The crypto market is bleak, and the most complete 2025 stablecoin wealth management strategy will take you through bulls and bears

Original author: @arndxt_xo, researcher at Crypro

Original compilation: zhouzhou, BlockBeats

Editor's note: This article discusses the strategies and yields of several interest-bearing stablecoins, including how different platforms can generate yield by investing in US Treasuries, DeFi lending, and real-world assets. Each stablecoin has different strategies and yields, such as staking, lending, or liquidity mining. The article also mentions the characteristics of these stablecoins, such as no lock-up, automatic accumulation of returns, etc., which are suitable for long-term investment and users who require stability, providing an innovative decentralized finance solution.

The following is the original content (the original content has been edited for ease of reading and comprehension):

What is an interest-bearing stablecoin? It is a stablecoin that remains pegged to $1 while also bringing passive income. How? By borrowing, staking, or investing in real-world assets like U.S. Treasuries. Think of it like an on-chain money market fund, but it's programmable and borderless.

In a stablecoin market of more than $225 billion with trillions of annual trading volumes, interest-bearing stablecoins are emerging as along:

• On-chain savings accounts

• Yield products powered by RWA

• Alternatives to banking and fintech

• Yields of around 3–15% per annum while keeping assets in USD

Let's break down how mainstream protocols achieve these benefits

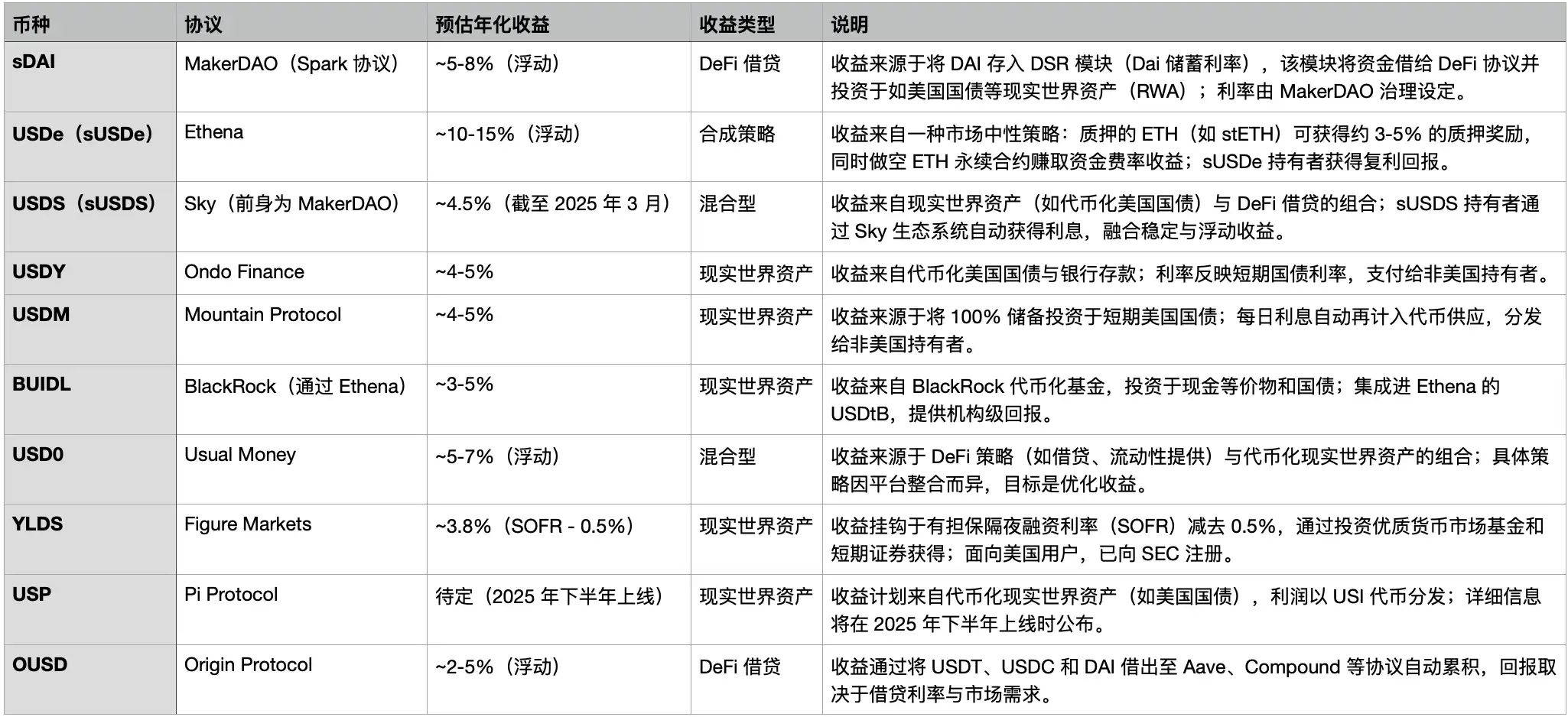

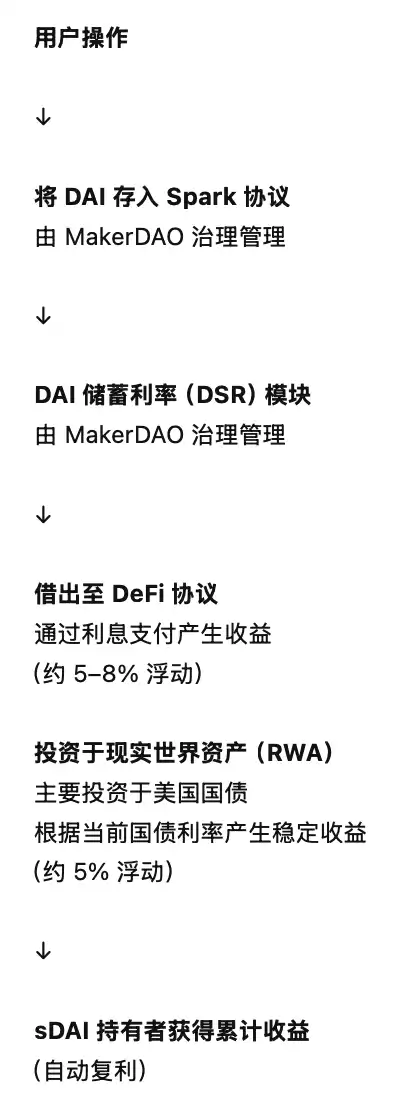

sDAI – Provided by MakerDAO through @sparkdotfi

→ Annual Yield: Approximately 5–8% (floating)

→ Strategy: DSR (Dai Savings Rate) yields from a variety of sources

• Deposit DAI into Spark

• Revenue sources include:

• Stabilization fee for the loan

• Liquidation proceeds

• DeFi lending (e.g. Aave)

• Tokenized assets of U.S. Treasuries

You will receive sDAI, a token based on the ERC-4626 standard, which will automatically grow in value (without rebasing), and the yield will be adjusted by the governance mechanism according to market conditions.

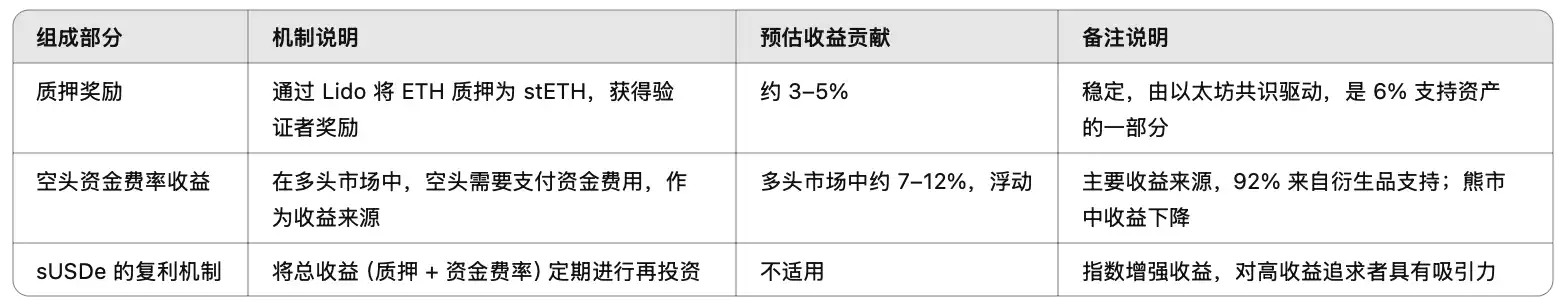

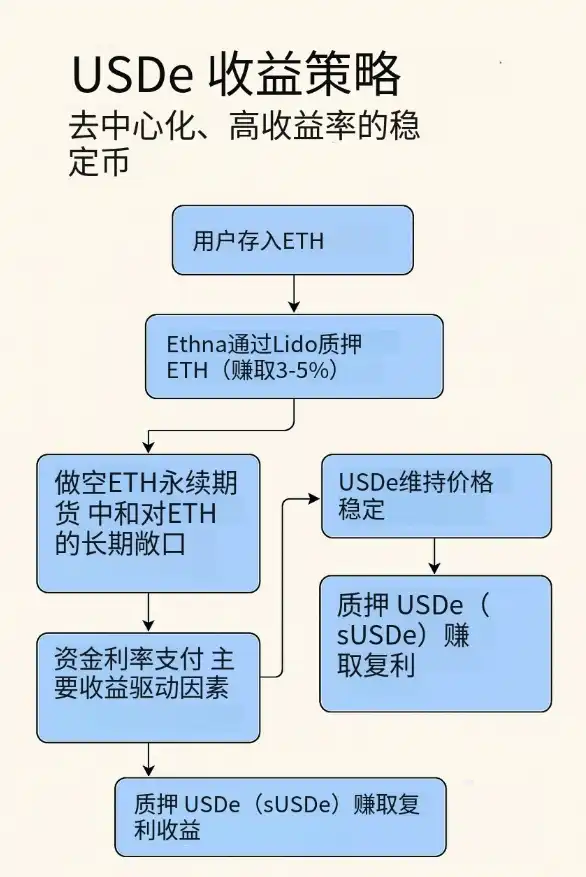

sUSDe – Synthetic yield provided by @Ethena_Labs

→ annual yield: around 8–15% (up to 29% in a bull market)

→ Strategy: Delta-neutral yield from Ethereum

• Deposit ETH → stake via Lido

• Also short ETH on CEXs

• Financing Rate + Staking Rewards = Earnings

sUSDe holders receive compounded earnings. High yield = high risk, but not dependent on the bank at all.

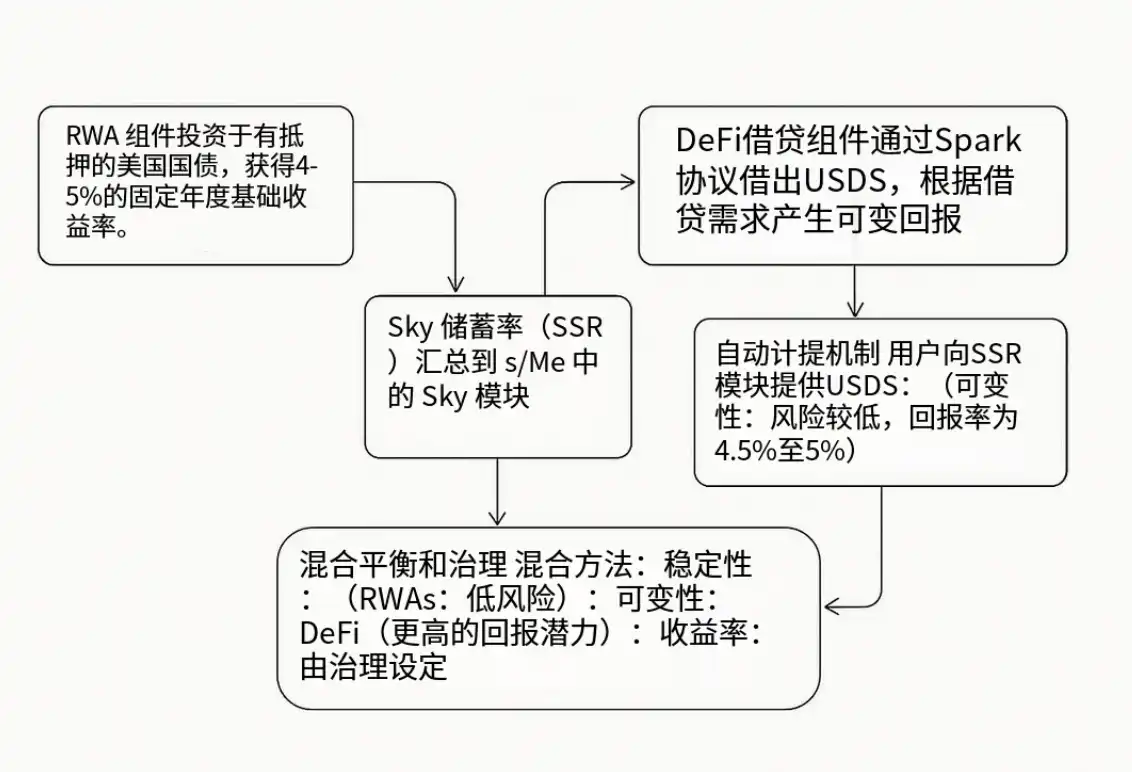

sUSDS – Provided by @SkyEcosystem (formerly the MakerDAO team).

→ Annual Yield: Approximately 4.5%

→ Strategy: Hybrid RWA + DeFi Lending

• The underlying income comes from tokenized U.S. Treasuries

• Additional income comes from Spark lending

• Proceeds are distributed through the Sky Savings Rate (SSR).

No staking, no lock-up, automatic balance accumulation, and the governance mechanism sets the target annual rate of return for SSR.

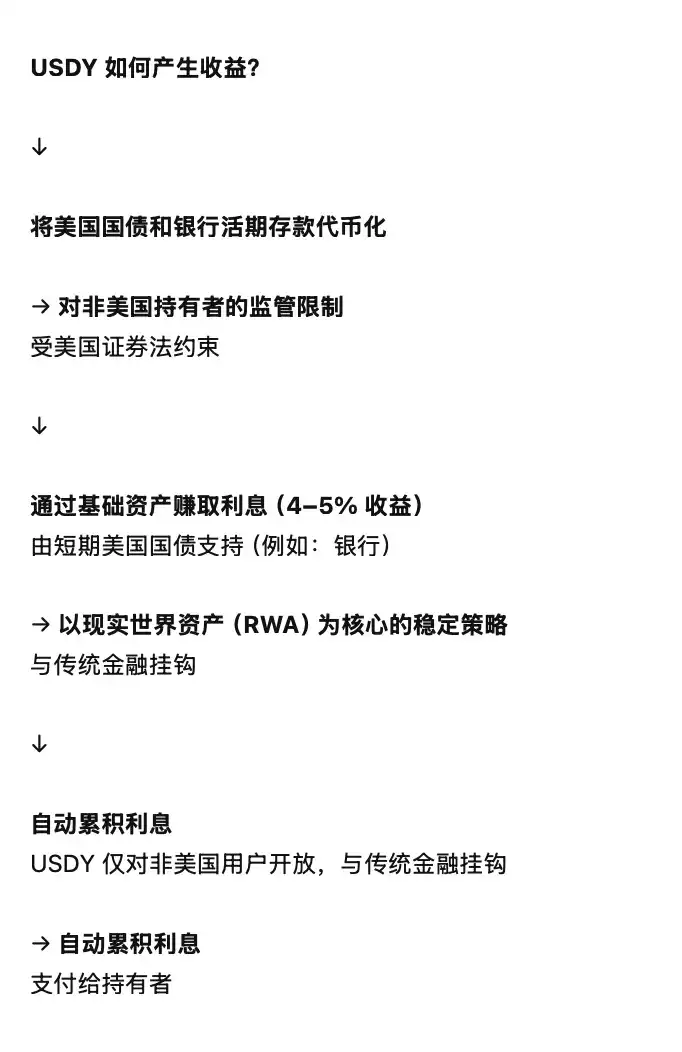

USDY – Offered by @OndoFinance

→ Annual Yield: Approximately 4–5%

→ Strategy: Tokenized traditional finance for non-US holders

• 1:1 support for short-term U.S. Treasury bonds + bank deposits

• Earn income like a money market fund

• As a result of Reg S, proceeds are distributed to non-US users

It is likely to be automatically accumulated, making passive income more seamless.

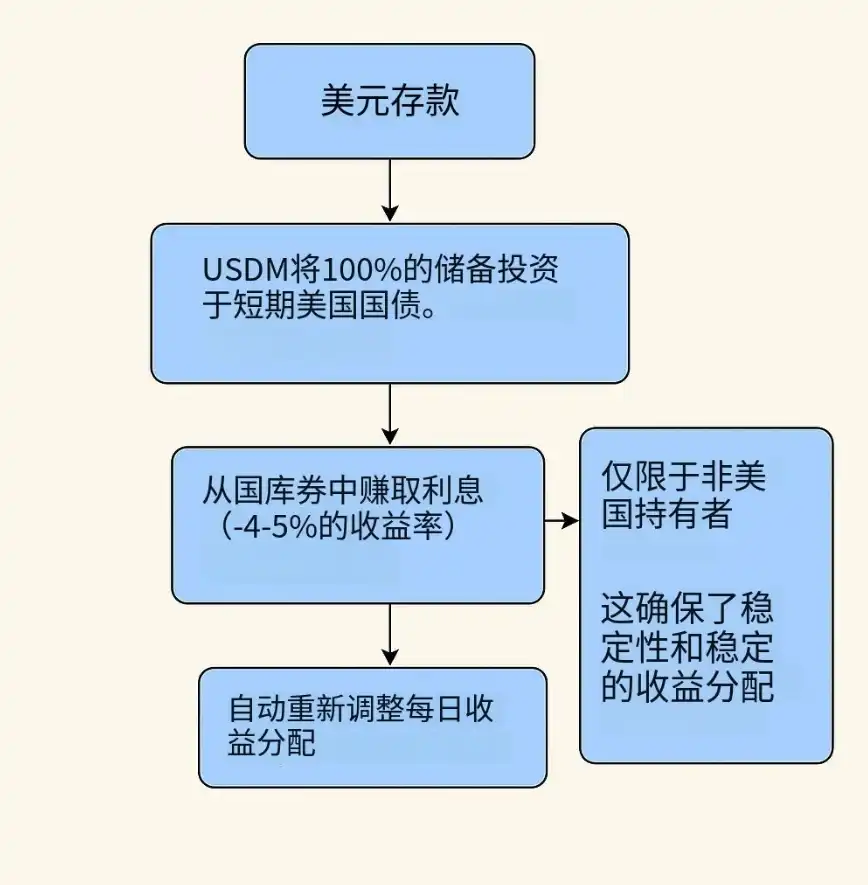

USDM – Provided by @MountainPrtcl

→ Annual Yield: Approximately 4–5%

→ Strategy: 100% backed by U.S. Treasury bills (T-Bill).

• All reserves are in short-term U.S. Treasuries

• Daily rebasing to grow your balance (e.g., 0.0137% per day)

• Non-U.S. holders only

Simple, stable, and fully transparent through audits.

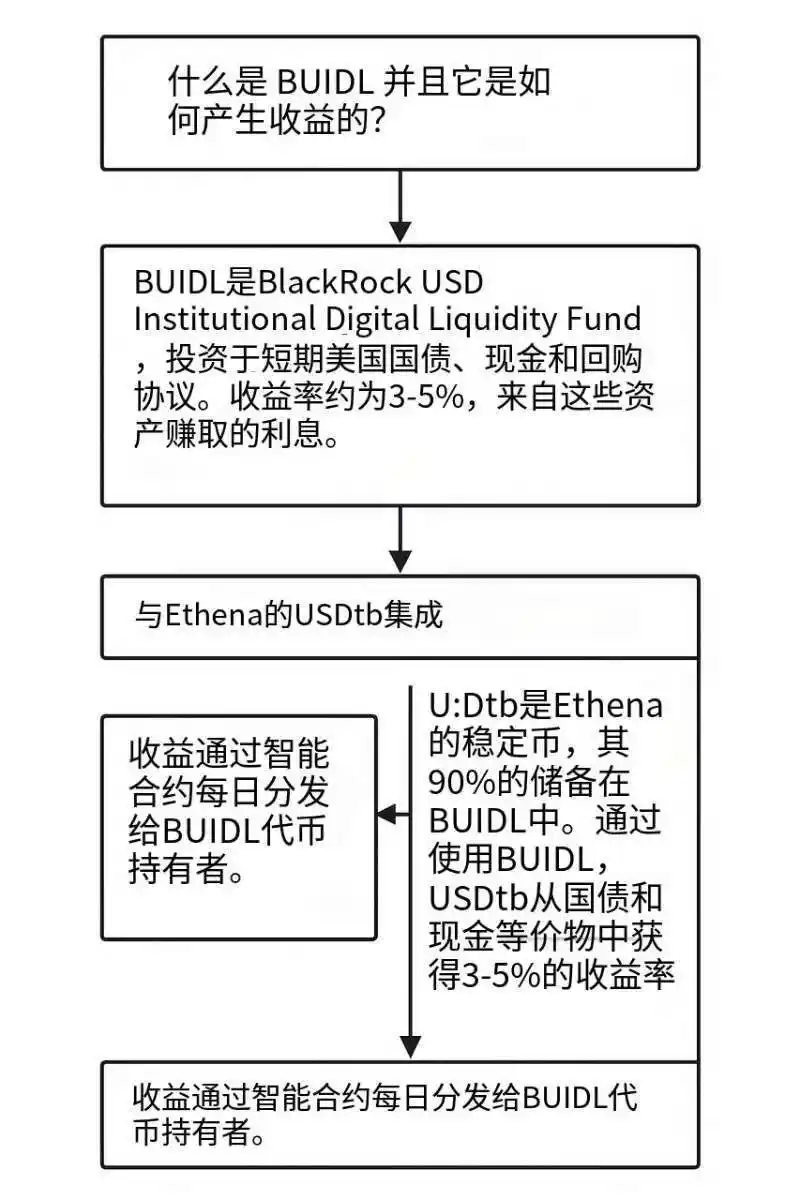

USDtb – Offered by @Ethena_Labs and @BlackRock

→ Annual Yield: Approximately 3–5%

→ Strategy: Institutional-grade tokenized funds

• BUIDL is a tokenized fund consisting of U.S. Treasuries, cash, and repurchase agreements (repos).

• USDtb uses BUIDL to back 90% of its reserves

• The security of traditional finance combined with 24/7 DeFi availability

Ideal for DAOs and protocols looking for security and yield.

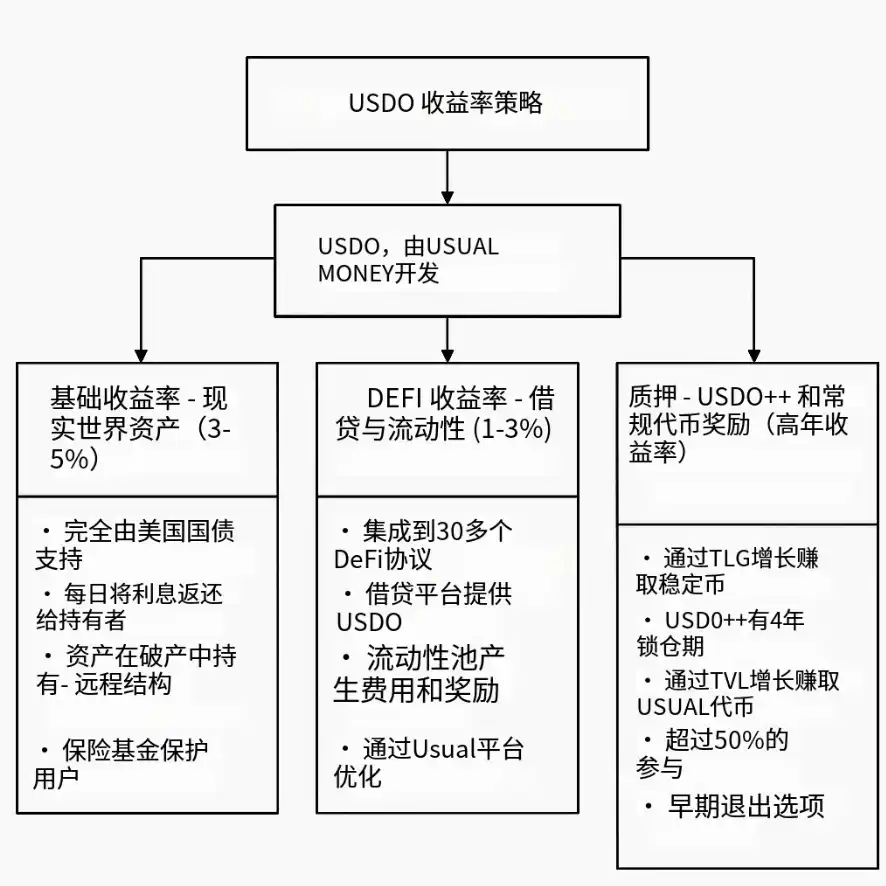

USD0 – Provided by @UsualMoney

→ Annual Yield: Approximately 5–7%

→ Strategy: RWA+ DeFi + Staking Rewards

• Underlying Yield: 3–5% from U.S. Treasuries

• Additional income: 1–3% from DeFi lending and liquidity mining

• Stake USD0++ → to get USUAL tokens (up to 60% APY)

Highly composable, deployed on 27 chains and 30+ decentralized applications.

YLDS – Provided by @FigureMarkets

→ Annual Yield: Approximately 3.8%

→ Strategy: Earnings pegged to SOFR (Guaranteed Overnight Financing Rate) that meet SEC compliance requirements

• Anchor SOFR - 0.5%

• Reserve funds are held in high-quality money market funds (MMFs) and U.S. Treasuries

• Accrue daily and pay out monthly

• Registered public securities – available for purchase by U.S. investors

Stable, regulated, and ideal for compliant on-chain investments.

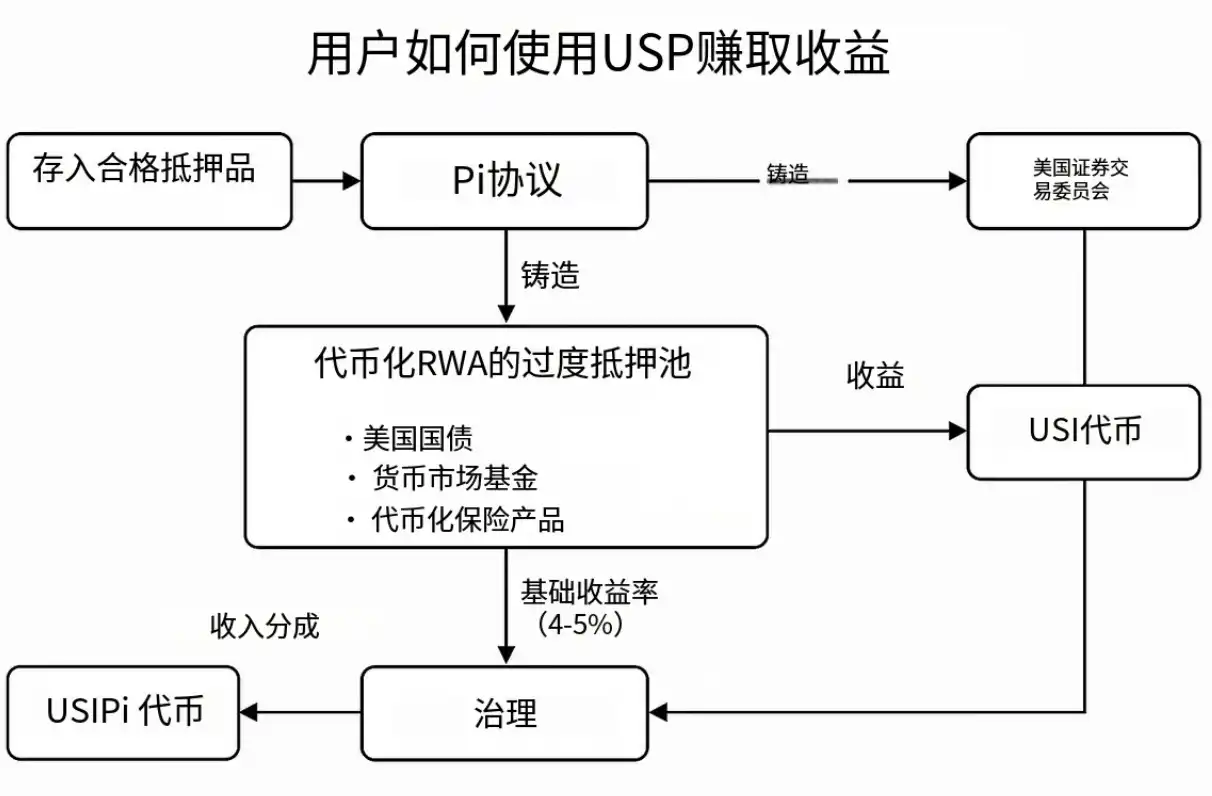

USP – Courtesy of @Pi_Protocol_ (expected to be released in the second half of 2025)

→ Annual Yield: Approximately 4–5% (forecast)

→ Strategies: Tokenized U.S. Treasuries, Money Market Funds (MMFs), Insurance

• Overcollateralized RWA support

• Dual Token Model:

• USP (Stablecoin)

• USI (Revenue)

• USPi NFTs offer revenue share + governance

Designed to align users with the long-term growth of the platform.

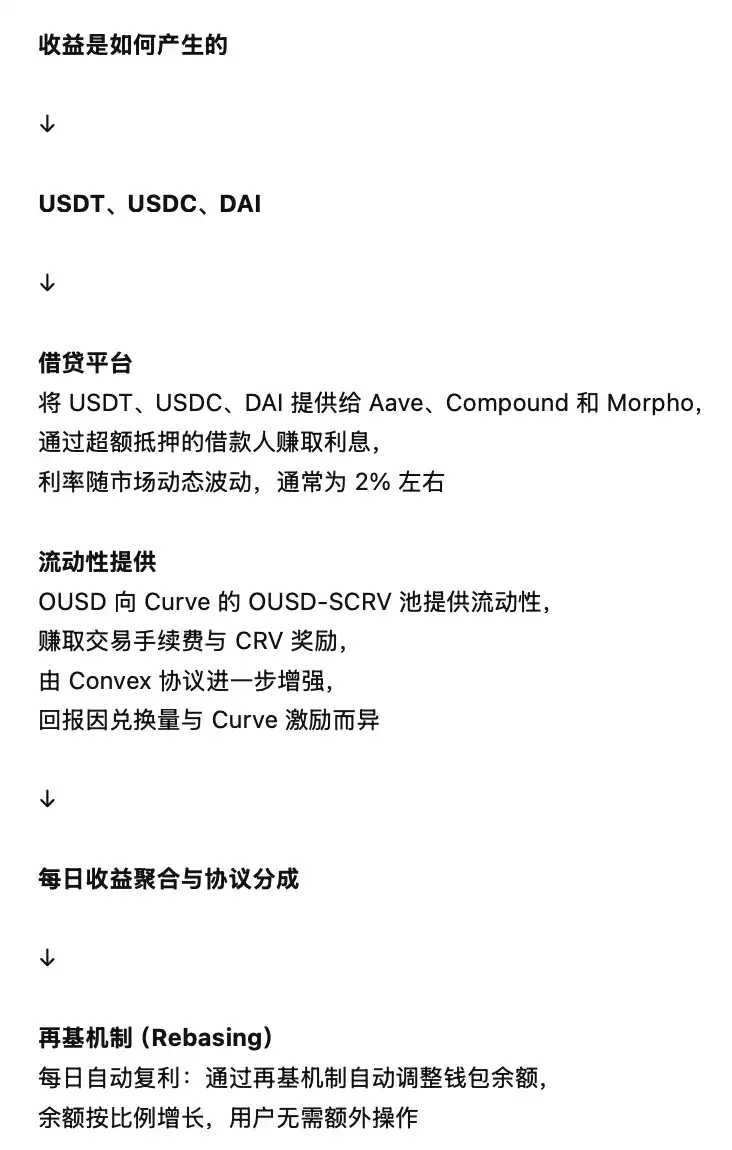

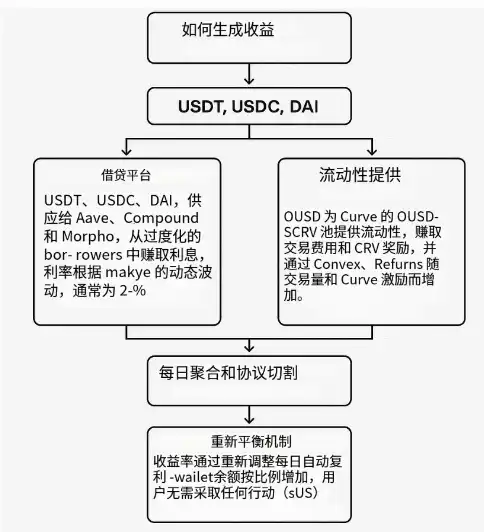

OUSD – Courtesy of @OriginProtocol

→ Annual Yield: Approximately 4–7%

→ Strategy: DeFi native, automatic re-based returns

• Lend USDT, USDC, DAI to Aave, Compound, Morpho

• Provide liquidity on Curve + Convex

• Rebase daily to increase your wallet balance

No stake, no lock-up.

「Original link」