$tETH is a next-gen liquid staking token (LST) that goes beyond just staking rewards. Let me tell you why:

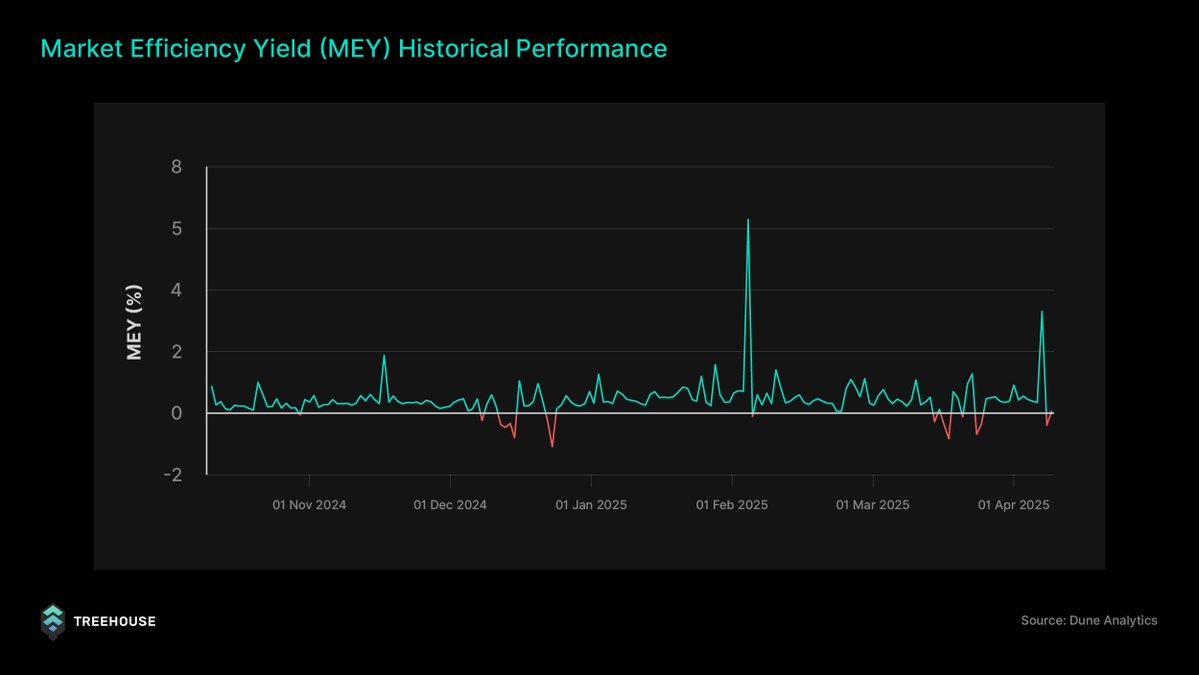

While tokens like $stETH, $rETH, or $BETH passively track the Ethereum staking rate, tETH actively captures Market Efficient Yield (MEY) by arbitraging ETH lending markets.

When borrowing rates exceed staking yields, tETH lends out stETH to earn more, boosting returns for holders without requiring them to lift a finger. On top of that, users earn Treehouse points (“Nuts”), which may offer future rewards as the Treehouse Protocol evolves.

Since launch, tETH has consistently outperformed leading LSTs by 40–50 basis points in APY, thanks to this layered strategy.

It’s also built with robust safety measures—no leverage, conservative risk parameters, and constant monitoring to ensure positions stay healthy and secure. This makes tETH not only efficient but also incredibly safe.

And this is just the beginning. With more yield optimizations and integrations on the way, tETH is shaping the foundation for a new fixed-income layer in DeFi through the Treehouse Protocol—bringing institutional-grade yield strategies to everyday users.

If u are looking for juicy $ETH yield, $tETH might be exactly what u are looking for.

🌳 tETH Historical Performance Review

Since launch, $tETH has outperformed the leading LST, stETH, by an APY ~50bps higher.

However, a reliable yield isn’t the only feature of tETH!

tETH’s underlying strategy has NEVER been liquidated in DeFi history.

Let’s break it down. 🧵

37

7.22K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.