Behind the surge in Injective data, is it a flash in the pan or the return of the king?

Author: Frank, PANews

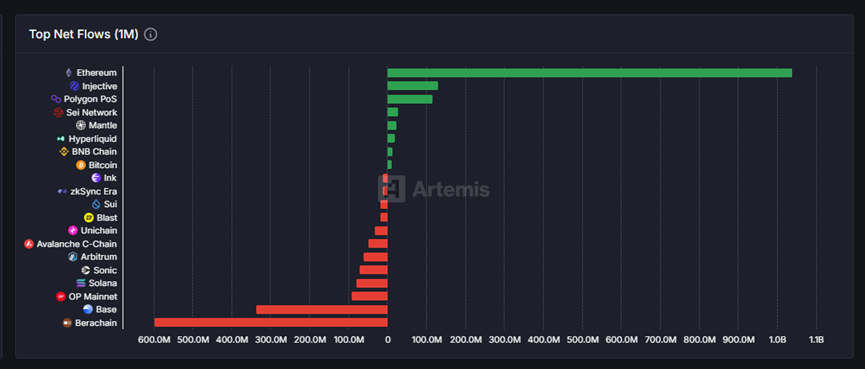

In the past month, Injective, a veteran public chain, has returned to the public eye with the second place in net inflows. According to Artemis data, Injective's net inflow in the past 30 days is about $142 million, which is only lower than Ethereum.

PANews also looked at other aspects of Injective's data and found that this net inflow was not a singular phenomenon. There has been a significant increase in on-chain fees, active users, token trading volume, etc. After a long period of silence, will Injective, the former rising star of the public chain, usher in an ecological explosion again? Or was it a short-lived flash in the pan?

With a monthly inflow of $142 million, is the high yield a "honey" or a "signal flare"?

Data as of June 4 shows that Injective has achieved a net inflow of $142 million in the past month. Although the amount is not high, it still ranks second in the recent data of all public chains. A closer look at the data shows that the obvious reason for this net inflow is that Injective did indeed see a wave of rapid and large inflows on the one hand, and a very small net outflow of $11 million on the other. Therefore, if we look into the reasons for this, Injective's top net inflow ranking is not due to its unusually active overall capital flows (i.e., large inflows and outflows at the same time). In fact, its simple capital inflow only ranks about 10th in the horizontal comparison with other public chains. The key to its outstanding performance in the 'net inflow' indicator is that the outflow of funds over the same period is negligible.

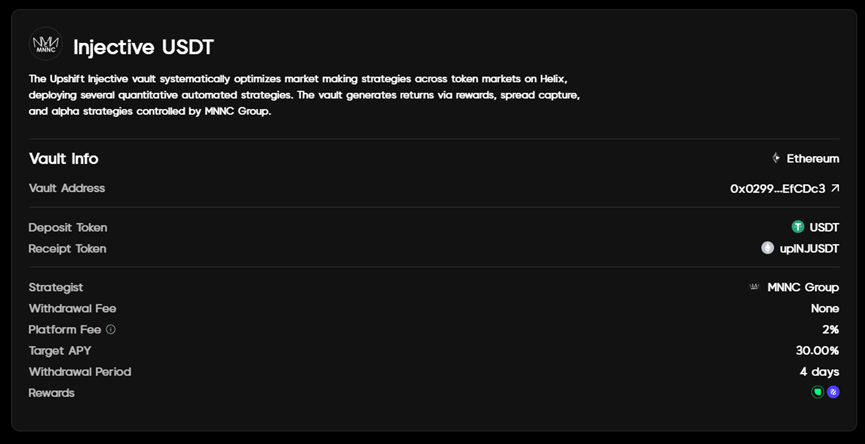

However, this kind of on-chain fund movement is also rare for the Injective network. Of the 142 million inflows, 140 million were completed through the Peggy cross-chain bridge, accounting for 98.5% of the share. Market analyst Keyrock pointed out in its May 26 report, "Key Insights, Bond Appetit," that the massive inflow was largely attributed to the launch of Upshift, an institutional-grade yield platform, on Injective. It is understood that Upshift's APY in Injective's vault has reached 30%, and this high yield may indeed be an important reason to attract funds to transfer assets to Injective.

However, PANews found through investigation that Upshift's vault hard cap of $5 million at Infinite could not fully handle the inflow and utilization of this part of the funds, and those funds that did not participate in this vault investment may be lost again in the short term.

From derivatives to RWA hopes, can Injective open up a new game?

In addition to the inflow of funds, Injective has indeed ushered in some important changes in the ecosystem recently. On April 22, the Lyora mainnet was officially launched, and this upgrade is an important milestone in Injective's development history. After this mainnet upgrade, technical optimizations such as dynamic fee structure and smart memory pools were introduced, and according to official sources, after the upgrade, Infinite was described as "faster" and claimed to have lower latency and higher throughput.

In addition, Injective has launched iAssets, an oracle framework specifically for RWA, and Upshift's vault is a RWA DeFi vault. On May 29, Injective officially announced the launch of the on-chain foreign exchange market for the euro and the pound, using the iAsset framework. From this perspective, Injective's new narrative seems inseparable from RWA.

As a veteran public chain, Injective's original core narrative was a decentralized derivatives exchange. The original Injective also evolved from a decentralized derivatives exchange to a public chain, which seems to be the same route as Hyperliquid, which is in the limelight today.

However, Injective's current derivatives trading does not seem to have achieved the expected goal, with data on June 4 showing that the trading volume of the BTC contract trading pair with the highest trading volume on Injective in 24 hours was about $39.75 million, and the derivatives trading volume of the whole chain was about $90 million, compared to Hyperliquid's daily data of about $7 billion, a difference of about 77 times.

Perhaps it was because it was difficult to open up the situation in crypto derivatives that Infinite chose to turn to the direction of RWA integration. On May 22, Injective's derivatives trading reached a maximum of $1.97 billion, significantly higher than other times, and has shown an upward trend in the near future.