Ethereum raised the gas limit to 60 million, and the scaling path is gradually becoming clear

Words: Ebunker

In the past, many people's impression of ETH's TPS (Transfers Per Second) was still stuck at "15 transactions per second". However, with continued protocol optimization, Ethereum's current TPS peak has increased to around 60, a 4x increase.

While this change is related to years of continuous optimization, the most direct reason for this is the simple and effective increase in the GAS Limit from the 15 million to 36 million cap.

Recently, ETH is about to raise the GAS limit to 60 million again.

What is GAS Limit?

Each of us using ETH needs to pay gas as a transaction fee. Gas Limit, as the name suggests, is the upper limit of the amount of gas that can be held in each block. The higher this limit, the more transactions a block can process, and the faster the network will be.

Of all the scaling paths, increasing the gas limit is arguably the most immediate way to do so.

More critically, this adjustment does not require a hard fork, as the Gas Limit is a dynamic parameter in Ethereum that PoS nodes can fine-tune under existing protocol rules.

In other words, the protocol itself allows producers of each new block to adjust the gas limit in the range of ±1/1024 compared to the parent block, which is itself part of the consensus mechanism. This is also very different from Bitcoin's mechanism of fixing the block size at 1MB.

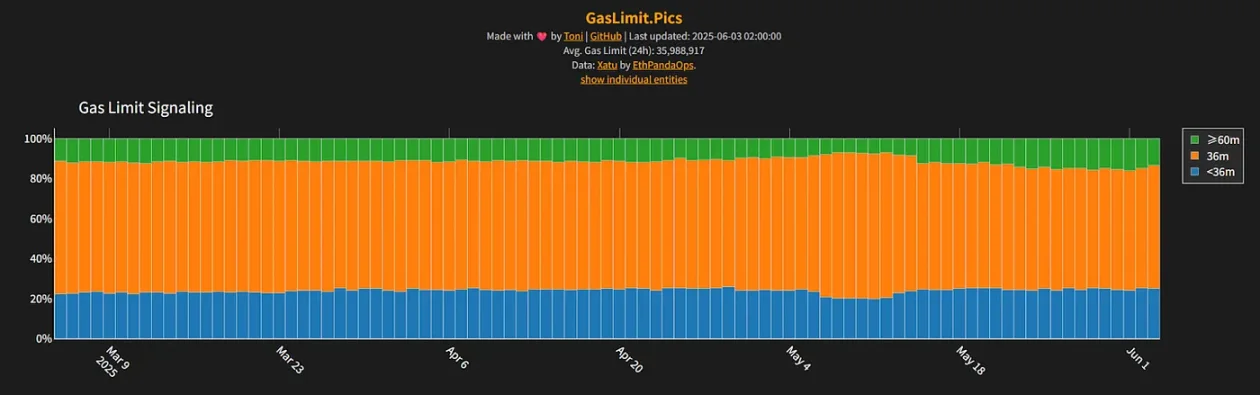

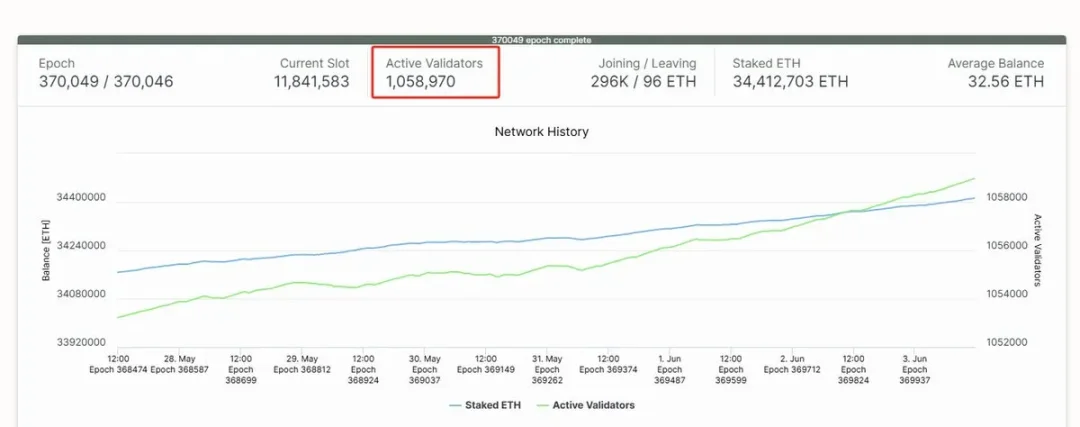

Therefore, increasing the gas limit does not require a system upgrade or code modification, as long as the PoS nodes continue to "signal" support at block time, the network can gradually adopt this change. There are currently more than 1 million validators across the Ethereum network, and as long as a certain percentage of support is reached, the network will automatically transition to the new gas cap and ensure the compatibility of all nodes.

So far, about 15% of validators have chosen to support a setup that supports 60 million gas. Ebunker has also been supported, and as an unmanaged node service provider, we are always focused on balancing the performance of the Ethereum network with decentralization. Since this is a voluntary process, a significant portion of nodes remain in an older version (e.g., 30 million) configuration.

Increasing the Gas Limit does not mean that PoS nodes can earn more money, in fact, it is likely to earn less.

Since the launch of EIP-1559, Ethereum's Base Fee has been directly burned, and validators can only earn tips that users actively add. Once the gas limit is increased, it means that the processing power of the entire network is increased, transaction congestion is reduced, and the pressure to compete for tips is also reduced, and the tip amount will naturally decrease. So, to some extent, the increase in the gas limit actually reduces the income of validators, and the amount of ETH burned further increases.

Therefore, under such an incentive mechanism, the validators who still choose to support the 60 million gas limit can be said to be selfless.

In addition, there has recently been a controversial proposal from the community – EIP-9698. The proposal proposes to increase the gas limit from 36 million to 3.6 billion over the next four years, with the goal of increasing Ethereum's TPS to about 2,000, aiming straight at the current high-performance chain Solana. However, this idea is clearly somewhat radical.

Theoretically, as long as the hardware performance of the node is strong enough, the gas limit can indeed be continuously raised. But the reality is that with over 1 million active validators, the Ethereum network needs to juggle a wide range of participants. However, the number of validators of some other high-performance public chains is only at the scale of 100, and the gap between the two is as high as 10,000 times.

Even the current round of proposals to increase the gas limit from 36 million to 60 million was only allowed to enter the network adjustment cadence after the Pectra upgrade brought about load optimization.

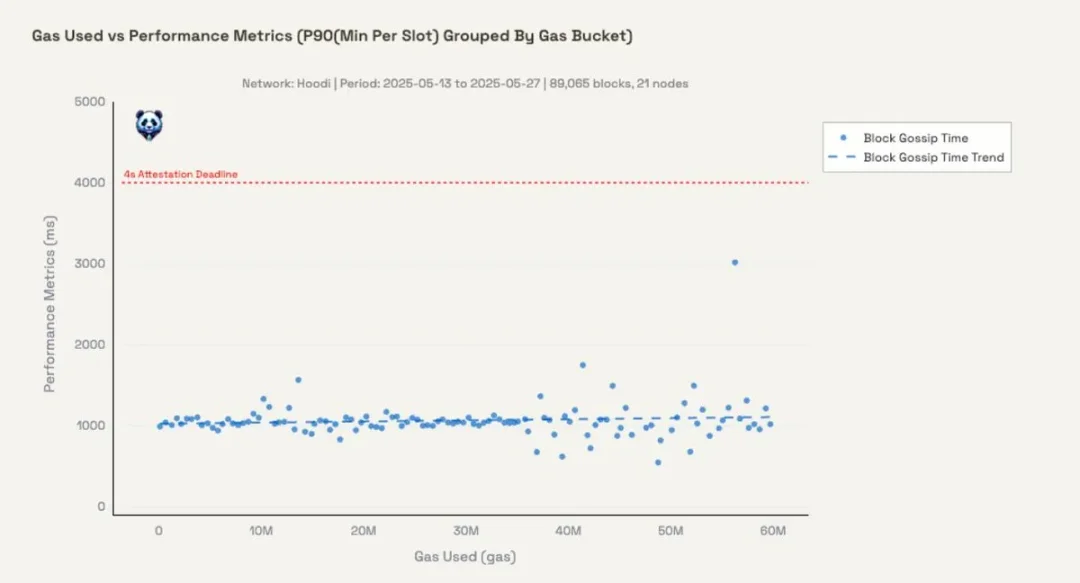

According to ethpandaops, after the gas limit is raised to 60 million, about 90% of blocks can be discovered for the first time within 1016 milliseconds. The block propagation delay has increased slightly compared to before, but it is still within the acceptable range.

However, 66% of nodes in the Ethereum network need to receive the block and its accompanying blob data in full within 4 seconds to ensure that the block is considered valid. Based on this propagation limit, the testnet deduces a theoretical upper limit of about 150 million gas limits. Therefore, under the current architecture, it is difficult to implement the vision of EIP-9698 in the short term.

Of course, if Ethereum implements a "large node/small node" architecture in the future, such as allowing nodes staking 2048 ETH to handle higher loads, while 32 ETH nodes to handle smaller blocks, it may open up new space for further scaling.

Therefore, although everyone often ridicules that the ETH Gas Price continues to hit new lows, and the "noble chain" has long ceased to exist, this may not be due to market changes alone, but that Ethereum itself is indeed becoming faster, more efficient, and more accessible.