Axiom’s Growth Play: High Gross Fees, Lower Net Costs

Part of this month’s @MessariCrypto new Messari Monthly report for Enterprise subscribers.

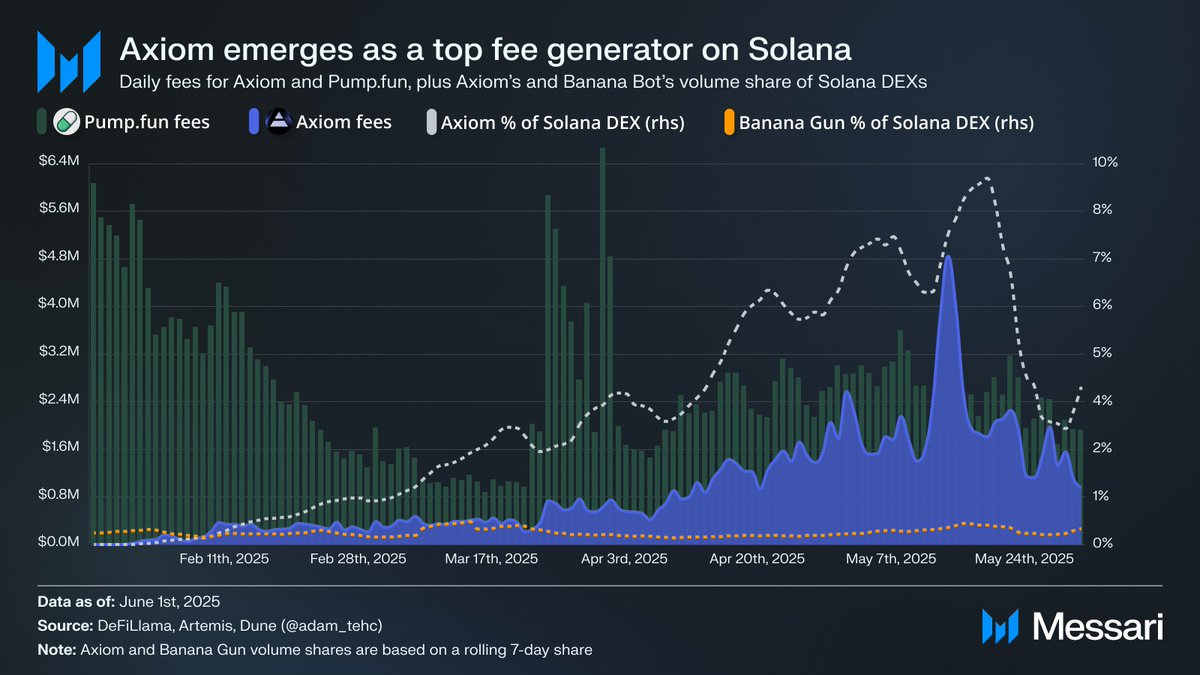

@AxiomExchange has quietly become one of the top fee-generating apps in crypto over the past month, recently surpassing $100 million in cumulative revenue in under six months. The protocol acts as a unified DeFi frontend, letting users trade memecoins on Solana, deposit into vaults, and access Hyperliquid’s perp markets from a single interface.

Its headline fee numbers, however, don’t reflect what it actually retains. Axiom offers up to 0.25% in SOL rebates and pays out as much as 30% of trading fees to referrers. That lowers the protocol’s effective take rate compared to competitors like Photon or TG Bots, which hold onto a much larger share of fees.

The result has been strong usage growth. Axiom now processes nearly 10x the volume of Banana Bot and accounts for around 4% of total Solana DEX volume, versus Banana Bot’s 0.4%. Lower trading costs have likely played a role in that share gain.

Axiom’s growth has also coincided with rising activity on @pumpdotfun. While the correlation between their fee trends has weakened recently, the timing still points to meme market momentum as a core driver.

By consolidating meme trading infrastructure, launchpads, DEXs, and perps into one interface, and pairing that with a lower take rate, Axiom has positioned itself to take share from higher-margin trading frontends.

To read future editions of Messari Monthly, subscribe to Messari Enterprise. Check out the full report here:

24

3.82K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.