Recently, the second level has had the concept of "delisting", quoting a statement

"You're a multi-million dollar shell project right now.

Now the bull market is coming, but you can't create hot spots without any fundamentals.

Even if you spend money and hard-pull retail investors don't follow, the end is just that you are hanging on the top of the mountain.

So you think of making money from the contract by pulling the spot, but there is no opponent at all, you see all this in a hurry,

Until one day, your name pops up in the takedown announcement, and you know that the last chance to belong to you has finally come. ”

Tokens generate fluctuations, first generate exposure, there is a good way to attract attention, not necessarily the first time to bring liquidity and volume, but will play a good role for the next trading, bring more trading volume, twice the result with half the effort.

In the same way, some token name changes, token replacement economic models, replacement, and mapping are also a means to attract attention and cooperate with trading.

🍊 Let's share another high-certainty opportunity in the last two levels, and the last time I talked about the more certain was the STO. STO valuations are undervalued, ranging from 0.06 to 0.23.

This time, let's talk about one, the classic trading of absorbing chips after the market washing, and the choice that this rebound may be relatively strong.

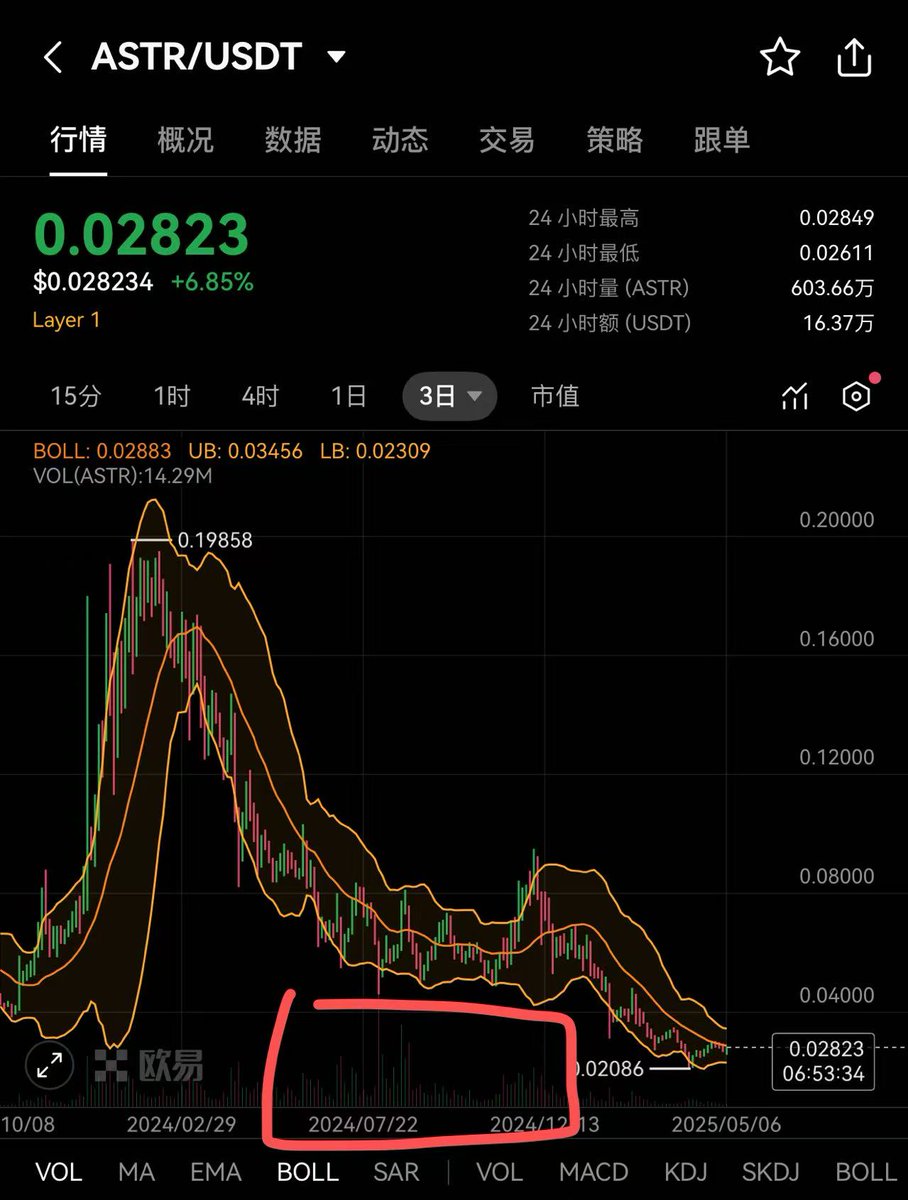

$ASTR is currently in the over-falling phase, and he has traces of similar bottoms to the bottom of the bank, which has generated more and higher trading volume than at other times and even at the peak of the currency price.

This is compared to many copycats that are purely distributed.

For example, before you compare BTC with this round of rise, there is actually a large amount of money quietly absorbing funds at the bottom.

Trivia: Japan's successive prime ministers have attended cryptocurrency conferences,

Japan is currently a low-interest rate country. The JPY-USD carry trade is huge.

You can borrow Japanese yen at an interest rate of less than 0.1% and get a yield of 5% in US dollars.

South Korea has Samsung, Japan has Sony,

Sony Bank is currently exploring a possible entry into this multi-billion dollar market for a Japanese yen stablecoin.

ACCORDING TO SONEIUM'S OFFICIAL WEBSITE

Soneium, powered by Sony's Block Solutions Labs, is partnering with LINE to launch four high-quality mini programs on the chain in the coming months. (There are currently about 200 million active users around the world using LINE Social Network.) )

In addition to marketing exposure to attract attention, there are also key economic model modifications:

Astar has launched a tokenomics-related proposal to transform the ASTR token model from dynamic inflation to one with a fixed maximum supply.

The proposal aims to gradually reduce token emissions by introducing an emission decay function, significantly reducing network inflation, and plans to stabilize the maximum annualized yield of DApp staking at 11-14% over the next two years, preparing for the next brand upgrade.

50% of the network transaction fees will be burned to enhance the long-term economic value and network independence of ASTR.

ASTR This position has a high profit/loss ratio and a narrow stop loss.

(When I edited the manuscript last night, the price screenshot was still at 0.28)

Now it's the time when the bottom is moving, so let's take it out.

There's a network of stakeholders here

1.The Soneium ecosystem is supported by Sony Japan.

2. Startale (Astar development team) is actually developed and operated, led by Sota Watanabe, the founder of Astar.

3. Operate the SOONEIUM ecosystem, which is also a few core people of the Astar team.

Conclusion:

The possibility of a token swap between Soneium and Astar cannot be ruled out.

ASTR can actually play quite a few cards, plus strong background support

Sony's resources and investments, as well as Sota's strategic close relationship with the Japanese government and Japanese foundations)

There is also a revenue cycle DEFI-related design, DEFI is almost the same, and I won't go into detail here.

Uncle, are you here to play?

Show original

14.88K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.