose to sell and make a profit, you will trigger a 7-10 day cooldown period during which your points will be cut.

The more you earn, the more points you lose.

This mechanism effectively reduces the selling pressure, which is one of the reasons why some projects will rise sharply after going live.

Your points have a direct impact on your ability to profit from Genesis.

More points = bigger distribution = higher potential earnings.

With around 80 million points distributed every day, there are multiple ways to earn points.

The smartest strategy is: accumulate points and only participate in the pre-sale that is oversubscribed by 1000%+.

In this way, your return multiplier can reach at least x40+.

After the token is listed, choose the right time to sell it for a huge profit.

Accept the points cut after the sale and wait patiently for the cooling-off period.

Focus on high-heat projects, avoid frequent cooldowns, and pursue big gains while using the gap time to earn more points.

Of the 24 tokens that have been listed, only 6 projects are oversubscribed by more than 1,000%, accounting for about a quarter, with one appearing approximately every two weeks.

Who wouldn't want to earn x50 or x100 every few weeks?

While you wait, accumulate more points and get ready for your next opportunity.

Of course, this pattern won't last forever. As more people learn how to utilize this system, its effectiveness may wane.

But for now, it's still working and may continue for a few more months.

Just focus on earning points and target high-demand items.