Of course.

This video explains the "House Sweeping" using these candles.

That action is good for the market.

So that MM can gather more goods > Push the price stronger.

Sweep the liquidity of long margin using collateral #Btc > #Wbtc > Acquire #Btc + #Wbtc.

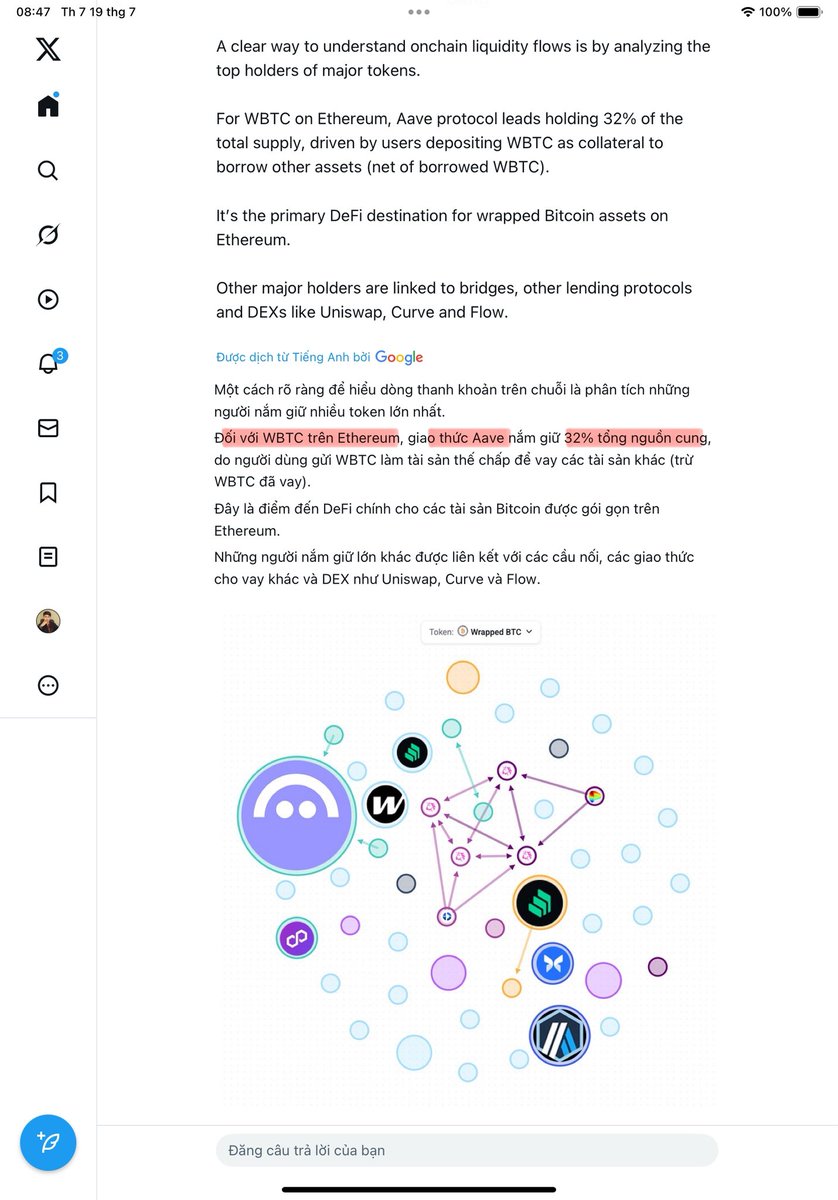

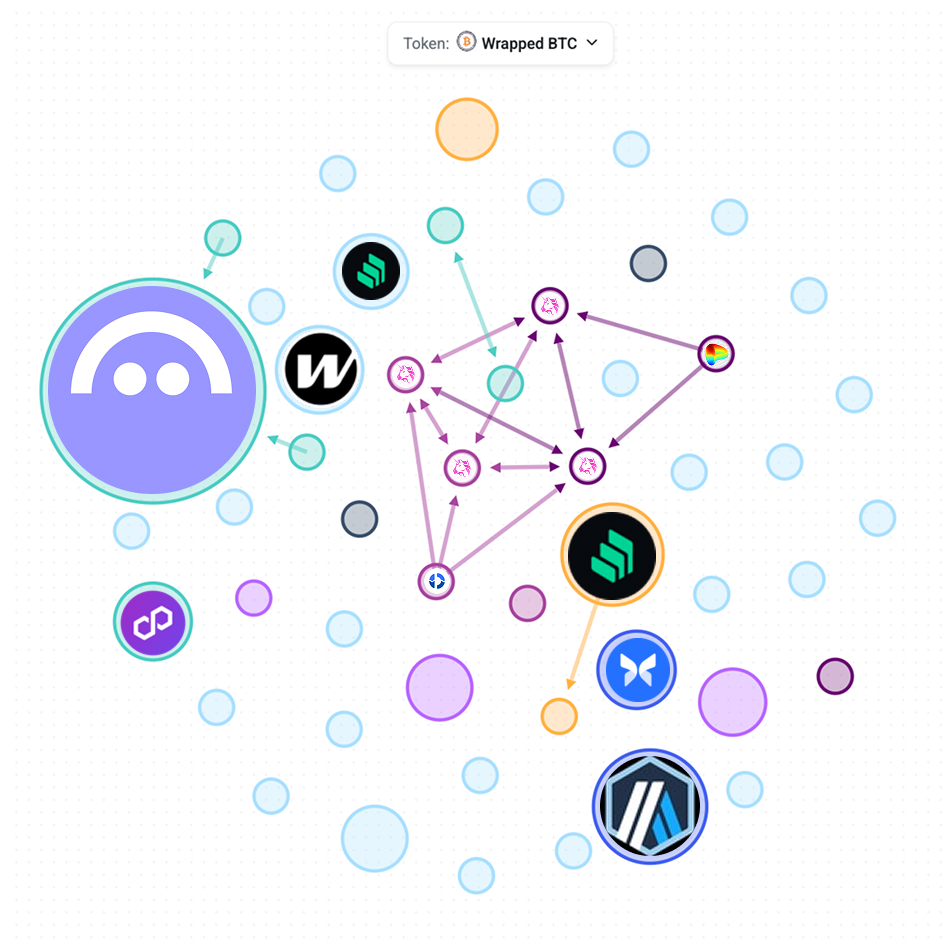

A clear way to understand onchain liquidity flows is by analyzing the top holders of major tokens.

For WBTC on Ethereum, Aave protocol leads holding 32% of the total supply, driven by users depositing WBTC as collateral to borrow other assets (net of borrowed WBTC).

It’s the primary DeFi destination for wrapped Bitcoin assets on Ethereum.

Other major holders are linked to bridges, other lending protocols and DEXs like Uniswap, Curve and Flow.

19.97K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.