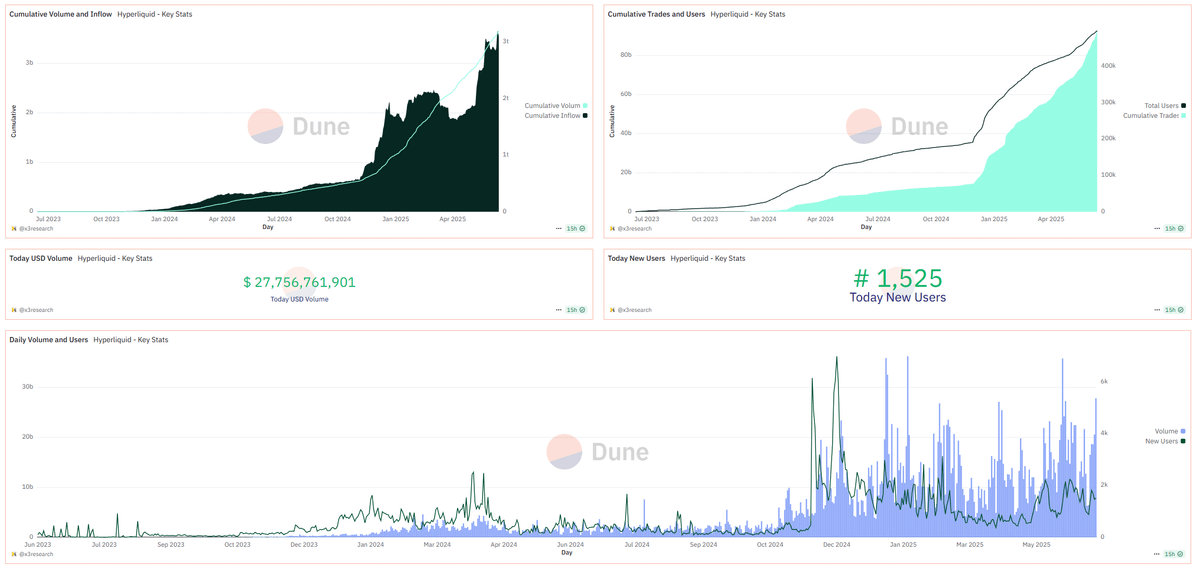

most people still think @HyperliquidX = perps only

they’re missing the real play: hyperEVM

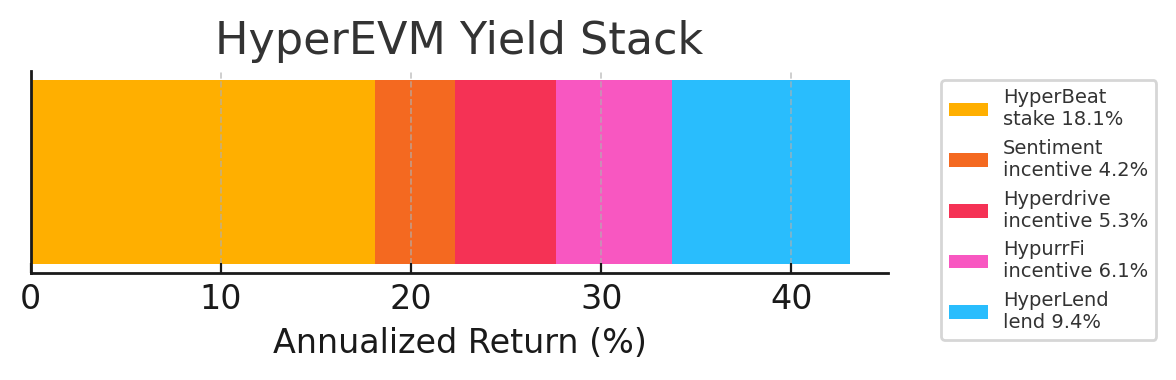

20 k wallets, 40 % neutral yield, points from seven protocols🧵

quick confession: I’m tired of refreshing dexscreener for cartoon coins

I want cash flow that survives the Sunday candle

hyperEVM feels like early jito: empty UI, rich loops, no engagement farmers yet

> perfect

on-ramp is boring but crucial. i bridged three times before running size

• sol / eth / btc? use @hyperunit

• any odd erc20? @HyBridgeHL

- test with 10$

- confirm it lands on hypercore

- only then size up

hedge first, flex later

• market-sell to usdc on hyperliquid spot

• market-buy the same notional of $hype spot

• open a 1× short $hype perp

funding currently pays me to be short, but i’m ready to flip if it inverts. delta-neutral or i don’t sleep

now the quiet magic: move the spot leg to hyperevm

- portfolio → balances → transfer to evm | one click, zero bridges anxiety

- stake at @0xHyperBeat → receive stHYPE

- lend sthype on @sentimentxyz, borrow fresh hype, stake again.

- loop twice more through @hyperdrivedefi and @HypurrFi. stop when ltv

hits ~75 %

safety > greed

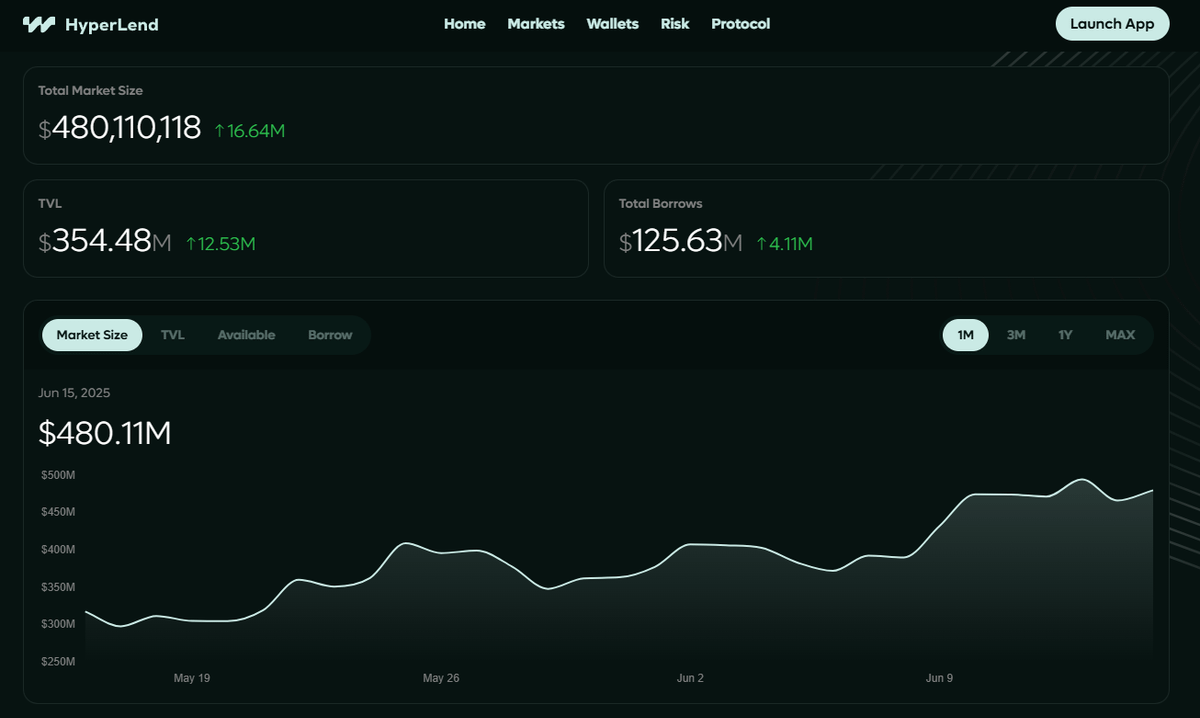

leftover hype goes into @hyperlendx for passive lend points

my sheet reads:

• 9.4 % base lend

• 18.1 % beat stake

• 3–5 % sentiment incentives

• 4–6 % drive incentives

• 4–7 % hypurr incentives

plus the big one: hyperliquid s3

totals fluctuate, but 38–44 % blended with zero price exposure is real

lite version if loops scare you:

25 % usdc → btc spot

25 % usdc → short btc 1× perp

25 % usdc → hype spot

25 % usdc → short hype 1× perp

bridge spot hype only, stake on beat, lend on lendx. cost-benefit is ~27 %, still beats 99 % of “safe” defi

edge boosters:

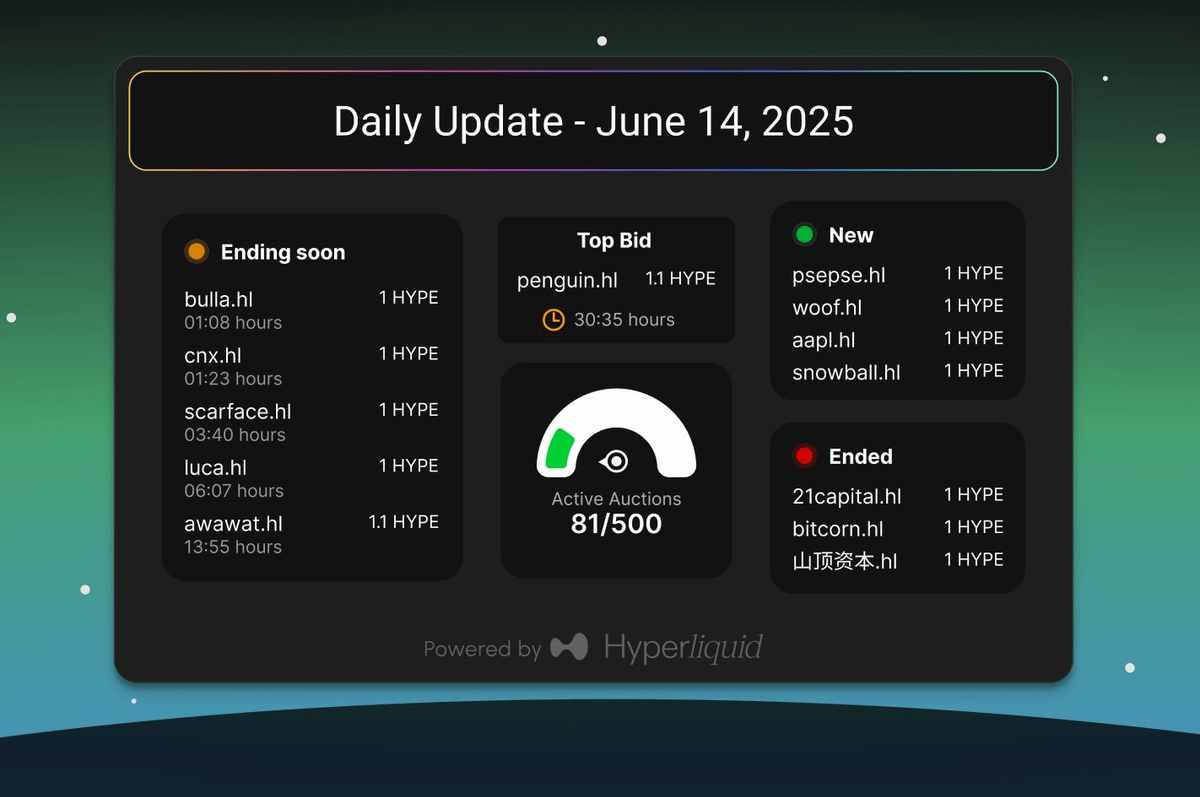

• mint a short .hl name on @hlnames – we all missed 2-char ENS, let’s not cry twice

• grab one floor @HypioHL nft – cult chat full of early strategies and weird multipliers

• test the coming mETH loop (stETH → evm, lend, borrow, repeat)

numbers look crazy but i won’t post until i survive a full funding cycle

philosophy break

we keep preaching “build in the bear”, then ignore the boring infra that pays builders

hyperEVM is exactly that: unsexy rails that whales quietly dominate

i’d rather be early janitor than late influencer

risks are real:

• perp funding flips → re-balance daily

• loops near 90% ltv liquidate instantly. set alerts

• hyperEVM tvl is tiny

• one exploit could sting

• size like a scientist

opinion:

this ecosystem feels like solana summer before influencers discovered raydium

the door is open, points are flowing, and nobody has written the “ultimate guide” yet

so i did my part

rt if you’re done waiting for altseason and ready to farm grown-up yield

drop questions below, i’ll share my live google sheet to anyone who shows they actually bridged

My fav ct guys

/ @belizardd @DeRonin_ @kem1ks @splinter0n @terra_gatsuki @0xAndrewMoh @KingWilliamDefi @0xJok9r @0xDefiLeo @cryppinfluence @CryptoShiro_ @the_smart_ape @AlphaFrog13 @0xTindorr @Hercules_Defi @eli5_defi @CryptoGideon_ @0x99Gohan @rektdiomedes

49

4.67K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.