Clear explanation of @aave V4. Translating in traditional lingo:

Hubs = vaults (multiple per chain, not one per chain as described on Aave blog which was confusing)

Spoke = markets

You come in through spoke (key difference) so you can use your collateral to borrow

🎙️New pod just dropped! I sit down with my old friend @StaniKulechov, Founder of Aave Labs, to deep dive into @aave v4 and its biggest updates compared to v3.

This is Ep. 1 of a new series where I analyze the evolving architecture of onchain lending markets and their impact on DeFi.

Just as onchain spot trading evolved from p2p models like EtherDelta to pooled AMMs like @Uniswap v2—and now to modular designs like Uniswap v4, built as lower-level protocols for sophisticated actors to run custom strategies without fragmenting liquidity—lending is following a similar path.

ETHLend struggled to scale its p2p fixed-rate lending approach and lacked sophisticated actors building on top of the protocol to abstract this complexity. Aave v1 introduced pooled liquidity, making it easier for retail users to borrow and lend using the same strategy dictated by the Aave DAO.

Now, Aave v4 marks a new phase: a modular hub-and-spoke design for deploying bespoke credit markets.

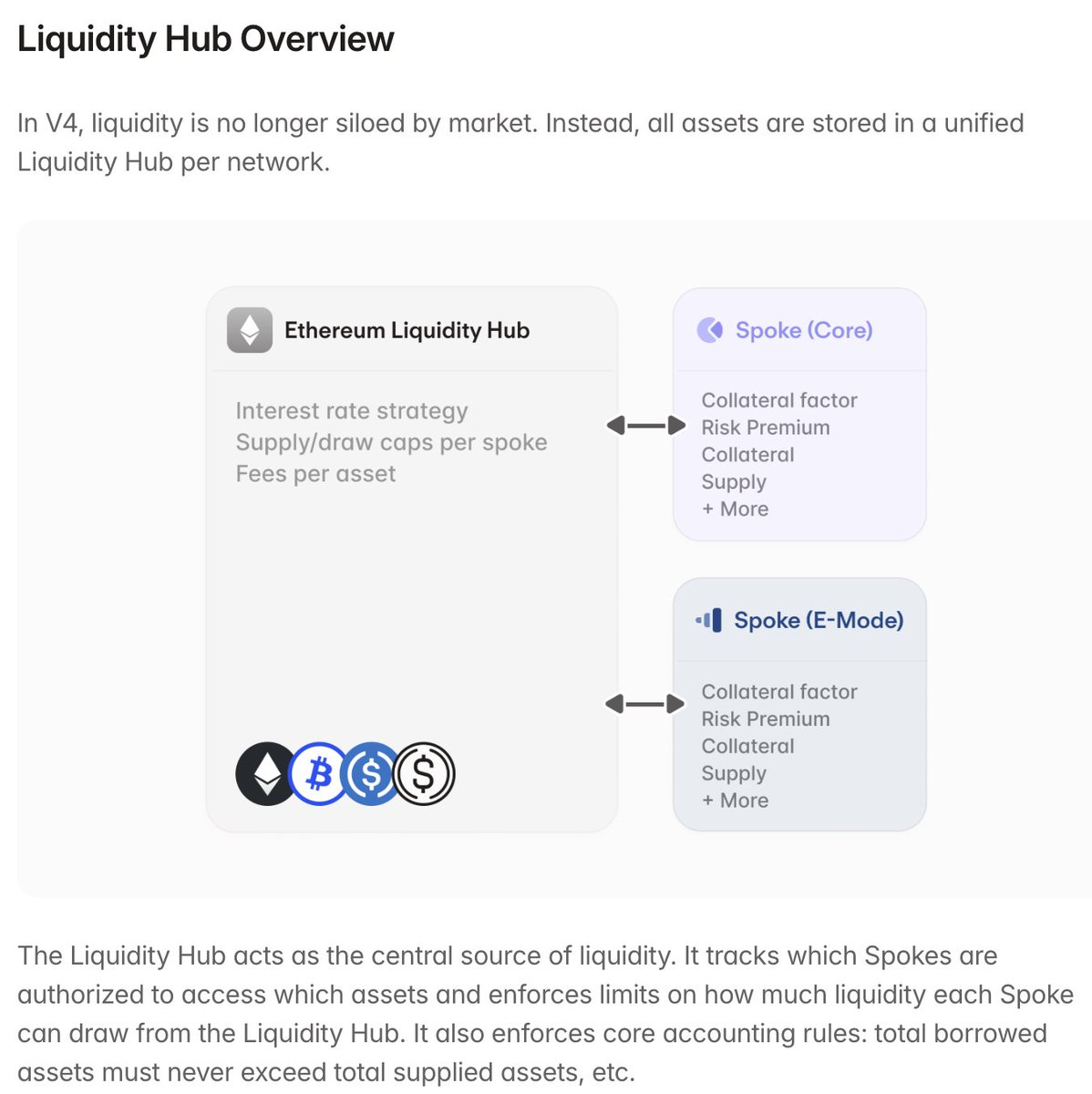

🧩 Hubs = Capital allocators that determine rates & provide credit lines

🛠️ Spokes = isolated, configurable lending strategies that draw capital from a Hub

Use cases range from RWAs to fixed-rate credit to looped LP vaults (e.g., strategies pioneered by @ArrakisFinance on Uniswap v3 + MakerDAO).

Critically, Aave evolves from a vertically integrated DAO—the sole allocator of protocol capital—into a permissionless platform where institutions (e.g., BlackRock) and DAOs can co-allocate capital alongside Aave itself.

This is the beginning of a modular credit layer for all of DeFi.

🎧 Listen here:

📺 Watch here:

📖 Aave v4 proposal:

@aave I'm still unclear how the interest rates strategy (on hub) and risk premium (on spoke) interacts.

5.66K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.