bingo

Continue to believe there are high odds we break the simplistic four-year cycle that $BTC has honored the last ~12 years. If that happens, most people will realize they over-traded what's to come, with too short-term a view. But to buy that thesis, you have to believe blockchains are foundational to our digital future, not some "get rich quick" scheme. Anyone approaching cryptoassets like lottery tickets, has the same odds of getting rich as someone buying an actual lottery ticket.

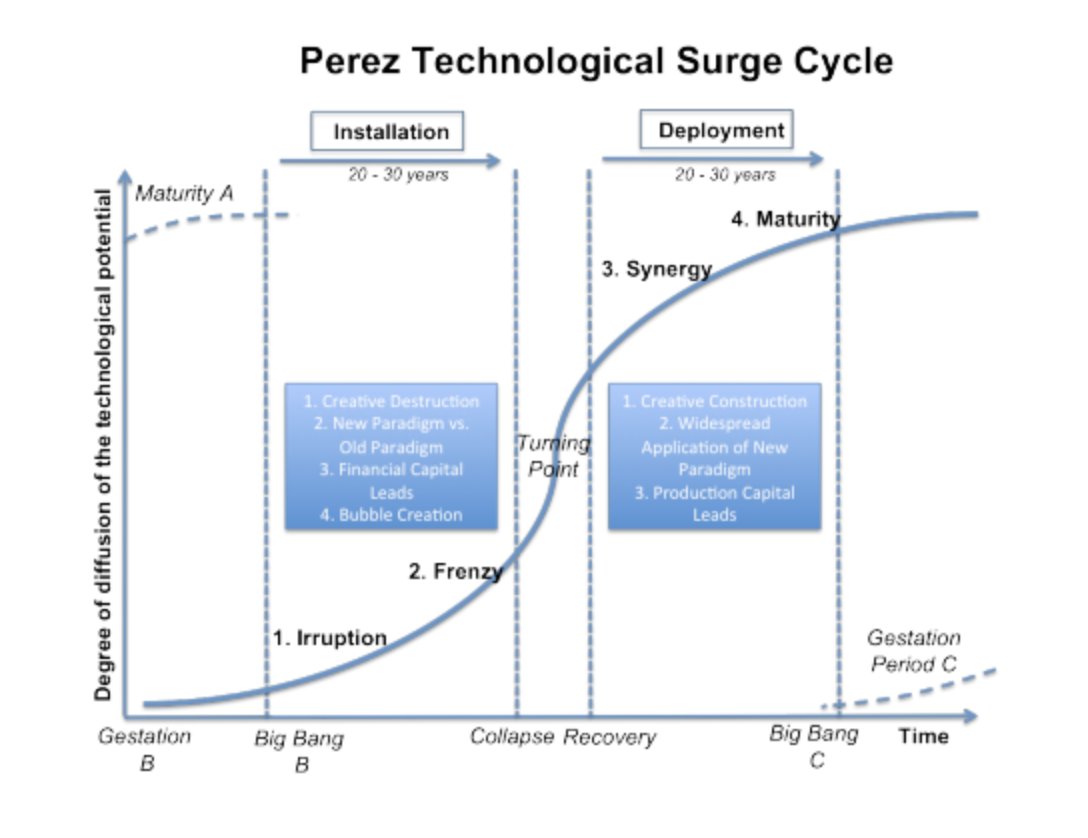

With a supportive US administration, crypto could be entering a goldilocks period over the next many years, where returns aren't as parabolic, but instead we see steadier growth, not to mention majors stop suffering 85-95% drawdowns. In Carlota Perez's framework (see image), we would be entering the "Deployment" period, after what was a very nasty 2022/23 on all fronts.

On drawdowns: I'm not saying they'll stop, I'm saying it's possible they get less extreme for the majors, which could whiplash people that overtrade with too much aggression. That said, I don't believe in "up only" unless you take an infinite view on Capitalism. But the 85-95% drawdowns come when there's too much unrealized profit in the market structure, combined with fear that the asset may never rise again. It's dawning on the world that BTC and quality cryptoassets are here to stay, and so the "this is dead" pricing is likely behind us for the majors (not for memecoins).

I also think BTC and $ETH both having ETFs, and perhaps SOL+ soon, will provide more consistent buying pressure for these assets. If you ever want to see the % drawdown BTC could be exposed to, look at the 200W SMA, which has been our most reliable technical support each bearish period. Right now at ~$40K that suggests a 60% drawdown is possible, which is a far cry from 80%+ (has to drop another 50% from 60% down, to hit 80% down). As BTC rises, so too will the 200W SMA. And despite always entertaining this number as a possibility, I continue to believe 2025 is a volatile but great year for us.

If there were two major sicknesses I could cure CT of, it would be 1) pessimism and 2) short-termism. Both of these will strip you of the opportunity to hone your investment skills and build significant wealth. Sure, I raise cash in frothy periods from extended assets, but I always stay net long because I firmly believe blockchains are key to our future.

3.2K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.