Congratulations to the following five friends who have won 300 $blue rewards.

@lulusi321

@zhouxingyu111

@xnobody30

@x_sanjin

@0x01_Cz

Leave the SUI address in the comment area

SUI Eco Leading DEX - Bluefin Lucky Draw

5*300 $Blue (about 5*35 dollars)

At the end of the article, let's first learn about Bluefin:

➤ Ecological data shows that there may be room for growth in Bluefin

As the leading DEX in the SUI ecosystem, Bluefin has a total trading volume of $53 billion, with a daily trading volume of $38 million and a total of 24,000 transactions.

Someone compared Bluefin to Solana's Jupiter, and Brother Bee made a comparison:

✦ Compare FDV's market capitalization

FDV of $Blue / FDV of $SUI = 0.26%

FDV of $JUP / FDV of $SOL = 5.15%.

✦ Compare FDV/TVL ratios

$Blue FDV/Blufin Ecology TVL=0.77

$JUP FDV/Jupiter Ecology TVL=2.07

✦ Compare the proportion of TVL ecology

Blufin's TVL/SUI's TVL = 6.98%

Jupiter's TVL/Solana & TVL = 24.59%

Compared to the value/ecological ratio of the DEX itself, Blufin is undervalued.

Compared with the value ratio or ecological ratio of the public chain ecology, Bluefin may also have room for growth.

➤ Bluefin product advantages determine its potential

❚ RFQ products provide users with the best trading solutions

Bluefin supports spot trading and perpetual futures, and is the first RFQ product in the SUI ecosystem. RFQ, Request for Quote.

According to the user's trading request (including price and transaction quantity), the system will select the optimal trading plan from the optional objects (including other traders, LPs, and aggregators) to provide the user, and the user will confirm and execute the transaction.

✦ Spot trading

For spot trading, Bluefin uses the CLMM model, Concentrated Liquidity Market Maker, a centralized liquidity market maker, where LP liquidity is concentrated in a specific price range, which makes the price slippage of spot trading lower.

At the same time, Bluefin also supports aggregators, so users can choose the best trading scheme among other users, LPs and aggregators to achieve extremely low slippage.

Of course, support anti-MEV.

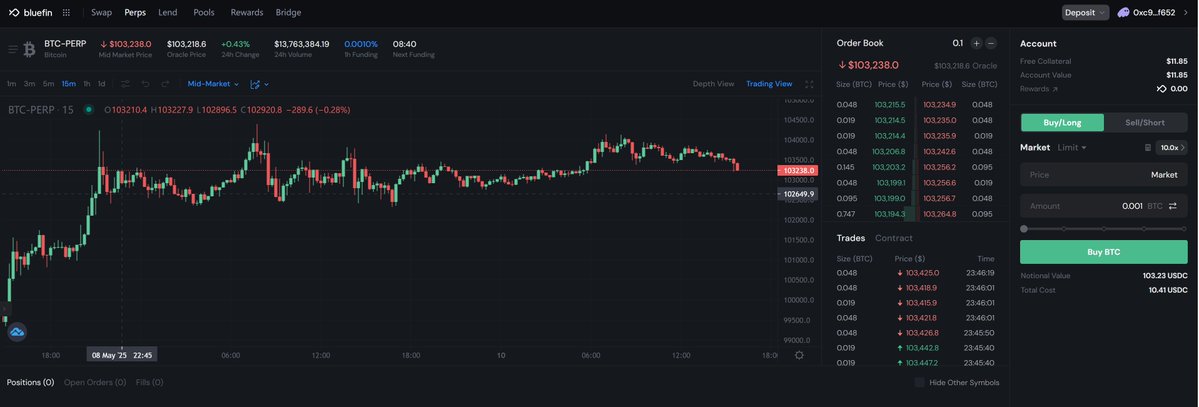

✦ Perpetual Futures

For perpetual futures, the system matches users with multiple liquid market makers with the optimal trading plan. Users can trade after depositing funds into Bluefin's perpetual futures account. Perpetual futures trading has 0 gas and 0 slippage.

The maximum leverage of BTC, ETH, SUI, and SOL is 20 times, the maximum leverage of mainstream coins such as APT is 10 times, the maximum leverage of SUI ecological coins such as BLUE is 5 times, and the maximum leverage of $TRUMP is 3 times.

Interestingly, after entering the mainstream currency trading interface, the default is 10 times leverage, the default is 5 times for BLUE, and the default for some coins is 1 time after entering.

❚ Transaction interface and experience close to CEX

After the spot trading enters the advanced mode, it can display the market capitalization, liquidity, trading volume, on-chain distribution concentration, holders and audit status, as well as recent trading volume and order information. It is more suitable for Chongtu dog and spot trading.

The perpetual futures trading interface is a relatively complete order book trading interface, and there is also information about market maker pending orders, which is more open and transparent.

Blufin uses the SUI+TEE+Walrus framework on the technical framework.

User funds are on SUI, and the decentralized storage exists on Walrus at the front-end of the platform, and users make transaction requests through the front-end, send the request to TEE (Trusted Execution Environment), match transactions in TEE, and then settle transactions on the SUI chain.

The whole process is decentralized, and this SUI ecological framework can achieve extremely high performance, and the transaction matching speed is usually less than 1 millisecond.

➤ The SUI ecosystem still has potential

#SUI is considered to be the next Solana, but in fact, the Move language, which is used to develop SUI applications, is notoriously development-friendly, so it may be more convenient to develop or innovate applications on SUI than Solana.

The SUI ecosystem will still have room for imagination in the next 0~4 years.

➤ To summarize

As the leading DEX in the SUI ecosystem, Bluefin may have the potential for horizontal expansion compared to Solana's Jupiter. The reason is that its RFQ can provide users with better trading solutions, trading interface design and SUI+TEE+Walrus framework to provide a better trading experience. In addition, the SUI ecosystem itself may have potential for vertical growth.

Finally, how to participate in the raffle:

1. Focus on @bluefinapp @oooh_aria @zabimx

2. Retweet and comment on Bluefin's highlights and @giverep at the end

75.22K

27

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.