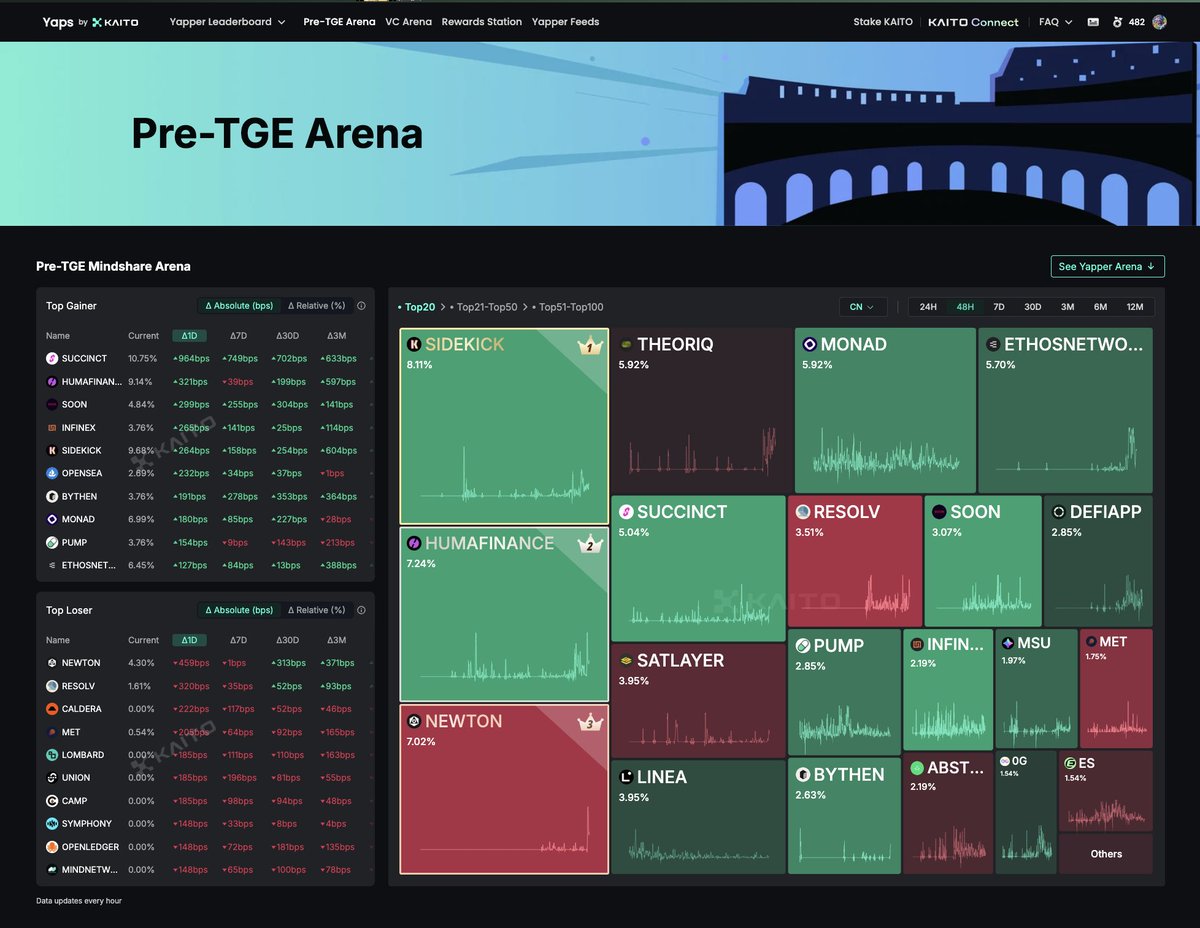

Lately, I’ve been glued to the Yaps Pre-TGE Arena leaderboard specifically the CN tab

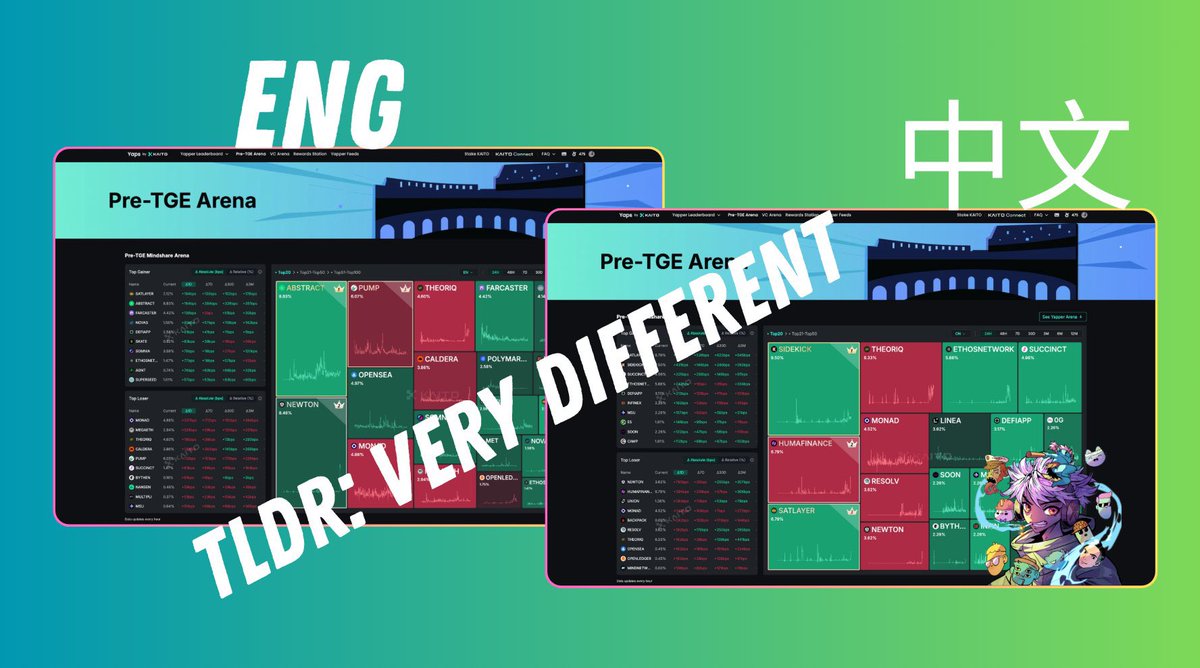

it’s fascinating to see just how different the Chinese crypto community’s attention is compared to the western one.

TLDR: BIGGGG Cultural Split:

CN side prefers stablecoin/real-world utility + community-native plays like @Sidekick_Labs and @humafinance

EN side leans infra + tooling with mod-scaling bets like @AbstractChain and @MagicNewton

This shows how fractured and rich crypto mindshare can be across regions.

What’s trending in one culture might be invisible in another

Chinese Crypto Community Focus:

SIDEKICK is clearly the standout leader right now. It’s holding the crown on the CN board, and the chart shows a strong, sharp rise. Likely driven by community-driven buzz or KOL narratives we haven’t fully caught in English.

HUMAFINANCE is another favorite

THEORIQ and MONAD are also staying strong

MONAD especially might be benefiting from the shared modular thesis, but its traction here suggests deeper CN engagement.

RESOLV shows strength on the CN board but is actually one of the top losers in terms of short-term mindshare dip. Possible overexposure from earlier hype.

Compare that with what we see on the EN side:

English crypto Yappers seem more intrigued by ABSTRACT, NEWTON, PUMP, and INFINEX with Newton spiking before a major cooldown.

SUCCINCT is the rare one performing well across both sides, showing it’s building a multi-regional narrative.

As someone bridging both sides, it’s worth watching where narratives converge those are often the strongest indicators for where capital and community might flow next.

And right now, the CN side feels a little earlier in narrative conviction.

See an interesting phenomenon on the Kaito Yappers Leaderboard about Chinese-speaking Chinese crypto twitter and the Western crypto scene

💡 Brief summary:

Oriental CT = Infrastructure, Automation, Capital Efficiency

Western CT = Atmosphere, User Experience, Speed Gameplay

After digging deeper into the latest Kaito Pre-TGE Mindshare Arena heatmap, I noticed a clear trend – the crypto space in the English-speaking and Chinese-speaking circles is moving in completely different directions

Top 3 👇 in the Chinese-speaking world

@Sidekick_Labs: The popularity is extremely high, probably due to its narrative of "intelligent agent automation", which meets the needs of developers for modular and invisible robotic agents, especially attracting groups who are concerned about localized AI infrastructure.

@humafinance: Rise with a real-world asset (RWA) narrative and focus on building a low-collateral lending market.

@satlayer: As an emerging platform for L2 infrastructure and AI-enabled networks, technological breakthroughs in zero-knowledge verification models and computing power markets are favored by early adopters in the Chinese-speaking community.

Top 3 👇 in English-speaking circles

@AbstractChain: Probably the most fluid modular protocol out there, and the Western community especially loves its clean $pengu Luca design and developer-first abstraction logic.

@MagicNewton: Known for a new level of community-driven projects that combine aesthetics, community culture, and speculative energy.

@pumpdotfun: Pure meme mania, chaotic farming on the Solana chain.

It's still early, and most projects haven't even minted tokens (TGE) yet. But this emotional polarization? It will spill over to other projects. And there is another important market on Kaito Yaps – South Korea. In the future, I expect the Spanish-speaking world (Latin America and Spain) to have different community traits as well.

If you're tracking cross-cultural explosion opportunities, this is a valuable alpha.

The next step is to see which project can successfully bridge the two worlds. Come on, everyone!

30.06K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.