Everyone is talking about RWAs.

But no one is speaking about the elephant in the room.

A $1.8 Quadrillion industry that only a few protocols are targeting.

In the third part of this series, we'll focus on @Mantle_Official, which is positioning itself as a "financial hub" at the intersection of Web3 and Web2 with its latest two products:

• Mantle Index Four (MI4)

• Mantle Banking

Before diving into them and into Mantle's vision, a bit of context:

⚙️ THE TECH

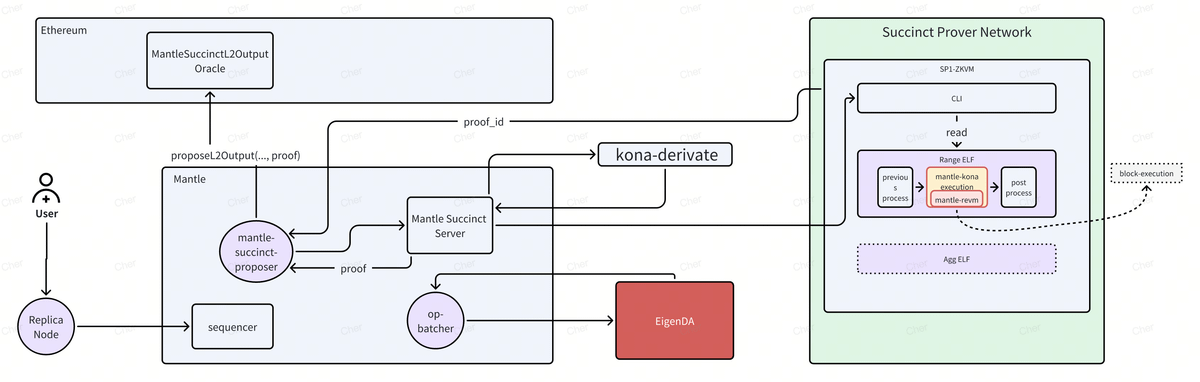

Mantle Network is an EVM-compatible Layer 2 that integrates @eigen_da for data availability and @SuccinctLabs for zero-knowledge proving to provide institutions with a scalable infrastructure to build on.

Both integrations were made this year and represent key steps in Mantle's shift from an optimistic to a zero-knowledge rollup.

The original OP Proposer was replaced with the new Mantle Succinct Proposer, responsible for submitting ZK proofs to Ethereum L1. In parallel, @SuccinctLabs's SP1 Prover Network was integrated to delegate more compute-intensive ZKP generation tasks to a professional network, thus enhancing the chain's performance and scalability.

One of the main upgrades was replacing the original OP Proposer with the Mantle Succinct Proposer, responsible for submitting ZK proofs of Mantle's state changes to Ethereum L1. In parallel, to handle more compute-heavy tasks while maintaining high performance, Mantle also integrated @SuccinctLabs’s SP1 Prover Network to delegate those tasks to its specialized network.

(See image n°1 for a breakdown)

About the EigenDA integration, previously used a custom solution built on top of EigenDA, while now it directly leverages EigenDA’s solution. This allows the chain to scale data availability further without compromising security.

Now that we've recapped how Mantle distinguishes itself from other networks, let's dive into the core topics of this piece.

🏦 MANTLE BANKING

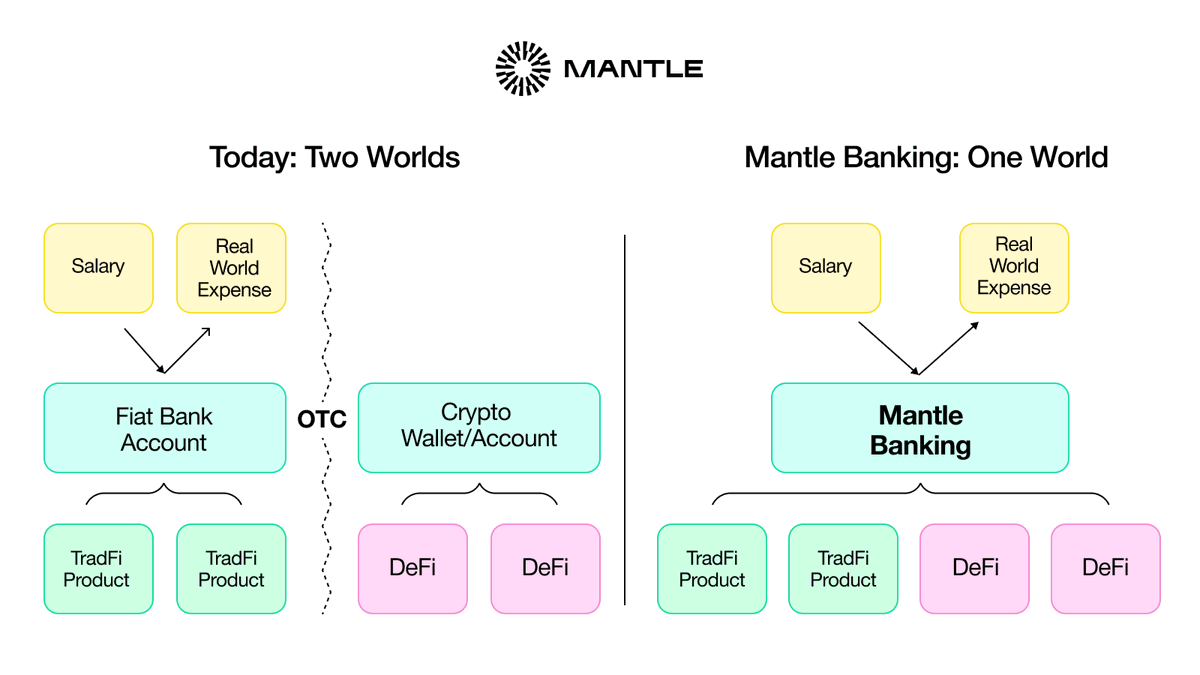

Mantle Banking is a crypto neobank that lets you manage fiat and crypto in one account, making it easy to receive, spend, and invest in both.

The platform allows users to set up a Swiss bank account and receive a globally accepted virtual debit card.

While launching such a service isn’t very difficult, there are two recurring problems most startups in this vertical face:

1.) Third-parties Dependency

2.) Web3 <> Web2 Interoperability

1.) Third-parties Dependency

Most startups launching these products don't control the underlying infra and, therefore, have a weak position when it comes to customer acquisition costs (CAC) and Lifetime value (LTV).

This is because:

1. They pay fees to external providers (e.g., custodians, payment processors, offramps, bridges).

2. They rely on their rules, uptime, and costs.

Ultimately, these two aspects increase the cost of serving customers and lower margins.

On top of that, users expect everything in one place. If your platform doesn’t offer spending, saving, investing, borrowing, and so on, they’ll quickly move towards whoever provides all of these.

2.) Web3 <> Web2 Interoperability

The second issue is most crypto apps can't properly connect to traditional banks or brokerages.

From on-ramping limitations (high fees, geo limitations, etc.) to banks limiting you once you interact with crypto apps, the UX is horrible.

Mantle nails these two problems by owning all parts of the value chain, from the blockchain to the banking one. This allows them to customize each layer of the stack and stay competitive in the market.

The mantle team outlined how ultimately capturing salaries via direct deposit into their neobank is the objective they're working toward.

From there, the use cases would be many, such as:

• Swap & send fiat currencies (USD, EU, SGD, etc.)

• Pay across platforms and merchants

• Interact with Mantle's DeFi Ecosystem

(Check image n°2)

🌐 THE PAYFI VISION

• The global payments industry records an annual transaction volume of $1.8 quadrillion.

• Total revenue across the sector reached $2.2 trillion in 2023 and is projected to surpass $3 trillion by 2030.

• Cross-border payments exceeded $150 trillion in volume in 2023.

• Digital wallets account for over 50% of global e-commerce payments and are expected to rise to 60% by 2026.

This is the scale of the payments industry today. However, most of this value still moves on traditional infrastructure.

And that's where the concept of PayFi comes in.

PayFi, aka Payment Finance → the merge of stablecoins, tokenized assets, and DeFi with legacy payment rails.

PayFi is based on the principle of the Time Value of Money, the idea that a dollar today is worth more than its value in the future because it can be invested or lose value due to inflation.

I'm briefly outlining this because it's exactly where Mantle wants to position itself with the Banking platform.

We're entering the phase where CEXs, L1s, and L2s will scale from targeting traders and DeFi users to the masses. This won't be done by creating some crazy DeFi apps that most of the population wouldn't be able to understand but by serving them what they already use daily.

Onchain and offchain worlds are converging, with CEXs, ecosystems, and FinTech giants racing to capture their share of the pie.

📈 MANTLE INDEX FOUR (MI4)

Simply put, the yield-bearing S&P 500 of crypto.

MI4 is a tokenized fund that offers diversified exposure to yield-bearing assets, with @Securitize as the tokenization partner, @FireblocksHQ as the custody provider, and the Mantle Treasury as the main investor by committing $400M from its balance.

The reason MI4 is very interesting is its institutional-focused approach, as it provides a relatively low-risk, index-based product that’s familiar to traditional investors.

On top of that, it bakes in yield generation, making it even more attractive to asset managers and funds.

The yield comes from blue-chip staking strategies like:

• @mETHProtocol's mETH

• @Bybit_Official’s bbSOL

• @ethena_labs’ sUSDe

These allocations are rebalanced quarterly, and the current fund's structure looks like this:

• BTC - 50%

• ETH - 28%

• USD - 15%

• SOL - 7%

What's remarkable about MI4 is that it's @Securitize’s largest tokenized fund, demonstrating Mantle's commitment to attracting more institutional participation and expansion beyond a generic-purpose L2.

🌱 INITIATIVES TO DRIVE THE INDUSTRY FORWARD

Lastly, as we did in the previous pieces, it's worth mentioning the initiatives Mantle is carrying out to increase ecosystem adoption and global expansion.

1.) Mantle EcoFund - Launched in 2023, it's a $200M fund investing in startups building in the Mantle ecosystem. The fund is also invested in Synergy, a $5 million initiative in collaboration with TON Ventures to advance cross-chain developments between the two networks.

2.) LATAM Expansion - In partnership with @odisealabs, Mantle is engaging with local developers, entrepreneurs, and communities, providing resources and support to accelerate Web3 adoption across the region. This is also part of a bigger vision, in which LATAM will be a main propeller of Mantle Banking's adoption.

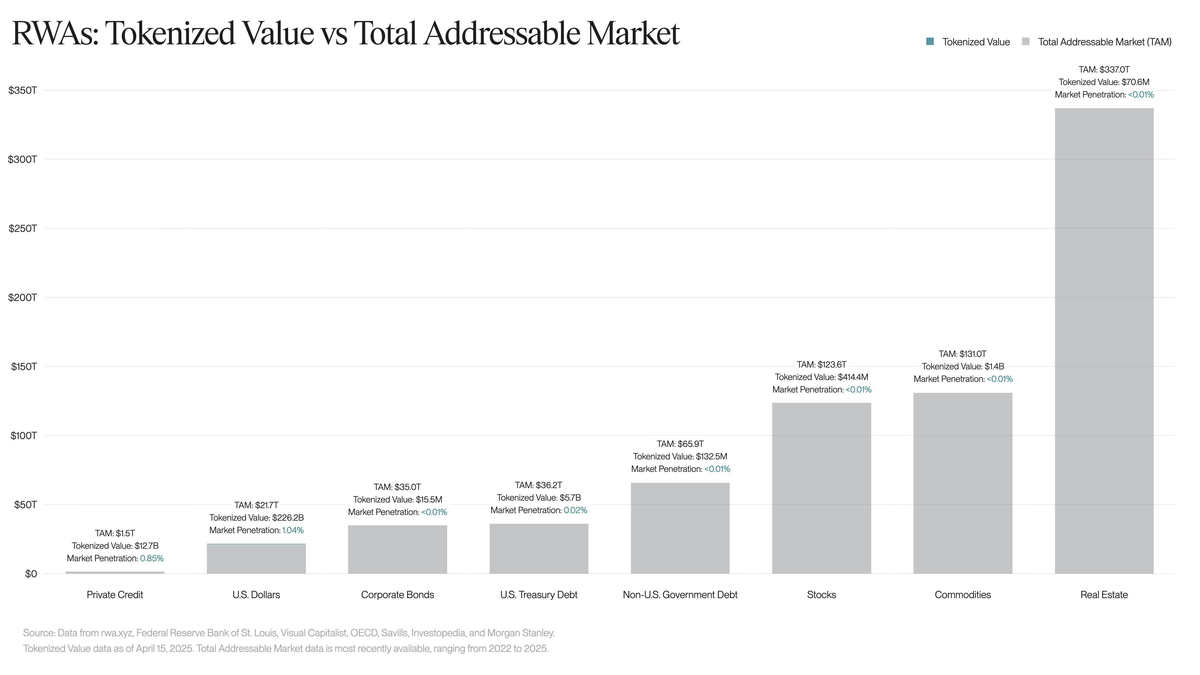

Everyone thinks RWAs had their breakthrough.

They're wrong.

We’re at less than 0.01% penetration across all sectors.

Check the first image for a clear breakdown.

In the first part of this series, we explored the state of RWAs across the top 10 networks.

As we're still very early and the market will evolve massively, I decided to dive deeper into RWA-centric chains, starting with the pioneer of RWAfi:

@plumenetwork

$50M TVL in vaults pre-mainnet.

$4.5 billion in committed assets ready to be tokenized.

With these numbers, once Plume's mainnet goes live, it will rank 2nd by RWA TVL, behind only Ethereum.

And it's fair to say that Plume's RWAfi narrative has gained a lot of momentum in the last few months. For those catching up:

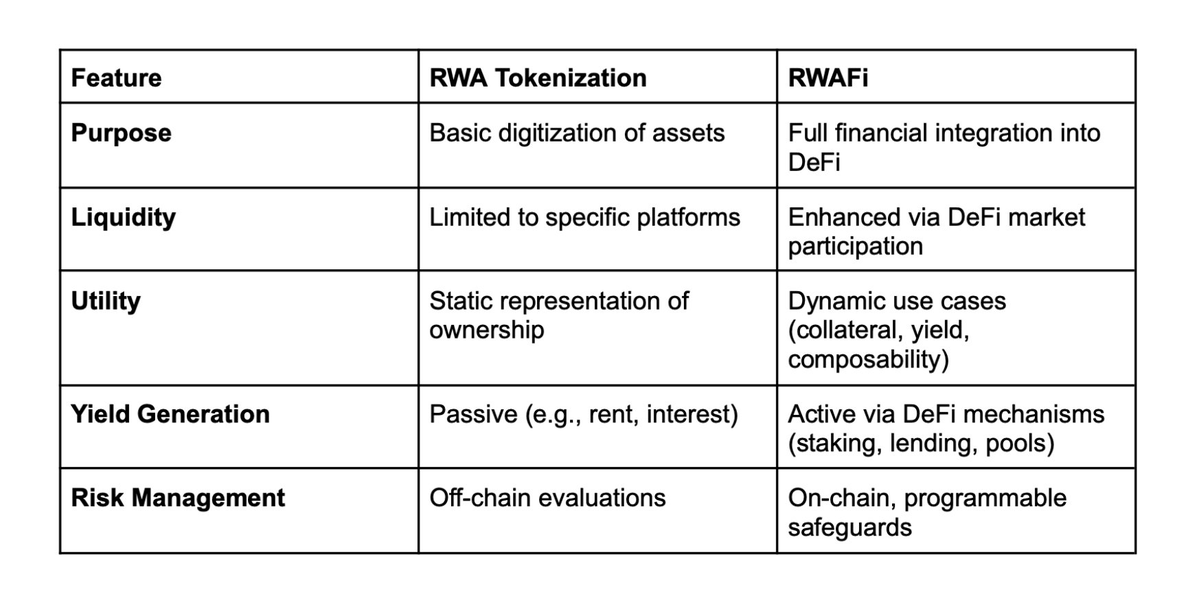

RWAfi = Real World Assets financialization

(Check image n°2)

🔮 THE VISION

Make it easy for RWAs to flow wherever they want onchain.

"RWAs are about making it easy to interact with the real world onchain, with a crypto-native user experience."

At the heart of the company's vision, there is the belief that tokens offer a superior UX compared to anything in traditional finance or Web2 today.

From financial instruments to gold bars to durian farms, the objective is to be able to trade, lend, borrow, and do anything with all kinds of assets.

Composability is the key word in all this.

As I highlighted multiple times in the first part of this series, composability is a critical component of RWAs.

Bringing assets onchain just for the sake of making them digital is useless.

Composability has similarities with the open capital markets of the past. When capital and assets flow freely, innovation explodes, new businesses are born, and entire economies grow.

• Amsterdam became the global financial center by pioneering stock markets, accessible to anyone.

• Singapore became a global financial hub within a few decades by encouraging the free flow of capital and minimizing restrictions on foreign investments.

The same will happen onchain. The more assets can interact seamlessly, the more value and growth will be unlocked.

⚙️ THE TECH

Now that we have a clear idea of what Plume aims to achieve, let’s dive into the tech side to see how this vision will become a reality.

Unlike many other RWA or general-purpose blockchains that combine L1s with L2s or Subnets, Plume focuses on turning its single L1 chain into a hub for all processes related to asset tokenization.

Think of it as a startup providing a full-stack infrastructure for:

• Tokenizing assets

• Meeting regulations and staying compliant

• Custodying assets

• Exploring composability and new use cases

All of this is made possible by bringing under the same umbrella four elements:

1.) Passports - Smart wallets

2.) Nexus - Data infrastructure

3.) Skylink - Interoperability infrastructure

4.) Arc - Tokenization app

(Check image n°3)

1.) Key Points About Plume Passport

Plume’s Smart Wallet integrates custody and compliance directly within the wallet, abstracting these functions away from the user.

These wallets provide features like gasless transactions, automated operations, batch processing, and other types of contract-based interactions.

All these features are natively built-in, allowing devs to customize their offerings and tailor them to specific use cases, something that wouldn't be possible if relying on third-party providers.

What Plume did differently was modify the core of the blockchain itself, allowing the storage of custom code directly inside a regular wallet (EOA).

This approach is not possible with Ethereum, for instance, as it'd require a hard fork of the network. As a result, builders on Ethereum rely on third parties, which utilize ERC-4337 to create a separate smart contract account linked to the externally owned account (EOA).

2.) Key Points About Nexus

Nexus is another crucial element of the blockchain, as it gathers several real-world data points, enabling new use cases for DeFi and non-DeFi applications.

See it as an aggregator of multiple external sources, which receives real-time data and streams it onto the blockchain. The current partner providers are:

• @SUPRA_Labs

• @StorkOracle

• @truflation

• @sedaprotocol

• @eoracle_network

• @redstone_defi

• @oraichain

• @OpenLayerHQ

• @ChronicleLabs

The key feature of Nexus that differentiates it from other data providers is its custom transaction type.

Instead of transmitting data together with tokens, Plume reserves a portion of the block space specifically for these data transactions, ensuring their timely processing even during peak network congestion.

However, if there is no congestion or excessive activity on the chain, this "reserved" block space is utilized normally for any other type of transaction.

3.) Key Points About Skylink

Developed in collaboration with @LayerZero_Core, this solution enables yield distribution directly to user wallets by creating unified pools that allow users to move assets by minting and burning across multiple chains.

This process is done by creating "mirrored YieldTokens" across partner chains.

When a YieldToken is created on Plume, mirrored tokens are automatically generated on each partner chain using LayerZero’s architecture.

These tokens reflect only the yield component of the native tokenized assets on Plume while inheriting all the security and compliance features of the underlying assets.

In simple terms:

• Constant yield streaming across any blockchain.

• Unified compliance and security standards across all chains.

4.) Key Points About Arc

Arc is a full-stack tokenization app that allows issuers to select the proper apps to install based on the specific type of asset being tokenized.

You can imagine it as an App Store where you plug in what you need, from KYC and AML features to secondary markets and off-ramps.

The platform has four main components:

1. Tokenization dashboard

2. Trading & analytics platform

3. Back-end server

4. Database infra

Developers can select the most suitable components for their assets without worrying about back-end hassles like development and compliance, as Plume takes care of all that.

📈 RECENT INVESTMENTS & PARTNERSHIPS

Q1 of this year has seen Plume receive commitments from leaders across different verticals of our industry.

In no case, the details of the investments have been disclosed, but the names are very relevant, so I thought it's worth quickly mentioning them:

• @yzilabs - Tier-1 incubator (fmr Binance Labs)

• @apolloglobal - tradFi giant with $700B of AUM

• @LayerZero_Core - Leading interoperability provider

Additionally, several partnerships across multiple sectors have been made. Props to the BD team grinding 24/7. Some key names include:

• @PayPal - Integrate PYUSD Plume's vaults

• @goldfinch_fi - Integrate Goldfinch's private credit product

• @superstatefunds - Deploy treasury bill and carry fund product

• @FireblocksHQ - Provide custody services

• @BitlayerLabs - Integrate native BTC bridge

• @Moca_Network - Support on distribution

• @MercadoBitcoin - Support on distribution

Regarding Distribution

The last two protocols in this list should significantly boost Plume's distribution network.

1.) The first, Mocaverse, will allow its network of 100+ companies and 700M+ users to access Plume's products.

2.) The second, Mercado Bitcoin (the largest CEX in Brazil), will tokenize $40M of asset-backed securities, consumer credit, corporate debt, and accounts receivable and distribute them to its 4+ million users.

In addition to these partnerships, a brief mention should go to Plume USD, Plume's stablecoin designed to facilitate all operations within the ecosystem.

The stablecoin will be mintable through USDT, USDC, and other assets and will be supported since mainnet day 1 by many protocols. Some of them include:

• @Cultured_RWA

• @SoleraLabs

• @NestCredit

• @OspreyMarket

• @metastreetxyz

• @mystic_finance

🦶 RWA'S ACHILLES HEEL

One of the key aspects when analyzing RWA-centric chains, if not the most important one, is their approach to the regulatory landscape.

In this regard, Plume made a very interesting move last week by publicly welcoming Salman Banaei, the former Senior Special Counsel at the U.S. SEC, as their new General Counsel.

@banamlas has 15+ years of experience across both the private and public sectors, including service at the SEC, Uniswap Labs, and the CFTC.

His role will be to oversee legal, policy, and compliance strategy, ensuring the team moves forward without crossing critical legal boundaries

Furthermore, to better align with regulatory standards, Plume runs AML screening when tokens are transferred.

This means that if someone uses a wallet to send tokens from another chain, and that wallet has done illicit activity, the transfer will fail and the tokens won't appear on Plume.

How does this work?

All transactions are submitted through the Plume RPC before being sent to the sequencer for ordering and execution.

Once the RPC receives the transaction, its details are forwarded to a third party that performs compliance and security screening by leveraging the OFAC sanctions list to detect potential sanctioned addresses.

In parallel, all transactions and network activity are monitored and analyzed to spot unusual patterns or suspicious behavior that could indicate fraud, money laundering, or sanctions violations.

In this case, Plume collaborates with third-party providers, including:

• @0xPredicate

• @chainalysis

• @elliptic

• @scorechain

🌱 INITIATIVES TO DRIVE THE SECTOR FORWARD

Lastly, as we did in part n°1 of the series, it's worth mentioning initiatives adopted by ecosystems to push the RWA sector forward.

Plume has launched two initiatives targeting not only RWAs but also the growing AI scene by collaborating with another ecosystem.

1.) $10M RWAI GPU Initiative focused on tokenized GPU assets in collaboration with @AethirCloud.

2.) $25M Ecosystem Fund to support real-world assets tokenization and early-stage startups.

7.74K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.