Big B @BTCBruce1 said that @pumpdotfun was banned because of a group lawsuit? I don't think that's the reason. If you simply look up information about pump being sued, you'll find that these two class action lawsuits actually occurred in January of this year, not recently. Moreover, based on the claims of these two lawsuits and the current SEC's regulatory stance on memecoins, the probability of pump winning is very high, as long as the court doesn't ignore the SEC's clarification statement on memecoins released on February 27. If pump wins this case, it can be said to be almost certain. This is also why pump has not caused much of a stir since being sued, nor has it affected its activity level and TGE plans.

Now, let's look at the collective lawsuit against pump from a legal perspective, and the likelihood of both sides winning, ultimately whether it will be as rumored online that a large sum will be paid and then the SEC will come down hard.

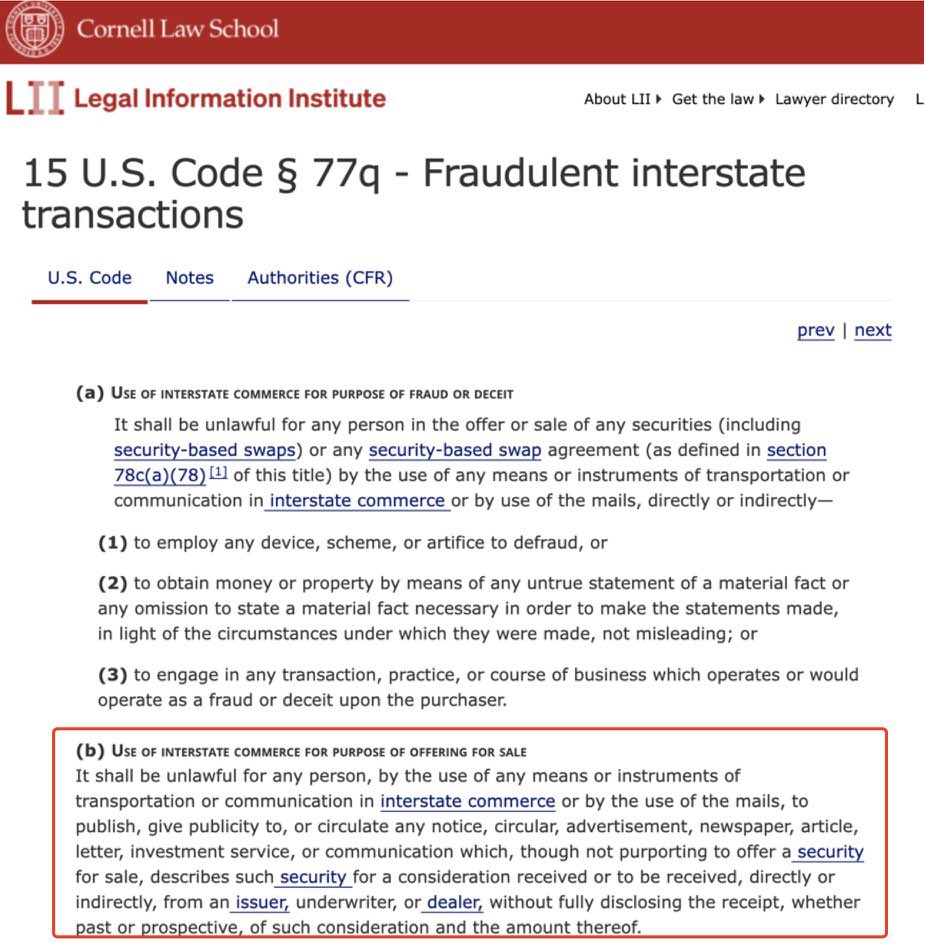

The two main class action lawsuits are Carnahan v. Baton Corporation Ltd d/b/a et al., No. 1:25-cv-00490 on January 16, and Aguilar v. Baton Corporation Ltd d/b/a et al., No. 1:25-cv-00880 on January 30. The main claims in both cases are for 15 U.S.C. § 77 Securities Fraud. This essentially accuses pump of violating the (b) clause in the image below (Image 1), but this claim assumes that memecoins are defined as securities, which means pump's market behavior includes the sale of unregistered securities.

Are memecoins securities? This is the most important legal issue in these class actions, and the answer, according to the current SEC's stance, is no. The reasons are as follows: (1) It is not a "security" under the Securities Act of 1933 (2) It is also not an investment contract as determined in SEC v. WJ Howey Co.

First, according to the SEC's statement on February 27 regarding the regulation of memecoins, it points out that memecoins do not constitute any common financial instruments specifically enumerated in the definition of "security" because they do not generate income and do not transfer rights to future income, profits, or assets of a business; a memecoin itself is not a security. For those who can read, refer to the SEC's original text: "Section 2(a)(1) of the Securities Act and Section 3(a)(10) of the Securities Exchange Act of 1934 each defines the term 'security' by providing a list of various financial instruments, including 'stock,' 'note,' and 'bond.' A meme coin does not constitute any of the common financial instruments specifically enumerated in the definition of 'security' because, among other things, it does not generate a yield or convey rights to future income, profits, or assets of a business. In other words, a meme coin is not itself a security." (Here, a caveat: if a memecoin is tied to a betting agreement/mining arrangement or options for RWA, it may be defined as a security.)

Second, according to the analysis of economic realities in the Howey test, memecoins also do not fall under the category of investment contracts. The Howey test mainly considers "whether there is an investment in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others," requiring that when "the efforts of others outside the investor are undeniably significant efforts that are key management efforts affecting the success or failure of the enterprise," the Howey test's "efforts of others" requirement is met. Here, the sale and distribution of memecoins do not involve investment in a business, nor is there a reasonable expectation that others' entrepreneurial or managerial efforts will yield profits.

First, the purchasers of memecoins are not investing in a business. In other words, their funds are not pooled for promoters or other third parties to develop memecoins or related businesses. Second, any expectations of profit from memecoin purchasers do not stem from the efforts of others. In other words, the value of memecoins comes from speculative trading and collective market sentiment, much like collectibles. Therefore, it does not meet the conditions for forming an investment contract. (Note here that those using the title of memecoins to actually raise funds for development or establish businesses, the shell of the memecoin does not guarantee your safety.)

So, based on the SEC's statement on memecoins, which came after these two class action lawsuits, it actually overturns the main claims of the two lawsuits, namely that memecoins are securities and that pumpfun is trading unregistered securities. Therefore, as long as the court does not contradict the SEC's statement on memecoins, pumpfun's victory can be said to be almost certain. The only risk point is that the court does not reference the SEC's current statement and regulatory stance on memecoins.

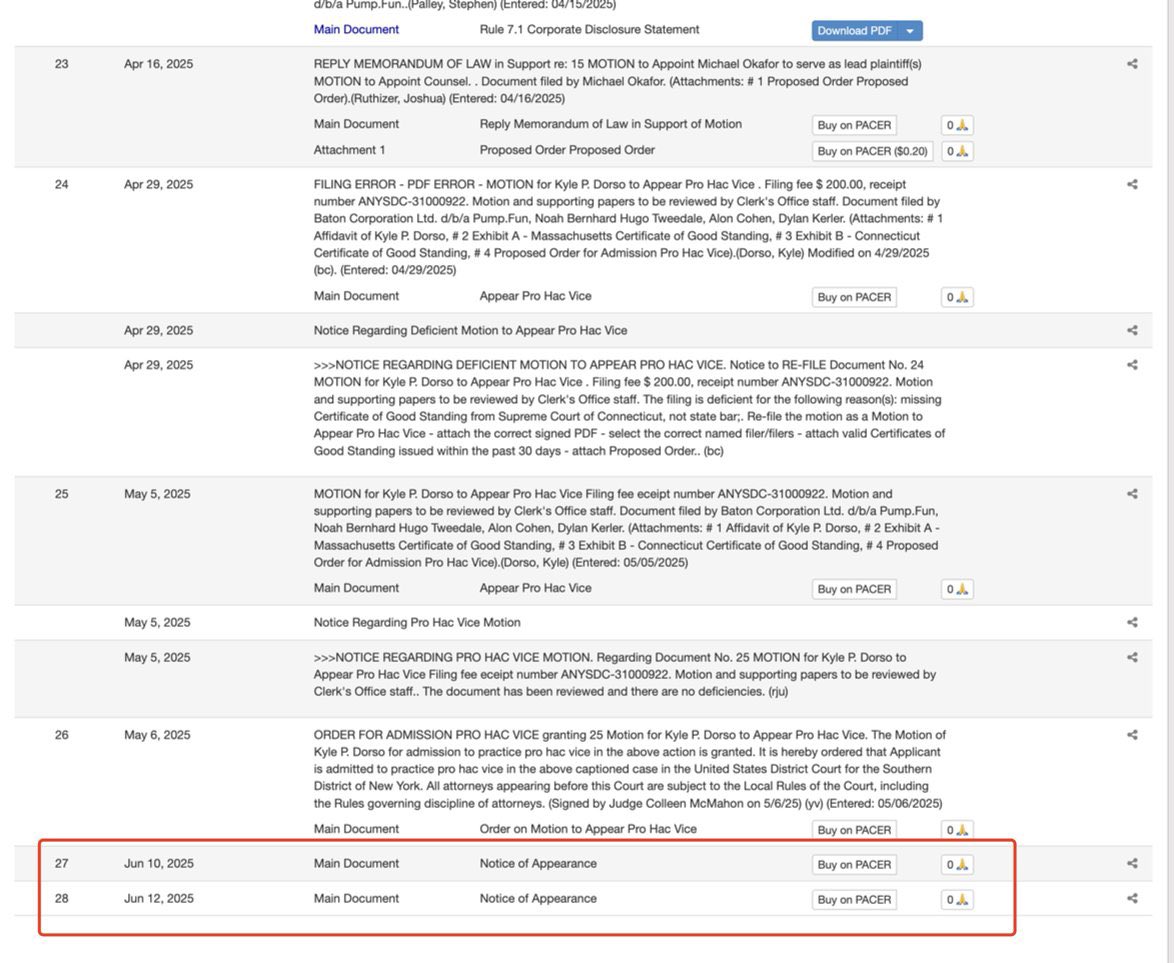

Additionally, this case is still under review, and there was indeed some movement on June 12, but it was just a notice to summon witnesses (Image 2), not a significant decisive step. So overall, saying that this time pump was banned due to the SEC's heavy hand can be said to be nonsense. Instead of worrying about this, it would be better to spend time researching and learning the law.

Show original

54

12.55K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.