The GENIUS Act is going to bring BILLIONS into the crypto/stablecoin space...

But how do you actually CAPITALIZE on this change?

Here are three sets of assets that will likely benefit from the bill passing

(Keep scrolling)

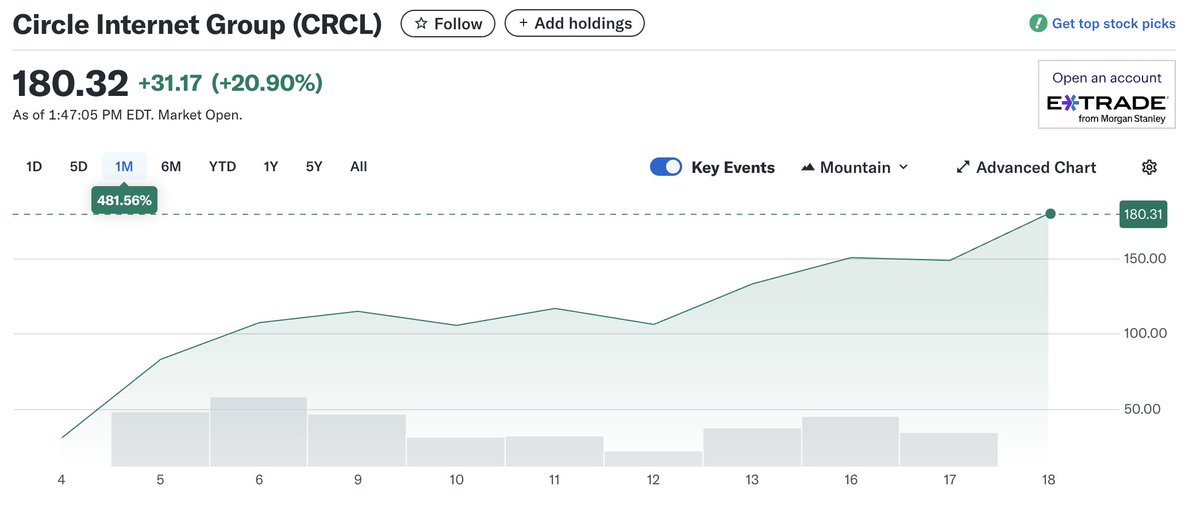

1/ @circle $CRCL (duh)

Circle is the issuer of $USDC and the only fully compliant & publicly traded stablecoin company in the US…for now

It's up ~6x since its IPO two weeks ago

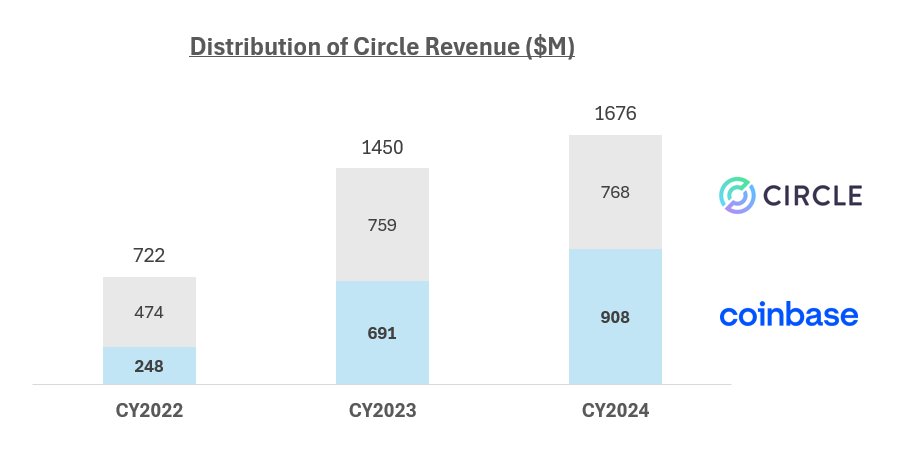

@YahooFinance 2/ @coinbase $COIN

Coinbase received – get this – 54% of Circle’s 2024 revenue, thanks to their current distribution deal

(A deal that is set to continue through 2025)

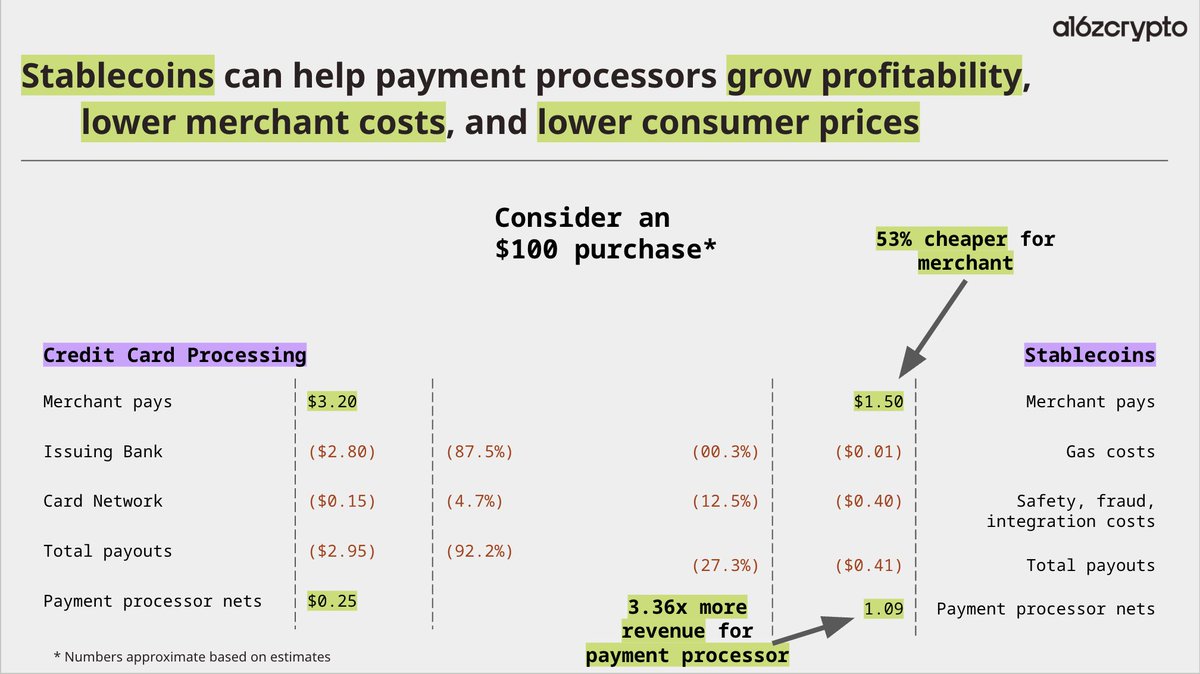

3/ Fintechs (think: @PayPal, @Blocks, @Stripe)

The GENIUS Act will allow non-bank fintechs to build/innovate in stablecoin payments

...and it’s estimated by @a16zcrypto that stables could more than 3x the revenues of payment processor businesses ↓

@lordvolth @SamBroner Want more insights like this delivered to your inbox daily?

Subscribe to our newsletter. It's free and you can always unsubscribe.

15

7.36K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.