There'll be one global backbone - Ethereum

Ethereum is the backbone of the new global financial system of L2s and L1 apps. No other chain will come close.

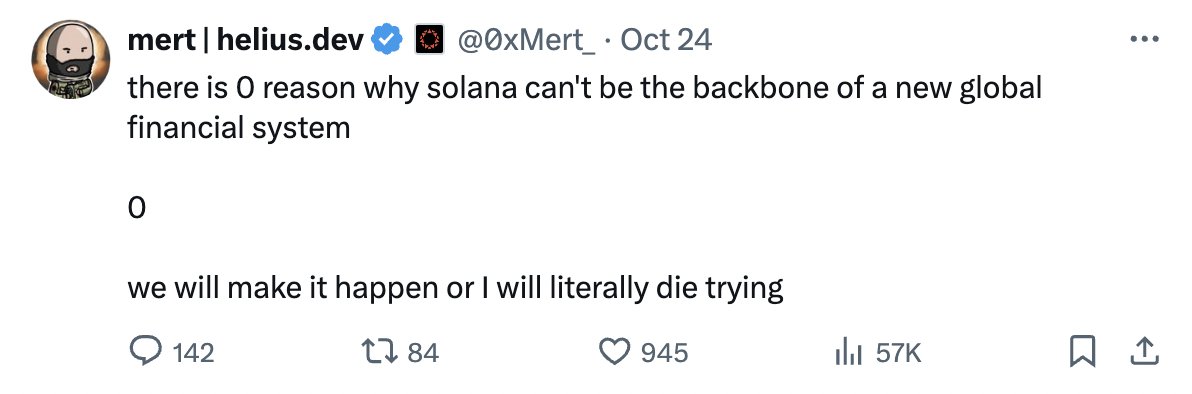

Mert suggested that Sol can pivot to being the backbone. But Solana will never be the backbone. Here's 5 reasons why.

Four years ago, Ethereum pivoted to focus on being the backbone of the new global financial system of L2s and L1 apps. Eth's backbone strategy is being increasingly recognized as an apex L1 strategy and genius move - it's still early, but the signs are there if you look closely, such as imitation being the most sincere form of flattery, and L2s dominating.

Solana has done very well this season in degen/meme growth and SOL price. Yet, imo Sol leadership are starting to see the writing on the wall in terms of L2s being on track to eat alt L1 market share. Now, they seem to be suggesting that Solana could pivot to become a backbone like Ethereum, too.

But Solana is fundamentally unsuited to be a backbone for L2s or even world-scale L1 activity. I'll explain why in detail.

As a preface, let's explore how Solana leaders seem to have have gradually admitted that Ethereum's L2 backbone strategy is excellent and that Solana might pivot to pursue being a backbone.

At first, Solana sold the idea that they were going to be so fast and so cheap that the entire world was going to use the single Solana chain. This was their "monolithic" era, a term they championed before it became a liability (because in reality, no one monolith can serve the whole world). They pivoted their marketing to use the term "integrated".

Then, mid this year, Solana acknowledged that L2s are the right approach. A few things led up to this. Solana leaders noticed that some of their flagship apps began building custom L2 appchains on Sol - this was for the usual reasons that customers love L2s (ie. control and customization, while being part of a greater whole and not having to run your own consensus). And earlier this year, a prominent Sol community member wrote a spicy thread on Sol's need to adopt L2s - the Sol community lit that mfer on fire because this was before their leadership admitted that L2s are ~inevitable. Plus, a major Sol dev team pivoted/expanded to building a SVM L2 on Ethereum (from Sol L1 app to Eth L2). The net result was that Solana leadership started leaning into L2s.

(Note that Solana didn't admit that Ethereum was right about L2s all along, instead they said their L2s are not L2s, but are in fact "Network Extensions". This is pretty huge marketing spin. It's is similar to Sol's recent new concept of "True tps" which they had to invent because, over the years, they pervasively misrepresented Sol's tps on many info sites by including the 80% (!!) consensus overhead in reported tps. Many sites still say Sol's tps is 3k but really it's ~750tps. Their new "True tps" was invented by them to counteract their longstanding practice of reporting "False tps". My point is that serious people doing serious diligence for serious onchain investment should be sure to look closely at Solana's claims - many do not hold up under scrutiny.)

Fast forward to this month, and now Solana leadership is starting to talk about how they can simply pivot to Ethereum's backbone strategy (but they can't for the reasons below).

Why is Solana starting to favor Eth's backbone strategy? Why now?

It's because it's finally becoming obvious to everybody that the world needs many, many new chains (thousands, then tens of thousands), and L2s are generally a much better deal than alt L1s (that's why Coinbase, Kraken, Sony, EVE Online, etc. chose L2), so being the backbone for L2s is an apex strategy.

So can Solana just pivot to being a backbone? No, this strategy is unavailable to Solana (for the reasons below).

In reality, Solana is in deep trouble in terms of their technical and economic strategy.

What trouble is Solana in specifically?

Solana will not be fast or cheap enough to serve even a fraction of the whole world's coming demand.

Solana is not decentralized enough to attract true giga whale capital.

Solana can't be a competitive global backbone for L2s.

Solana bundles consensus and execution, which is slower and costlier than doing only execution. That's why the most scalable L2s - who only need to do execution and not consensus, while also benefiting from being part of the overall trustless composability network effect across all L2s - will soon be faster and cheaper than Solana. See MegaETH.

To say the previous point again because it's crucial: not only will Solana not be the backbone, but soon, it won't even be the fastest or cheapest chain.

Right now to some people (including many investors), Solana might seem like the best at everything - a better version of Eth. But this couldn't be further from the truth. Soon, Solana will be the best at nothing - on a technical/economic level.

So far this season, ETH may have lost the ratio battle against BTC and SOL (season's not over), but Ethereum has been playing chess, not checkers. Ethereum is on track to win the "war" of capturing the vast majority of onchain growing to global ubiquity because Ethereum scales the way the world actually works - via an L1 backbone and marketplace of L2s.

In short, Ethereum was right all along that being the backbone is by far the best L1 strategy. Yet, while Solana leadership may suggest they can become a backbone, they can't.

~~~

5 reasons why Solana will never be suitable as a global backbone

1) Solana has no real client diversity and probably won't ever have it on a meaningful timeline.

Client diversity means that your chain is run by several independent programs in parallel. This greatly helps to prevent both attacks (multiple independent dev teams and programming languages) and accidents (multiple codebases, as bugs are usually local to a single codebase).

Client diversity is mandatory for a global backbone.

To achieve client diversity, no single program can run a majority of your validator stake. This requires at least three independent chain clients and balanced stake between them. It also requires a PDF protocol spec and research community that's upstream of your chain clients. The protocol spec determines the "definition" of the chain, as well as the correctness/reliability of this definition. This ensures all the clients are working towards the same rigorously specified goal.

Today, Sol has only one production client (agave rust). Sol is trying to build a second client (firedancer), but it's proving to be extremely difficult and delayed because they have no real protocol spec or research community, and because the agave rust client is highly optimized and strongly leverages underlying hardware, making it even harder to extract the low level design into a PDF protocol spec to then reimplement in new clients.

Firedancer is not close to being ready to run 50% of stake in production with its entire own codebase. imo years, not months.

Even once Solana has firedancer in production, they won't yet have achieved client diversity. To do so, they'll need at least a third production client (so that no client has more than 50% stake, impossible with 2 clients), and a balanced stake between them, and for all three clients to be 100% original codebases with no code overlap, no dev team overlap, no code dependency/library overlap, and written in all different programming languages.

Ethereum has four production chain clients that meet these criteria, and has for years.

2) The second reason that Sol will never be a global backbone is because their chain requires very high bandwidth (they recommend 10Gbps upload). This adds very significant real-world centralization and risk.

The entire point of a global backbone is to minimize risk in all its forms, so burdening with extremely high bandwidth requirements is a non-starter.

A high bandwidth requirement is difficult to work around. You can buy a big computer and transport it anywhere, but you can't get 10Gbps upload in many areas, especially not outside of capturable corporate data centers or over VPNs.

The backbone must be able to run practically anywhere. The credible threat of running the backbone anywhere - even totally avoiding data centers entirely if needed in the future - is a key part of risk minimization.

10Gbps is Sol's recommended upload today, but it'll increase over time. For Solana, the bandwidth problem doesn't get better over time.

3) Solana has a high risk of a future outage. Solana's halted lots before and lacks Eth's protocol-level fallback to continue producing blocks even if "finalization" can't occur.

When there are 200 countries with 100 trillion in assets trusted to a global backbone, it's pretty important that the backbone always does what it says it will do, including never going offline.

4) Sol lacks economic decentralization. ~2% of SOL TGE/ICO was sold publicly. That's a ~98% (!!) insider allocation.

ETH sold 80% publicly, and then PoW with high inflation for seven years had the upside of distributing ETH very widely because miners must dump almost all their ETH to pay for mining costs.

On an economic and operational basis, Solana is relatively very centralized. This adds significant risk and detracts from suitability as a global backbone.

5) zk proof aggregation for L2 settlement means that the L1 global backbone has no reason whatsoever to sacrifice even a tiny amount of decentralization for extra scalability.

Although the Eth L1 is intentionally not focused on execution scaling, every L2/L3 in the world, even 100,000s of chains, will be able to settle on Ethereum because of zk aggregation.

Solana specializes in L1 execution scaling, which is a liability for the global backbone's requirement to maximize decentralization and credible neutrality.

~~~

For these reasons, Solana will never be the backbone of the new global financial system.

imo, Solana won't even be "a" backbone in the sense that Solana's year-over-year market share will continue to decline vs all of Ethereum (L1+L2) across key hard-to-game metrics like non-native app capital or major corp integrations. This is because the world is generally much better off onchain on Eth L2 or L1 vs. on Solana or any other chain. Don't trust me - ask Coinbase, Kraken, Sony, Visa, the City of Buenos Aires, and many more existing and upcoming corps and govts.

Anybody doing serious diligence to come onchain will uncover the points I made above, including corps and govts seeking to invest or build - which will soon be all of corps and govts across the world.

Ethereum is the backbone of the new global financial system. No other chain will come close, Solana included. L2s are destroying alt L1 market share and distributing ETH as money. Significant value accrual to ETH will follow.

Show original

490.16K

1.33K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.