Optimistic about the long-term development of Web3 in Hong Kong

While everyone is talking about airdrops, Hong Kong is playing a big game of chess – the official passage of the Stablecoin Bill on May 21 is perhaps the most important regulatory breakthrough for Asian markets since the passage of Bitcoin ETFs.

Why is this matter worthy of everyone's attention in Web3?

Because this is not just another regulatory document, but a silent revolution about who will issue the money of the future. While the US continues its hegemony with USDT/USDC, and while Europe is still hesitating on CBDC, Hong Kong is trying to find an unprecedented "third way"...

▌Why is this the "Norman landing" of Hong Kong finance?

1️⃣ The hegemony of the US dollar is being challenged the most

- At present, 95% of the global $300 billion stablecoin market is monopolized by US dollar stablecoins

- The amount of USDT on-chain settlement in a single day has exceeded the sum of Visa+Mastercard

- Hong Kong wants to break the "digital colonization" of the US dollar in the crypto world

2️⃣ A new breakthrough has been found in the internationalization of the RMB

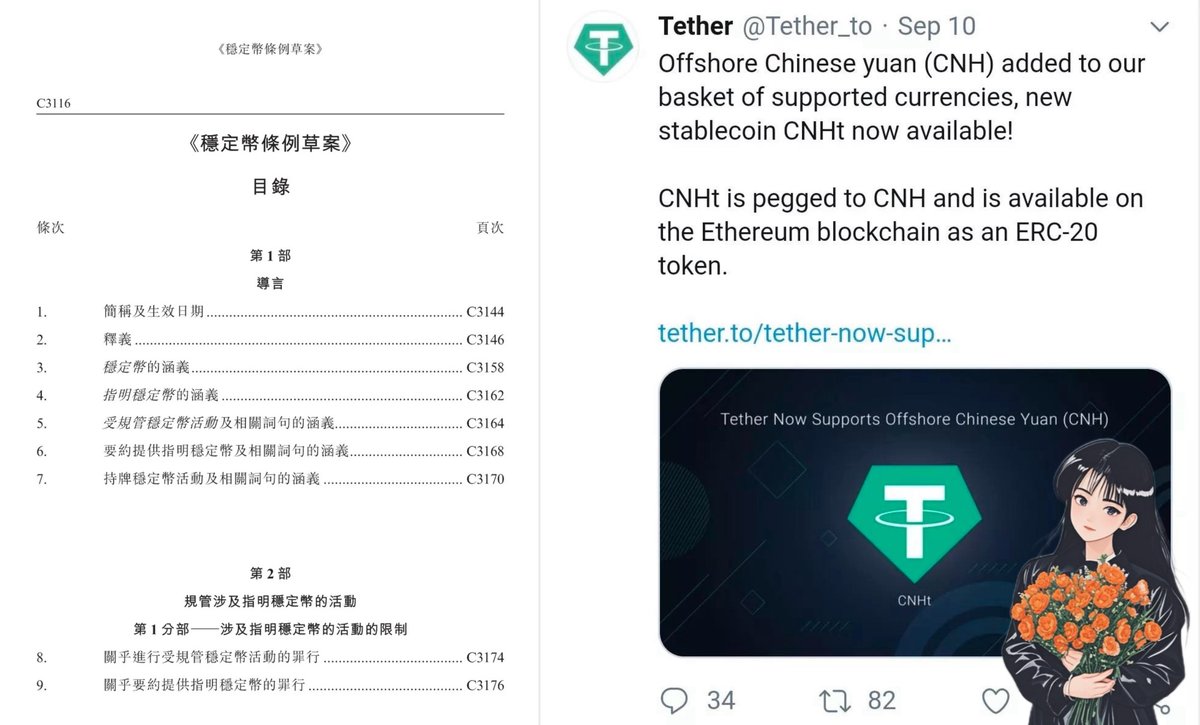

- The offshore renminbi (CNH) stablecoin will make its debut on the world stage

- In the future, cross-border trade may be settled directly using digital yuan

- Hong Kong becomes a "digital gateway" to the renminbi

3️⃣ Financial security upgrades

- Establish an autonomous and controllable blockchain payment network

- Reduce reliance on the SWIFT system

- Protect against potential financial sanctions risks

▌Hong Kong's "secret weapon": dual-anchored stablecoins 💎

✔️ At the same time, it is anchored to USD + RMB

✔️ The reserve ratio is dynamically adjusted

✔️ Maintain the Hong Kong dollar linked exchange rate advantage

✔️ It also opens a digital channel for the renminbi

Technical Architecture:

- Smart contracts automatically balance dual currency reserves

- Real-time on-chain audits are transparent and verifiable

- Support multi-chain interoperability

▌The global stablecoin war is ⚔️ heating up

Latest results in 2025:

1️⃣ USDT: 80 billion market capitalization, 66% of the market share

2️⃣ USDC: 30 billion market capitalization, 25% of the market

3️⃣ Others: DAI, FDUSD, etc. are struggling to catch up

Hong Kong Opportunities:

- The world's first regulated fiat stablecoin

- Backed by a population of 60 million in the Greater Bay Area

- Radiate the "Belt and Road" digital trade

▌Ten-year roadmap 🗺️

2023-2025: Foundation building period

· Completion of the legislative supervision framework

· The first batch of licences was issued

· HKD stablecoin pilot

2025-2027: Expansion period

· Launched a dual-anchor stablecoin

· Establishment of regional payment networks

· Cross-border application scenarios are implemented

2027-2030: Globalization

· Multi-currency stablecoin matrix

· Participate in the development of international standards

· The target market value is 200 billion

2030+: Convergence period

· Interconnection with CBDCs in various countries

· Become a digital financial superhub

▌Test of life and death: the "three mountains" ⚠️ that Hong Kong must cross

1️⃣ Technical off

- Smart contract security

- Cross-chain interoperability

- The system is resistant to attacks

2️⃣ Trust Off

- Transparent management of reserves

- Strict compliance audits

- Crisis response mechanisms

3️⃣ Regulatory Clearance

- Balancing innovation and risk

- Cross-border coordination challenges

- Geopolitical implications

▌The ultimate prophecy? : Hong Kong's path 🇨🇭 to "Digital Switzerland".

✅ If successful:

· Global Digital Asset Pricing Center

· The key fulcrum of RMB internationalization

· A new generation of financial infrastructure standard-setters

❌ Fail:

· The status of traditional financial centers has been weakened

· Marginalized in the wave of digital finance

· Lose the right to speak on monetary sovereignty

🔗 Read the original article from the Quantum School:

--------

When Tether and Circle monopolized the $300 billion stablecoin market, and when the US SEC used a regulatory stick to divide its sphere of influence, what Hong Kong is doing is to reserve a "non-dollar option" for the crypto world.

This is not a simple regulatory follow-up, but a well-designed financial breakthrough – using the Hong Kong dollar stablecoin to maintain local payment sovereignty, using the renminbi stablecoin to open up a new offshore channel, and finally building a "digital financial breakwater" outside the US dollar system. #usdt #usdc #fusd

8

27.26K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.