1. Nike saw its share value plummet shortly after the announcement of new tariffs by US President Donald Trump.

In just two hours, the share price fell by 9% – for us, i.e. for the cryptocurrency market, it is bearable, but on the traditional stock exchange it is a rather rare sight.

The main reason for this decline was the announcement of high, 46 percent tariffs on products imported from Vietnam. This is important for Nike, mainly because as much as 50% of global footwear production comes from this country.

They were hit hard.

2. During Donald Trump's speech, the US market lost about $1.5 trillion in valuation

The whole phenomenon is interesting because until now, i.e. 6 a.m., there is a huge, huge commotion.

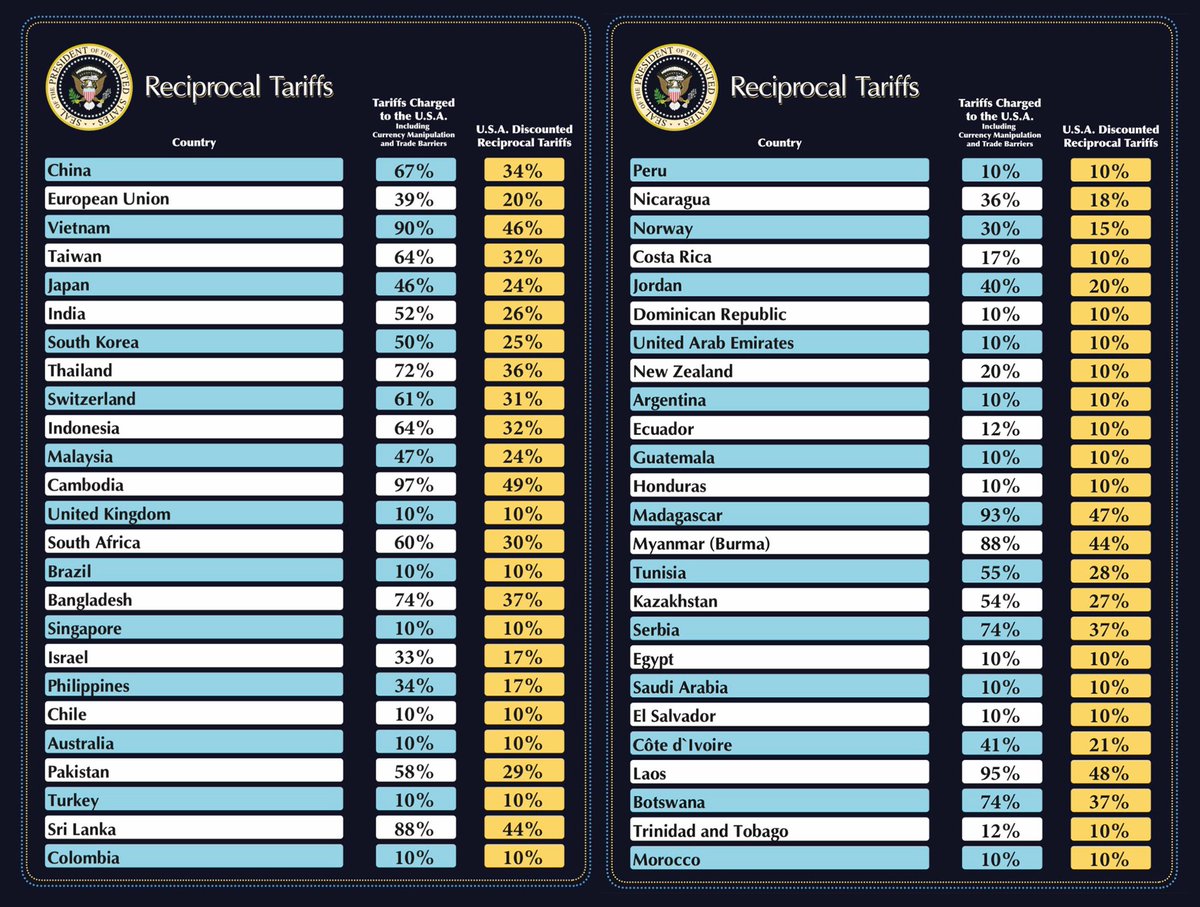

Because despite the fact that the entire list of tariffs has been published on the White House website, it is not necessarily clear what it means.

For example, the table indicates tariffs of 34% on products imported from China. However, the Chinese already had tariffs at the level of 20%.

And for example, Treasury Secretary Bessent, said on television that in his opinion this means that tariffs are raising to a total of 54% on products from China. (20% +34% from the board). CNBC and other sources also write about 54% tariffs on China.

3. In total, the reciprocal tariffs announced by Trump will cover more than 60 economies.

What is even more interesting according to the CICC analysis

the tariff range could cause the effective tariff rate in the U.S. to skyrocket from 2.4% in 2024 to 25.1%, exceeding the level in effect after the passage of the Smoot-Hawley Tariff Act of 1930 (Great Depression)

According to their analysis, PCE inflation in the US will increase by 1.9 percentage points and reduce GDP growth by 1.3 percentage points, and will also bring an additional 700 billion from tariffs to the budget.

It is interesting to see from what perspective the FED will look at this data in the future.

4. Coming back to China, so far there has been a lot of talk about China artificially weakening the Yuan to compensate for the difference in potential tariffs with a weakening of the currency. However, I don't think anyone expected such high tariffs.

Personally, I don't see a way to devalue the currency by an additional 1/3 without threats, but that's just my opinion.

The Chinese Ministry of Commerce itself responded, after the announcement of these tariffs, that they would take countermeasures to protect their own rights and interests.

I suppose it's about customs duties the other way around.

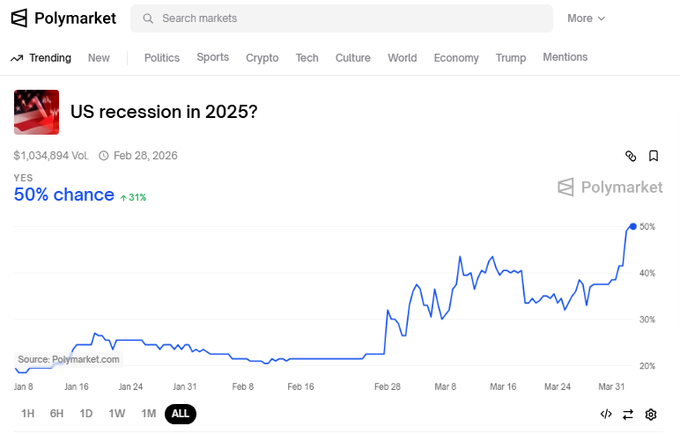

5. Bookmakers are betting a 50% chance of a US recession in the course of their current actions

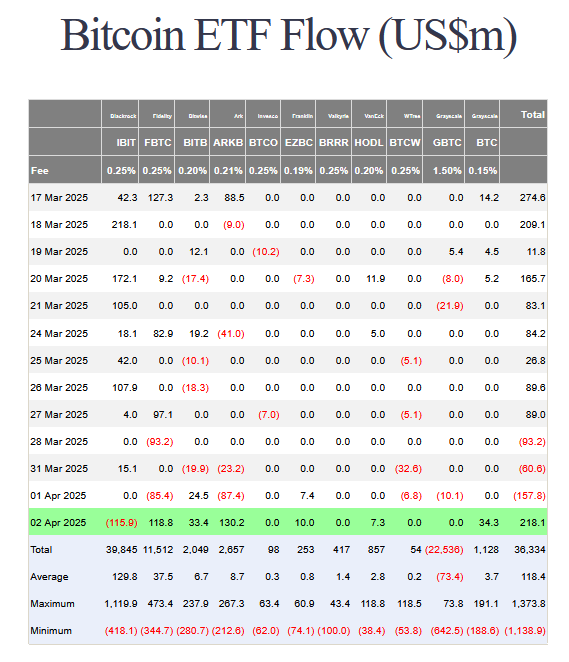

6. ETFs, or rather ETF clients, it would seem that they did not panic.

Although here we have an interesting phenomenon, probably for the first time in history, Blackrock's customers got rid of their shares and selected other ETfs, it usually looked the other way around.

Nevertheless, I wrote "it might seem" at the start, I wrote this mainly because ETFs only worked for an hour after the tariffs were announced.

So it's hard to say how it will be today.

7. UBS reportedly estimated a few days ago that if the proposed tariffs are fully implemented, the inflation rate in the United States could rise to around 5%.

However, I did not get to a direct analysis, and I do not know what tariffs were previously estimated.

A large discrepancy, in relation to other more precise calculations, I would look at such data with a certain distance anyway.

8. According to data released by JPMorgan, 14 public bitcoin mining companies lost a total of $6 billion in market value in March. It was the worst month in the history of this sector.

In percentage terms, this 6 billion is about a 25% loss.

Interestingly, BTC lost 3-5% during this time.

-----------------------------------------

That's it, I won't bother you any longer.

If you have read it and you can, please leave a comment to improve the range. Thanks.

Show original

963

70.89K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.