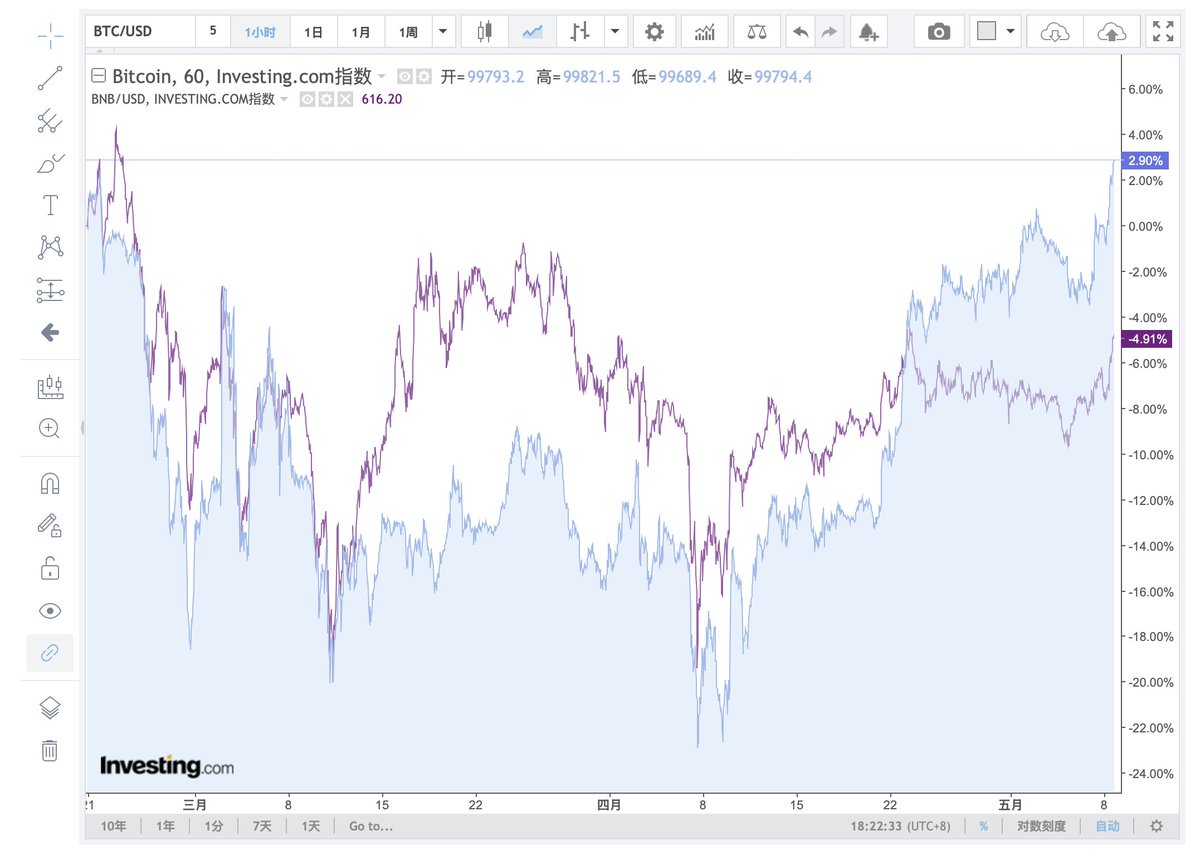

For the past six months, there has been an illusion that the movements of $BNB and $BTC seem to be somewhat opposite, and this illusion is caused by sporadic memories when looking at prices. For example, when the price of BTC rises, BNB starts behind, and when BTC sometimes falls, BNB does not fall so hard.

However, the data will tell me that this is an illusion/illusion, and 3000 points were taken on the 1-hour price chart in three months, and the regression model was built at the same time, and the result was that the prices of BNB and BTC were highly fitted.

This is a rough regression equation, and time series are also used for multiple regression, and the results are very different.

BNB% = -1.20 + 1.33 × BTC% + 0.45 × BSC Volume + 0.18 × TVL - 1.80 × Regulatory Event - 0.04 × Fear & Greed Finger

Conclusion:

1. The BNB price is highly dependent on BTC (β₁=1.33);

2. Pay attention to the changes in the BSC ecosystem (trading volume, TVL), and BNB has additional upward momentum when the ecosystem is active;

3. Regulatory events and deteriorating market sentiment (increased fear) can depress BNB prices;

4. There is still room for $BNB the "Bhutan" model to become a sort of national reserve or into the portfolio of sovereign investment funds as CZ acts as an advisor to more and more sovereign states.

Data is sometimes the opposite of how people feel.

Show original

4.15K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.