【 Virtual Review Day 10 】

From now on, I will review daily, recording my investment journey and insights.

If you haven't registered at @virtuals_io yet,

👉

Investment Overview

- Total Investment: 3,500 $USDC + 200 + 720 = 4,520

- $Virtual Position: 2.5k $USDC

- Virtual MAX Locked Position: 2k $USDC

- $Vader Position: 400 $USDC (fully locked for one year)

- Other Investments: $Virgent 200u, $WINT 720u

Today's Key Data

- Total Points: 14,394 Pts

- Vader: 3,973 Pts

- Yapping: 4,945 Pts

- veVIRTUAL: 5,476 Pts

- DAB: 2,452 Pts (decreased by about 800 Pts from the previous day)✅

- Current Earnings: About 1,100 USDC (not yet recouped)

Strategy Planning

Short-term Strategy:

- Regularly buy $AIXBT and hedge

- Maintain positive buying to keep point growth

Mid-term Planning:

- Focus on 200%-400% oversubscribed projects

- Continuously stake quality projects

Long-term Goals:

- Continue staking and wait for yellow lock to sell in batches

- Accumulate points and wait for high valuation projects to exit

Items to Clarify

- Need to analyze the black box mechanism in depth

- Track the operations of top addresses

- Study the optimization of point acquisition efficiency

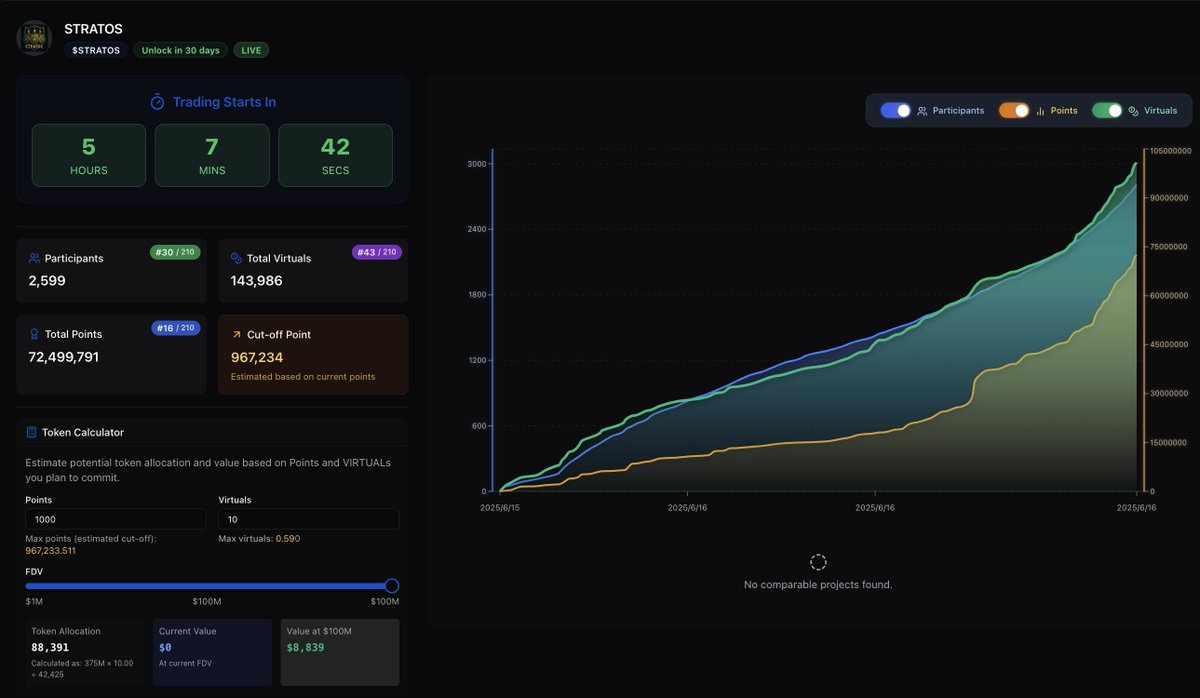

Tonight's new listing is @stratos_vip $STRATOS, which is rated Tier 3 by @VaderResearch. I put in quite a few points mainly to gamble a bit, to see if I can stake all the tokens from the new listing daily to earn more token points and find a bit of pattern in their black box.

Risk Warning: @Alvin0617 previously mentioned that the parent project of this project failed, but Jeff is a Partner this time.

Review Summary

After 10 days, I am currently in the mid-to-late tier, and I haven't sold anything yet. The recoup rate based on staking is about 1/4, mainly from the new listings $IRIS and $BAIBY.

In the Virtual ecosystem, all operations require a 14-day waiting period, so strategy execution needs more careful planning. I will continue to observe the operations of front-row addresses and optimize investment strategies.

Show original

15

12.05K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.