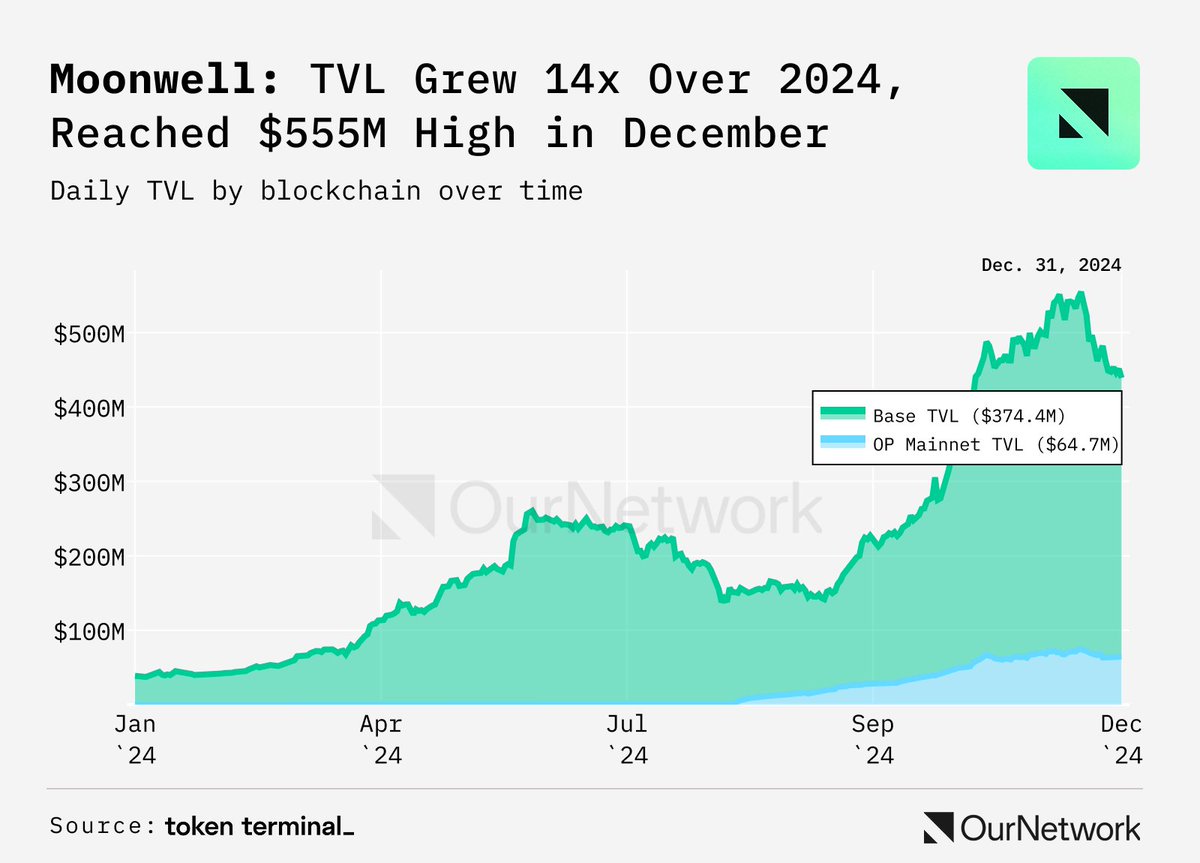

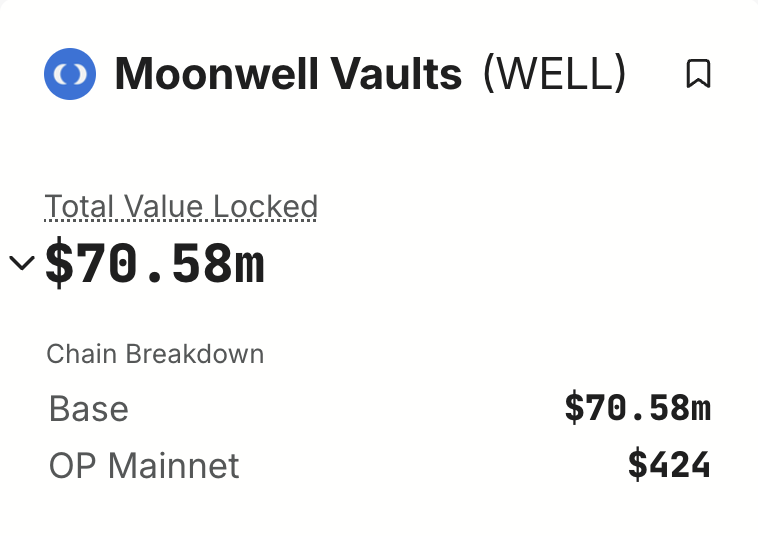

Thanks to @TokenTerminal and @OurNetwork__ for sharing this data. This doesn't count our Morpho vaults which supply USDC to the @Coinbase Borrow product.

We actually reached over $1 billion total market size in late 2024 and are currently at $512m despite macro headwinds.

🌜📈🌛

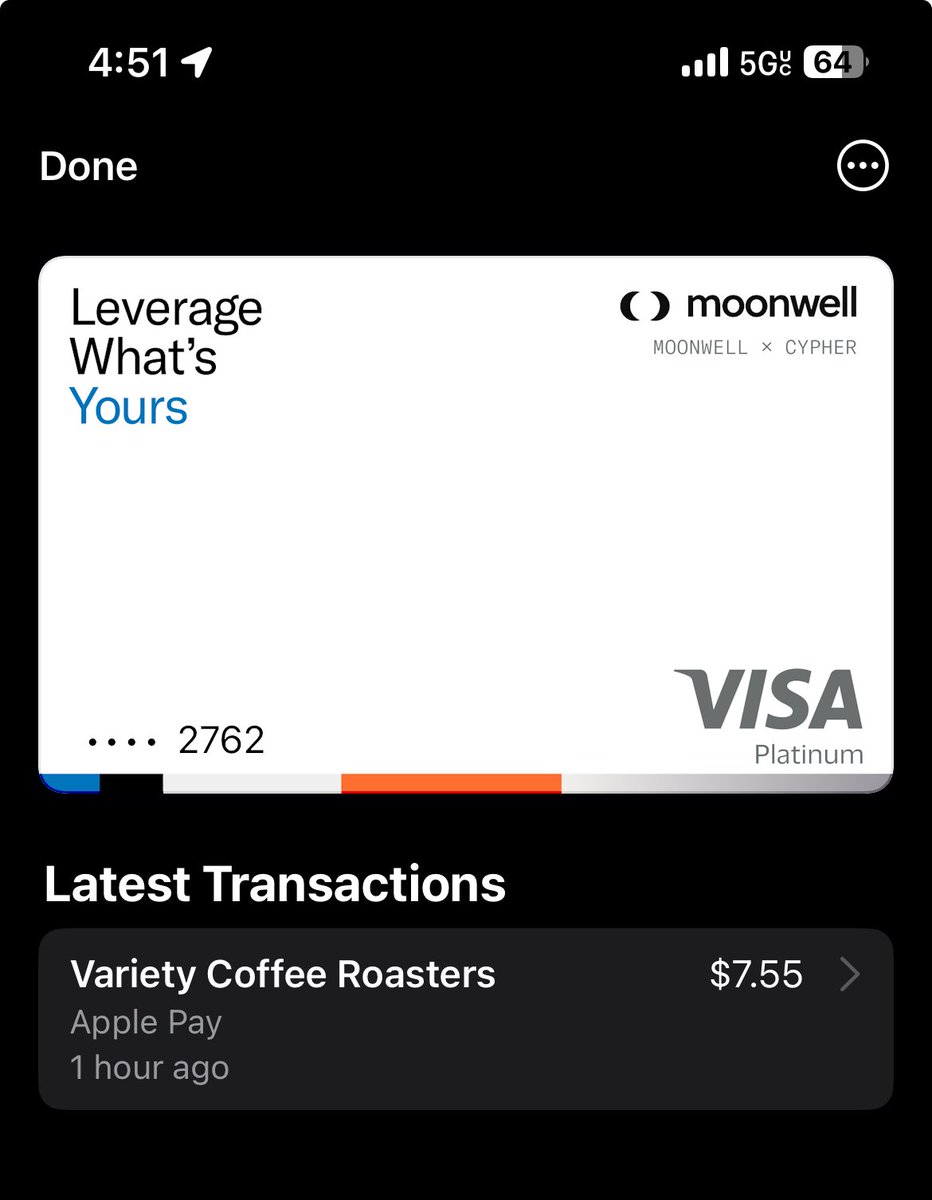

When you support the best collateral assets like cbBTC, VIRTUAL, MORPHO, AERO, and tBTC, holders can borrow to shop with the Moonwell card without selling, and USDC suppliers earn real yield from longs that don't have to sell to get leverage...

🌜💳🌛

One of the ways contributors have increased protocol revenue is through curating @MorphoLabs vaults. The Moonwell Flagship vaults generate performance fees which contribute to revenue, although the lender earnings are captured in Morpho's numbers.

🌜🦋🌛

All 3 of these revenue drivers have landed in the last 9 months, during extreme market volatility:

🏪 New markets for @Base native assets like AERO, WELL, MORPHO, VIRTUAL, and cbBTC

🦋 Moonwell Flagship and Frontier Morpho Vaults

🔮 Oracle Extracted Value

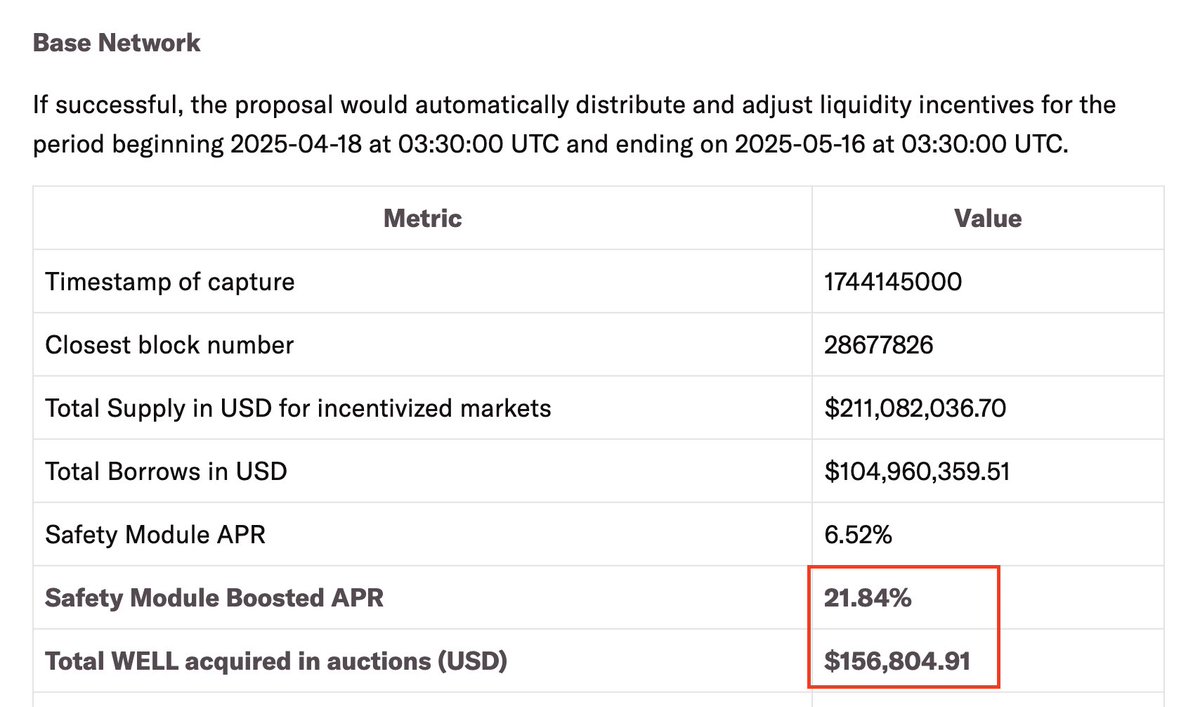

To complete the circle, Moonwell contributors at @SolidityLab also implemented another industry first: excess reserves (revenue) now get auctioned off for WELL to bolster the ecosystem reserve which rewards WELL stakers for providing shortfall insurance.

I hope you can see the vision @MoonwellDeFi contributors are building. We're all building it together, with dozens of devs across many countries, companies, and timezones. Follow me for more high quality content on @Base and Moonwell, and please repost:

28.73K

159

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.