Despite billions in funding, crypto has much fewer apps compared to traditional app stores.

The problem isn't just adoption. Development is just too complex.

@Ensobuild makes building simple.

🧵

1/ Building is hard.

Security audits can cost six figures and take months. Every chain has different code, gas mechanics, and security models. Markets reward new chain launches over apps.

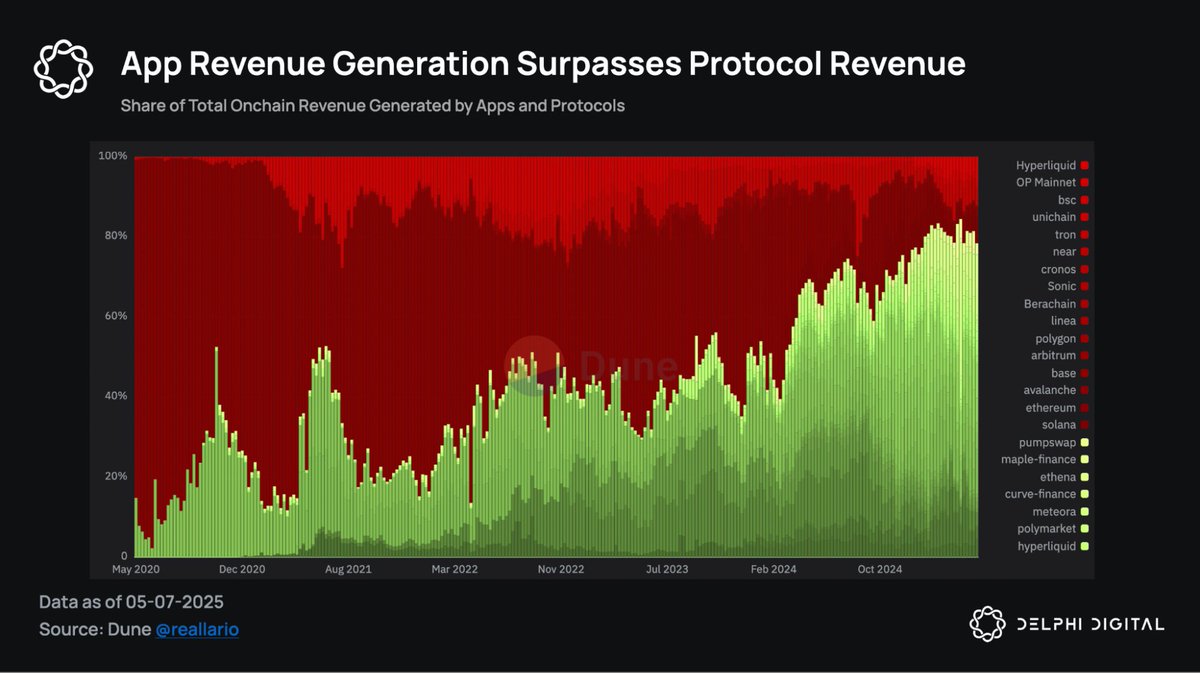

Meanwhile, app revenue represents around 80% of total crypto fees but is overlooked compared to infrastructure.

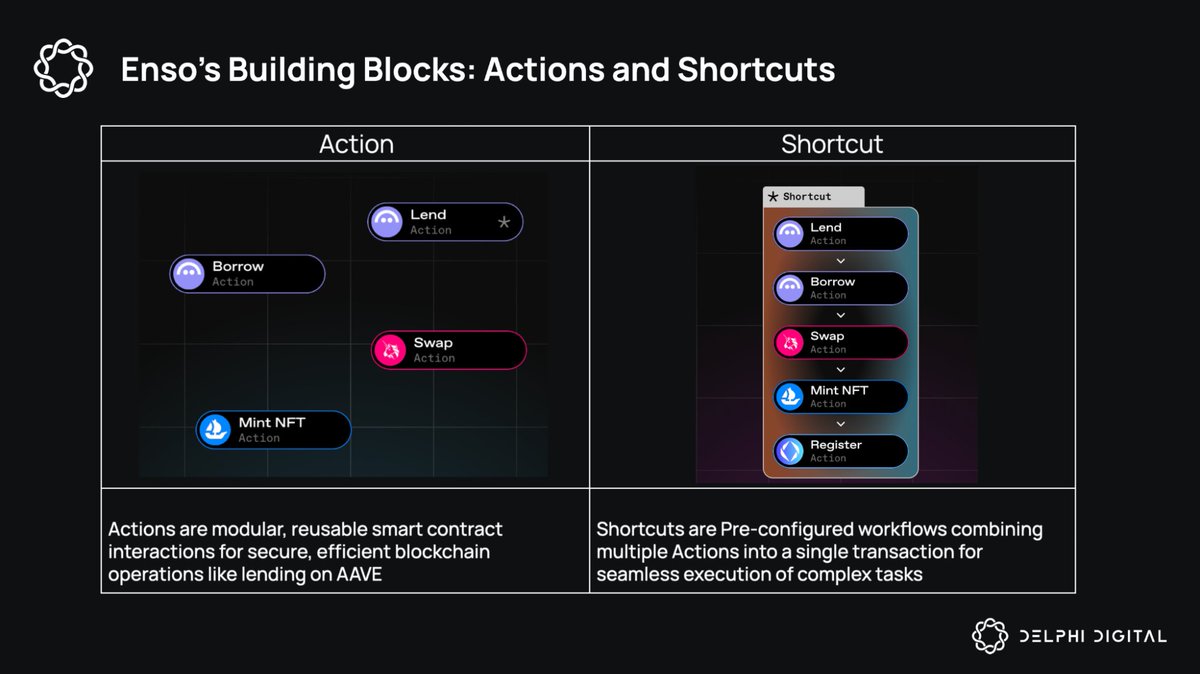

2/ Enso fixes this by creating prebuilt shortcuts.

Instead of wasting time on integrations, builders can use Enso's building blocks for their app.

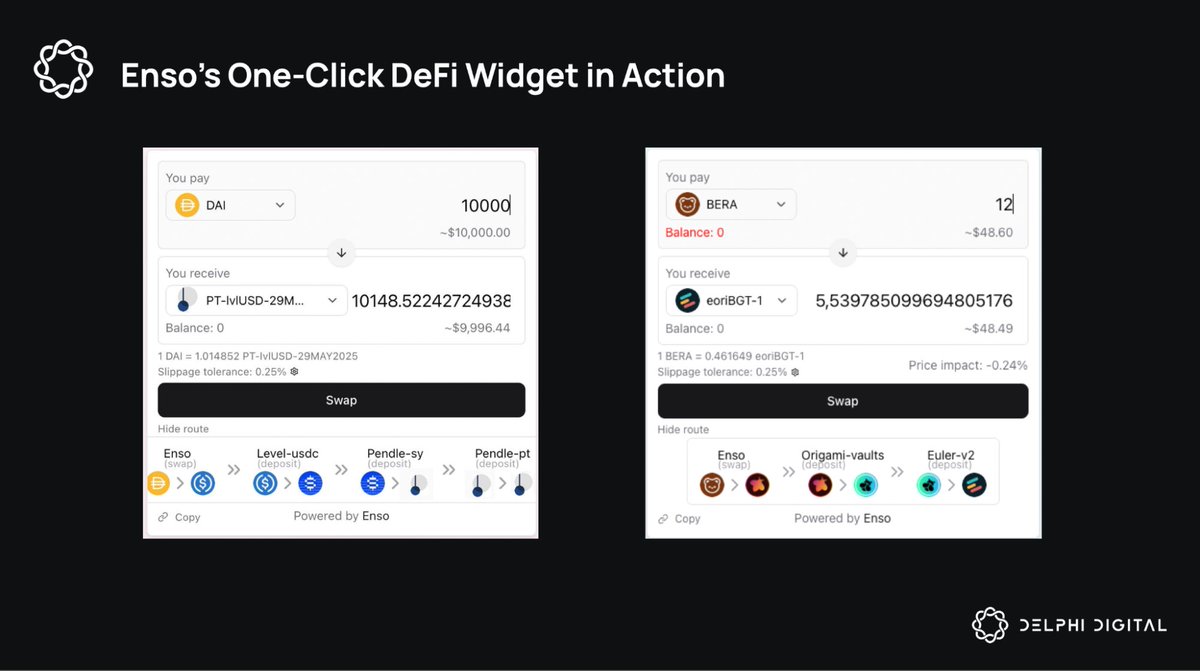

Basic actions like swap, lend, and stake can be combined into shortcuts that are executed as one transaction. Users say what they want and Enso handles the rest.

3/ Three key players make this work:

• Action Providers: Build standardized smart contract abstractions, rewarded based on usage

• Graphers: Universal solvers that transform user requests into executable bytecode, compete for efficiency rewards

• Validators: Security layer that validates solutions, must stake ENSO tokens with slashing protection

4/ Enso aggregates smart contracts across all chains into one unified data layer.

This enables a new way to interact with DeFi. Users state what they want in natural language (E.g. Maximize my yield), Graphers compete to find the best path to this result, and validators verify whether this path is safe.

5/ The results speak for themselves:

• $3.1B handled through Boyco campaigns

• 300M ZK tokens distributed via ZKsync Ignite

• Unichain LP migration simplified from 9 steps to 1 click

• Onplug recreated in 2 days what would take them 7 months manually

• Otomato reduced lengthy integrations to hours

6/ The future will be written by apps that people want to use and Enso makes making them easier.

Enso is building the infrastructure to make that possible.

The only way to innovate is to make building so easy that good ideas can become good products.

The full consulting report dives into Enso's use cases, competitive analysis, and business sustainability.

You can read the report here.

23

7.4K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.