Why I'm bullish on on-chain institutionalization as the next alpha, starting with 🧐🧐 the upgrade of @LorenzoProtocol $BANK

TL; DR

1) Why on-chain institutionalization?

Transactions and earnings are the two core needs of blockchain. Capital will look for ways to scale globally with minimal resistance, which is exactly in line with the characteristics of blockchain.

2) Why Lorenzo?

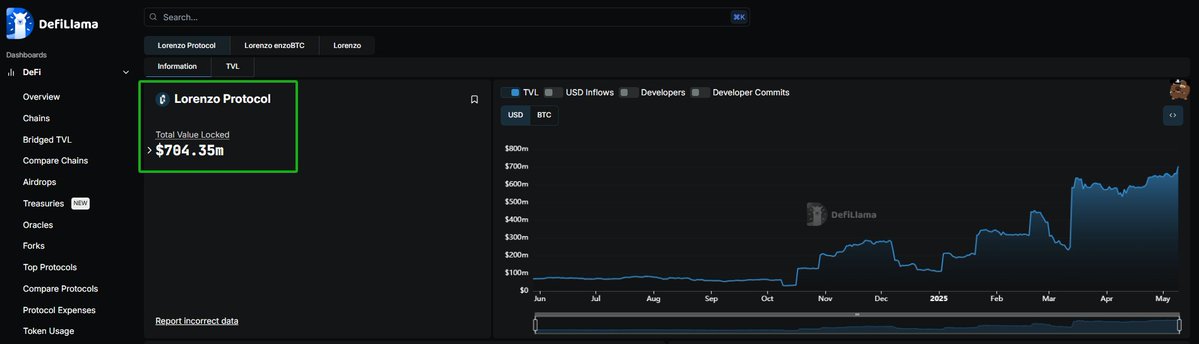

It is an objective fact that $642 million TVL has been accumulated; The financial abstraction layer connects the strategy side and the capital side. At the same time, modularity allows other protocols to serve as distribution channels for Lorenzo's strategy.

3) How to reconstruct the valuation logic?

veToken model, revenue buyback. Becoming an institutional-grade on-chain asset management infrastructure will allow Lorenzo to have more protocol revenue, and even fundamentals, which can also be better fed back to $BANK itself.

————————————————————————————————

Here is the text:

The core argument is not complicated, capital will naturally look for opportunities for disorderly expansion (i.e., it does not want to be restricted by geography, regulation, etc.), which is very consistent with the permissionless and decentralized nature of blockchain.

Capital flows will choose the least resistance method. That's how it is on-chain.

The development of blockchain is accompanied by the continuous falsification of concepts, always answering the question, "What can blockchain do and what can't it do?" "At present, trading and earnings are the two main scenarios.

On-chain institutionalization refers to providing institutional customers (including B-end users such as investment institutions, funds, and project parties) with on-chain decentralized and permissionless native trading or income services on the chain.

In the past, the blockchain industry's services for institutions were mainly carried out in the form of centralized Web2, such as custody, wallet multi-signature, structured derivatives, etc.

But at present, it is clearly felt that with the advent of modularity and restaking, the security of new L1 and L2 can be built on top of Bitcoin and Ethereum.

In addition, the volume of crypto asset funds, hedging methods, and transaction depth have been continuously improved, and the acceptance of crypto assets by traditional companies and sovereign funds has increased.

The way institutions participate in the chain has expanded from established DeFi yields such as @aave @Uniswap @CurveFinance, to $BTC $ETH Resting re-staking (such as @eigenlayer), and then to new RWA chains. Funds from institutions participating in the chain continue to spill over from the Ethereum mainnet.

————————————————————————————————

What is Lorenzo, and what has Lorenzo upgraded?

Lorenzo has been upgraded from a BTC staking protocol to an institutional-grade on-chain asset management infrastructure, which can provide a native real income strategy for institutions, asset users, and ordinary users.

This doesn't just mean a change in the narrative, it's also about fundamentals and

A change in the logic of valuation.

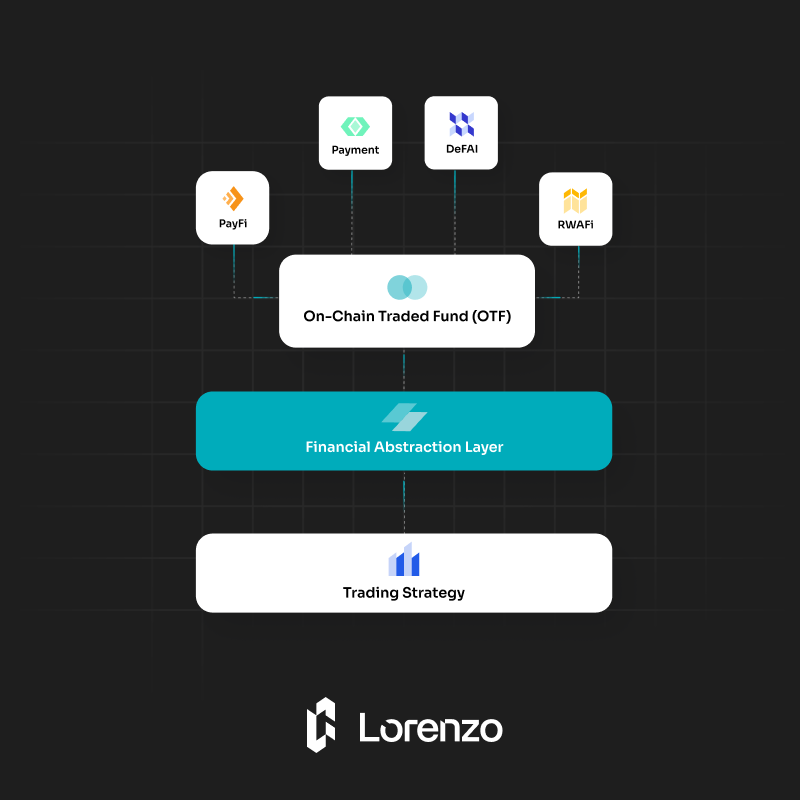

Lorenzo has built a general Financial Abstraction Layer to provide composable and verifiable modular income modules for institutions, PayFi, RWA, DeFAI and other projects.

To put it simply, as shown in the diagram below, Lorenzo builds an intermediate layer that connects the yield strategy, the asset side, and the user.

1⃣ The yield strategy provider encapsulates the yield strategy (such as fixed income, principal protection and dynamic leverage) into a Token, and when the user buys it, Mint corresponds to the token, which is equivalent to purchasing the yield strategy.

Its income strategies can be based on real-world assets, such as RWA assets, quantitative funds, or based on CeFi strategies, such as exchange arbitrage, quants, and more.

Lorenzo can now provide these strategies on-chain and realize on-chain fundraising, off-chain execution, and on-chain settlement. Lorenzo calls it an On-Chain Exchange Fund (OTF).

In short, the yield strategy provider provides the yield strategy based on Lorenzo and tokenizes the strategy.

2⃣ The asset side and the user are the buyers of the strategy, depositing assets and obtaining the benefits of the strategy. Where does the buyer come from?

Wallets, U card issuers, PayFi project parties, DeFi capital pools, CEX capital pools, etc., there are funds piled up, seeking safe and stable income.

Due to the tokenization of strategy income, in addition to making it easy for users to choose products directly according to the rate of return, the strategy can also be encapsulated and provided to other protocols, such as the RWA protocol Plume and so on.

Look at the picture and summarize again,

A yield strategy provider that provides strategies to Lorenzo's Financial Abstraction Layer.

Strategies will be tokenized into OTF (On-Chain Traded Fund), and different strategies correspond to different tokens.

Institutions, such as PayFi, RWA, DeFAI, and other projects, can either use their own pools to purchase strategy tokens, or act as a distribution to provide these strategy tokens to their own users.

————————————————————————————————

The question is, why would an agency put its money in Lorenzo?

1⃣ First, Lorenzo currently has $704 million in TVL. This is an established objective fact.

2⃣ Second, the Lorenzo yield scenario is native, and introducing CeFi or DeFi yield strategies to the Lorenzo chain means that there is a certain threshold for not being able to participate in these strategies elsewhere, or wanting to participate in these strategies.

Users will have their assets in custody, which will be co-managed by Lorenzo with PayFi and RWAFi partners, and mapped to the exchange.

Professional revenue strategy, superimposed on-chain interest-bearing services, to provide users with income. In terms of security, Lorenzo provides risk control and compensation mechanisms.

3⃣ Third, Lorenzo strategy income is tokenized, which means that the strategy is scalable and can be deployed as a token to other chains.

For example,

1) For example, a professional team acts as a strategy provider and provides the strategy to the Lorenzo chain, and then tokenizes the strategy and provides it to the RWA chain @plumenetwork.

Users can purchase the token on the Plume chain, which is equivalent to holding the yield strategy.

2) For another example, suppose the options platform @DeribitOfficial's Green Leaf Loan, or Silver Fern USDT volatility strategy, as the strategy provider.

Institutions can buy on the Lorenzo chain in a decentralized way, mapping funds to a centralized exchange strategy. It is equivalent to enjoying the strategic benefits of professional institutions on centralized exchanges on the chain.

————————————————————————————————

Team, funding, and token model

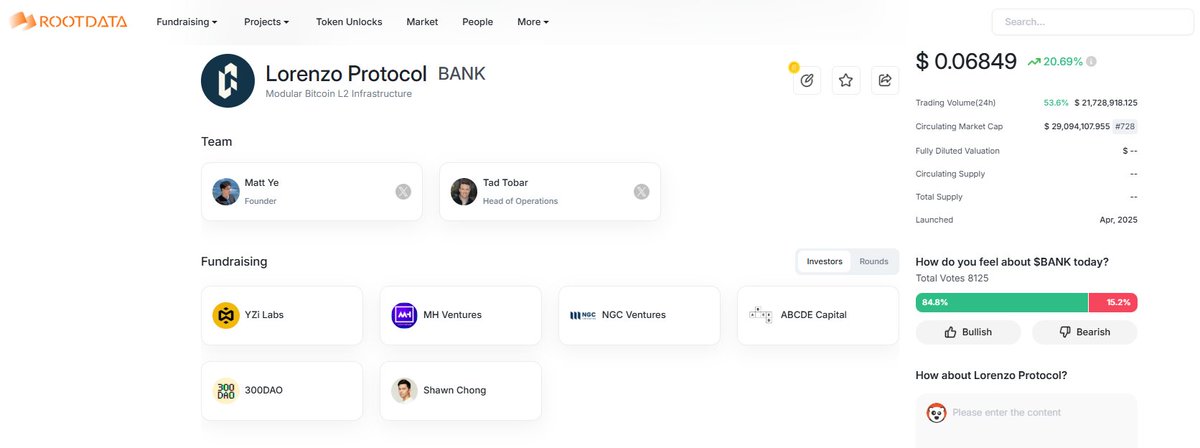

Lorenzo investors include @yzilabs (Binance Labs) @animocabrands @GumiCryptos @PortalVentures and others. Founder @MattYe_MEP, COO @TadTobar.

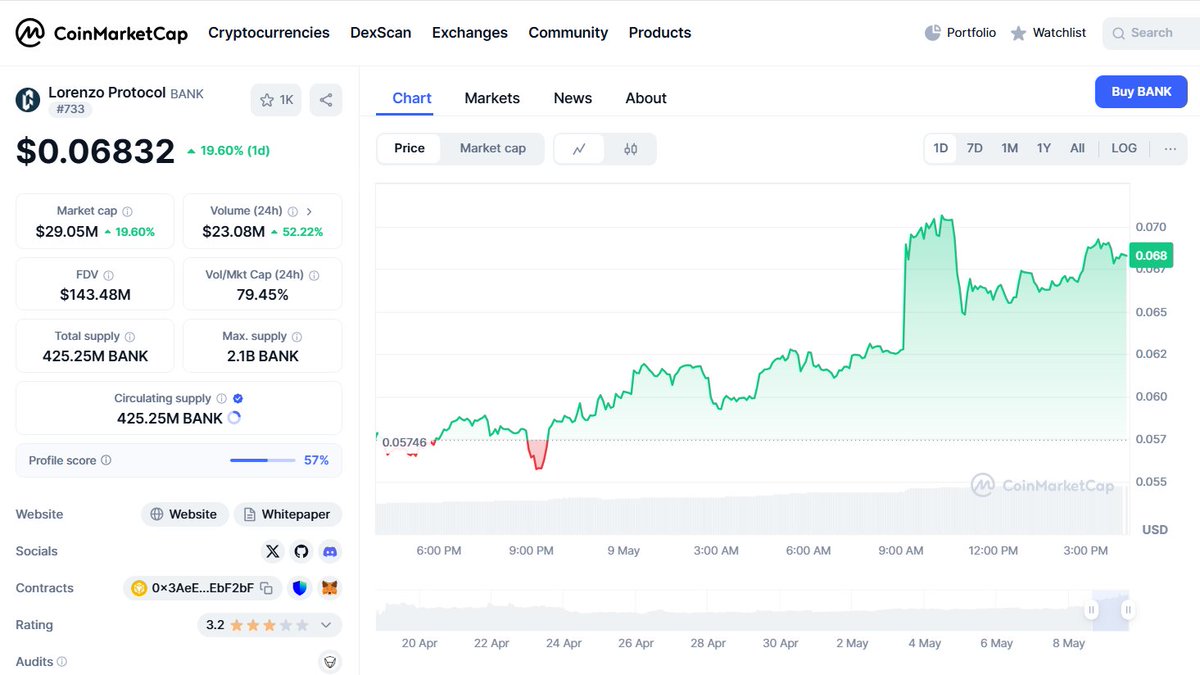

The token $BANK has a current market cap of only $29.05 million and an FDV of $143 million.

$BANK Total supply of 2.1 billion, initial circulating supply of 20.25%. The VE token model is adopted, that is, users lock up their positions to obtain veBANK, which represents the right to vote and the right to obtain protocol income.

At the same time, the protocol will use the revenue to buy back $BANK tokens. (emphasis added)

————————————————————————————————

$BANK Changes in fundamentals and valuation logic

$BANK The core of the fundamentals lies in the veToken model and revenue buyback.

1⃣ About veToken

The veToken economic model represents that the project is $CRV @CurveFinance and its token. Users lock up tokens and get veTokens.

The longer the lock-up period, the more veTokens you get. veToken cannot be sold and has no liquidity, but it can receive protocol revenue.

If you also hold veToken, you can vote to choose which trading pool to direct your $CRV rewards to.

This is also the source of buying orders for $CRV. Projects that build pools on Curve, in order to attract liquidity with higher $CRV emission rewards, buy $CRV lock-ups, vote for themselves, and direct $CRV emissions to their own pools.

At the same time, in order to obtain more rewards, large investors will also vote for the LP pool they participate in.

As a result, protocols such as $CRV War and Convex were born, taking advantage of the illiquidity of veCRV to guide users to lock up $CRV on their own platforms and provide cvxCRV with liquidity.

Back to $BANK.

The VE model lock-up mechanism will reduce the market circulation, so that the already only 14000+ US dollars in circulating market value will actually be further reduced.

And, perhaps, there may be a strategy provider, or a large player participating in a strategy, who buys $BANK lock-up and votes for themselves in order to guide $BANK reward emissions.

Of course, whether there is a $BANK emission incentive or not, Lorenzo has not yet announced.

2⃣ Revenue buybacks

There are very few projects in the cryptocurrency world that have fundamentals, that is, continuous buying.

Once the liquidity is not good, the market turns bearish, and there is no fundamental buying to undertake, the currency price will fall even worse. In a bull market, buying orders will bring "currency price - income", and the flywheel cycles.

And fundamentals, a very important point, is to continue to earn.

First of all, Lorenzo provides a revenue scenario, and it is an original real earning, which is just needed. Secondly, whether it is trading, fees or strategic income margins, it will bring continuous revenue to Lorenzo, which will also feed back to $BANK.

In conclusion, @LorenzoProtocol $BANK represents a new attempt at on-chain institutionalization that can be followed for the long term.

🧐🧐

1/ After our @BinanceWallet IDO, we didn’t pause — we leveled up.

Lorenzo has evolved into an institutional-grade on-chain asset management platform, focused on tokenizing CeFi financial products and integrating them with DeFi.

At the heart of this evolution: The Financial Abstraction Layer!

6.06K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.