To truly be a new platform, stablecoin issuers need to have really good global banking connectivity and close the loops with existing rails (correspondent banking, SWIFT, PIX, SEPA, etc.).

Treasury bills/BUIDL wrappers don't cut it. You need to go through the sweat and costs of building out connective tissue to global fiat rails which takes reg cap and licenses.

The founder of one of the largest "decentralized stablecoins" recently said to me "you're not really a stablecoin unless you have a bank account."

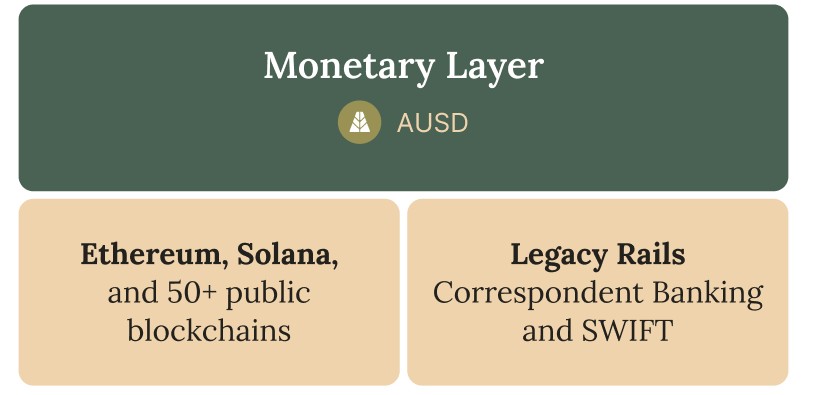

We're building AUSD to be the glue between the new rails and the legacy rails. Oh, and our on/off ramp costs are FREE. Even against USDC/USDT.

Thanks to @sytaylor, @ccatalini, @Nick_van_Eck, @SplitCapital and my wife who all gave feedback to this post in one form or another.

If you'd like to read on medium, link here.

61

6.98K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.