Amazing post by @Donnie100x. Must read!

"𝙏𝙝𝙞𝙨 𝙬𝙞𝙡𝙡 𝙗𝙚𝙘𝙤𝙢𝙚 𝙩𝙝𝙚 𝘽𝙞𝙣𝙖𝙣𝙘𝙚 𝙤𝙛 𝙤𝙣𝙘𝙝𝙖𝙞𝙣 𝙗𝙪𝙩 𝙬𝙞𝙩𝙝𝙤𝙪𝙩 𝘾𝙕.”

That’s @cryptocevo after testing @BananaGunBot Pro.

And when you zoom out, the metrics tell the same story.

Let’s break it down by the data 👇

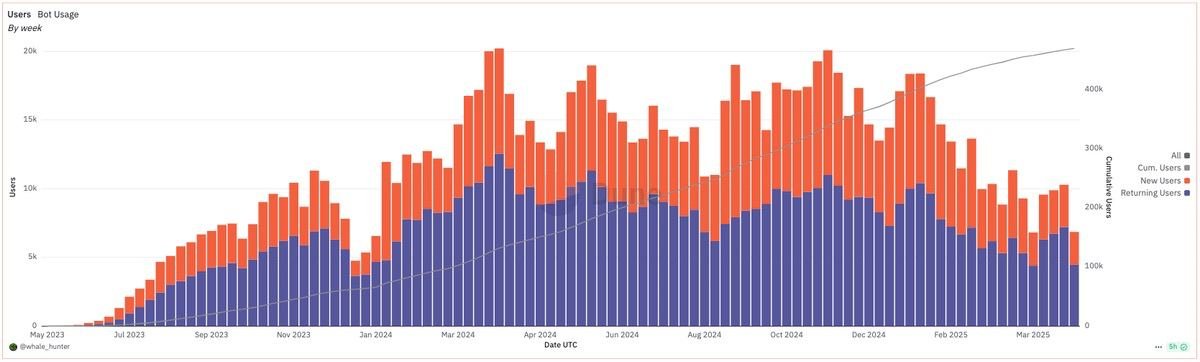

1. 𝐁𝐨𝐭 𝐔𝐬𝐚𝐠𝐞 (𝐔𝐬𝐞𝐫𝐬)

The consistent rise in returning users (blue bars) highlights deep retention: traders are integrating it into their daily flow.

That data matters more than vanity spikes.

Even during dips in new user growth (red), core usage held strong signalling real product-market fit rather than campaign-driven noise.

Notably, the cumulative user curve (gray line) shows long-term compounding: a steady climb past 400k total users by March 2025.

For a bot spanning chains like $ETH, $SOL, $BASE, $BNB, $S, and $UNI, this kind of organic stickiness is exactly what you'd expect from something built by on-chain traders, for on-chain traders.

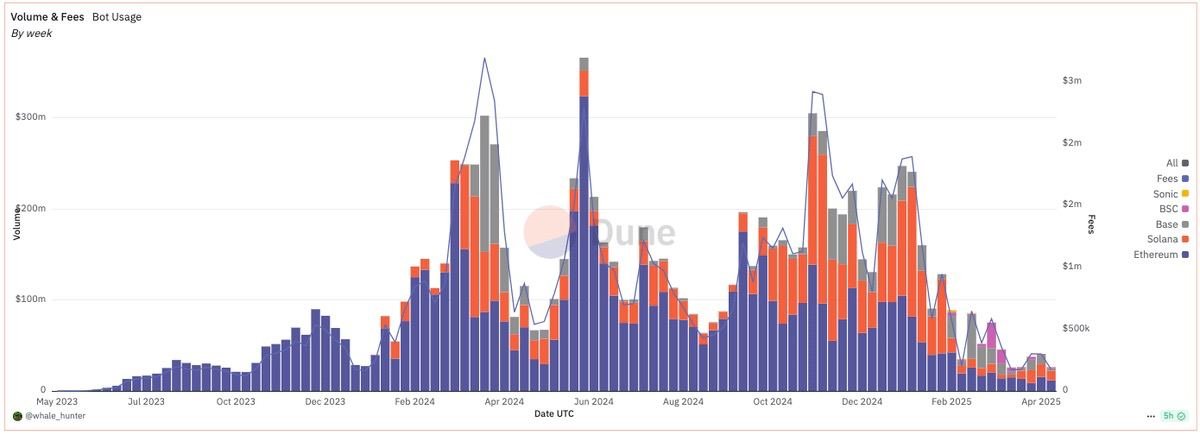

2. 𝐁𝐨𝐭 𝐔𝐬𝐚𝐠𝐞 (𝐕𝐨𝐥𝐮𝐦𝐞 & 𝐅𝐞𝐞𝐬)

The spikes in volume and fees, particularly during Q1 and Q4 2024 reflect conviction.

Traders were executing large, fee-generating positions across multiple chains, with Ethereum and Solana leading the charge.

The presence of newer chains like Base and Sonic in the later months points to Banana Gun’s agility in adapting to shifting ecosystems.

What’s especially telling is that even during broader market cooldowns, fee generation didn’t fully collapse.

That resilience suggests the bot is deeply embedded in the flow of active traders.

Volatility or not, it’s still extracting fees and facilitating meaningful volume, which is exactly what you'd expect from a tool that’s part of the on-chain trader’s daily stack.

3. $BANANA

After breaking past the $19 resistance level, price briefly touched $22 before consolidating in a tight range.

This sideways chop above prior highs suggests healthy digestion of gains rather than exhaustion.

Volume spikes on green candles confirm that buyers remain in control, even during pullbacks.

Watching for a clean push above $21.50 with rising volume to confirm continuation. Overall, structure remains intact.

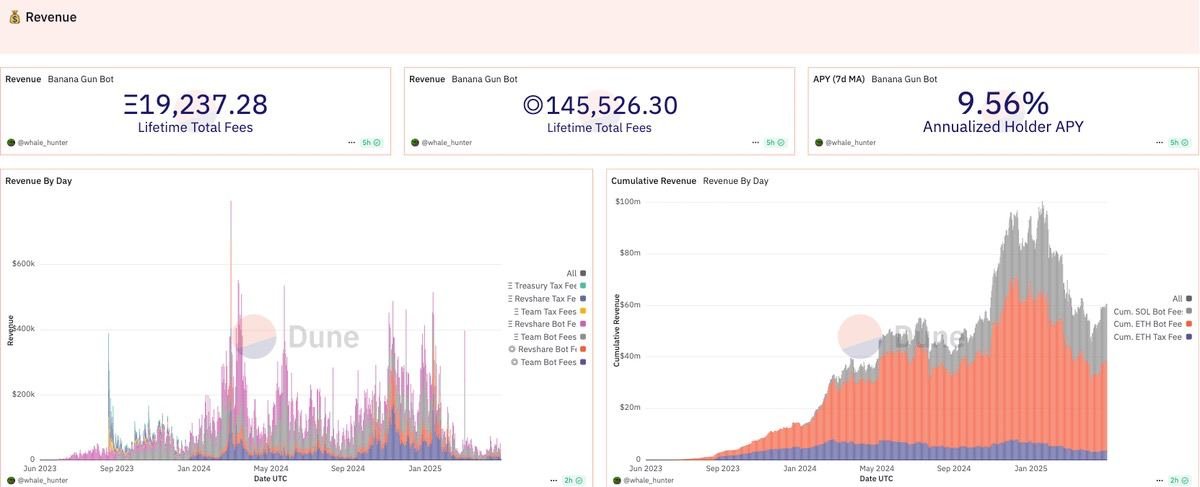

4. 𝐑𝐞𝐯𝐞𝐧𝐮𝐞𝐬 & 𝐇𝐨𝐥𝐝𝐞𝐫𝐬´ 𝐀𝐏𝐘

This final chart brings the Banana Gun story full circle: it’s a business with real, recurring revenue and tangible yield.

Over 19,000 ETH in lifetime fees, over 145,000 SOL-equivalent, and a sustained 9.56% APY for holders

The layered revenue sources (taxes, bot usage, revshares) show a system built for durability, not dependency on hype cycles.

And the compounding effect is clear in the cumulative curve: even with fee volatility, the trend remains unmistakably up and to the right.

If the earlier charts proved Banana Gun is sticky for users and valuable for traders, this one confirms it’s also delivering real economic value.

With metrics like this, how long until this becomes standard infra?

25.19K

196

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.