Pendle Updates #25.6.17

$PENDLE is a highly elastic coin; it rises when the market rises and falls when the market falls. I think it can be considered as a more volatile version of $ETH, essentially ETH Beta.

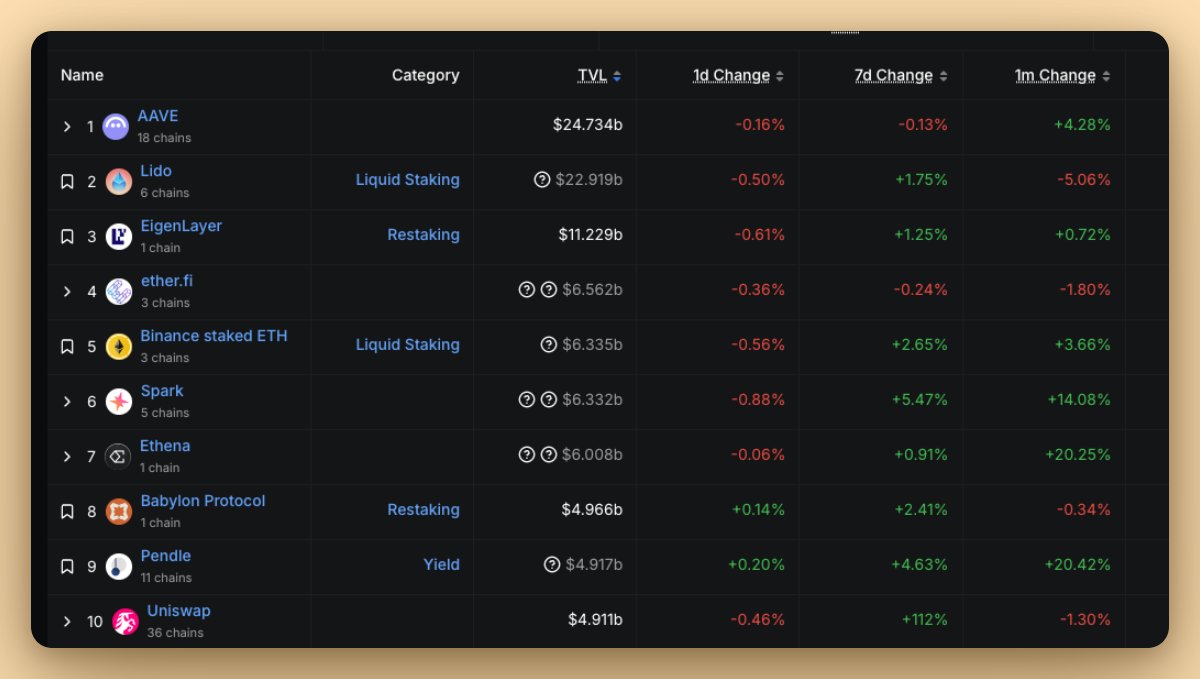

1/ Pendle's TVL returns to the Top 10

2/ New pools

Yearn aGHO-USDf 25-SEP [ETH] | reUSDe 18-DEC [ETH]

3/ Hot pools

Stables: USD(Midas) [31-JUL] [ETH] @ 21.35% LP-APY | USD(Midas) [31-JUL] [ETH] @ 11.48% PT-APY

ETH: wstETH [25-DEC] [ETH] @ 6.03% LP-APY | pufETH 26-JUN [ETH] @ 7.33% PT-APY

Trending Markets: csUSDL [31-JUL] [ETH] 11.04% PT-APY | sUSDe [25-SEP] [ETH] 7.78% PT-APY

4/ Restarted pools

ETH: | asdCRV 18-DEC | upUSDC 18-DEC | dWBTC 18-DEC | uniETH 25-JUN2026 | pufETH 25-JUN2026 | rsETH 25-JUN2026 | agETH 25-JUN2026 | eETH 18-DEC | eBTC 18-DEC | LBTC 18-DEC | weETHs 18-DEC | xsolvBTC 18-DEC | rswETH 25-JUN2026 | swETH 25-JUN2026 | hgETH 25-JUN2026

ARB: dUSDC 18-DEC | uniETH 25-JUN2026 | wstETH 25-JUN2026 | rsETH 25-JUN2026 | eETH 18-DEC | gUSDC 18-DEC | rETH 25-JUN2026

BERA: iBGT 18-DEC

MNT: cmETH 18-SEP

BASE: wcgUSD 18-DEC

5/ Pendle's TVL is highly resilient, recovering to its previous level just a week after a drop on the expiration date, indicating strong market demand for it.

On 29 May 2025, $3.8B of TVL on @pendle_fi matured.

At its lowest, TVL dipped from $4.61B → $4.10B (-11%) on the 1st day, as per @DefiLlama.

But in just 7 days, it fully rebounded, marking our best ever post-maturity 7-day retention rate.

Since then, TVL continued to climb despite the turbulent market and 2 weeks since the maturity event, Pendle is now sitting at ~$4.9B of TVL.

This resilience signals a maturing fixed yield market (i.e. Pendle market), driven by real, sticky demand and supported by more predictable capital flows. Our strategic shift toward stablecoin-focused yield further strengthens this foundation, making Pendle’s TVL less sensitive to broader market volatility. In both bull and bear, the appetite for stable, fixed yield endures.

We've spent years kneading in the yield sweatshop to reach this stage, and now the dough is set for us to finally start cooking - Boros, Citadels...

Job's not done, Pendiddlers ~

6/ Buffett's Investment Theory: Invest in companies with strong cash flow and high return on capital.

Pendle meets this standard.

vePENDLE thesis - Buffett's philosophy applies in DeFi

The market has matured since the 2020–2021 bull run. Speculation-driven strategies like memecoins and airdrop farming often reward only early players, while point farming yields diminishing returns for most.

So how do we build sustainable, long-term success in DeFi?

This is when Buffett's principle still holds: invest in businesses with strong cash flow and high return on capital.

@pendle_fi fits that mold. With vePENDLE, holders gain exposure to real yield, sustainable revenue, and growing integrations across LRTs, RWAs, LSDs, and stablecoins.

Here’s why vePENDLE is the most underrated value play in DeFi right now:🧵

8/ Pendle x Converge

⚡@pendle_fi is joining Converge.

One of DeFi’s biggest success stories, growing from lows of under $10 million TVL to over $5 billion in just two years. 📈

We’re excited to be bringing Pendle to Converge as one of our core apps to unlock yield trading on a range of dollarized assets.

Here’s what this means 👇

23

9.07K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.