These past couple of days, I originally wanted to take a break and relax... probably just a few days off a year, but when I saw the market warming up again this morning, I had to get back to it!

It's mainly noticeable that this time, besides the DeFi tokens being strong, the AI agents are also not falling behind! $VIRTUAL $AIXBT $VADER

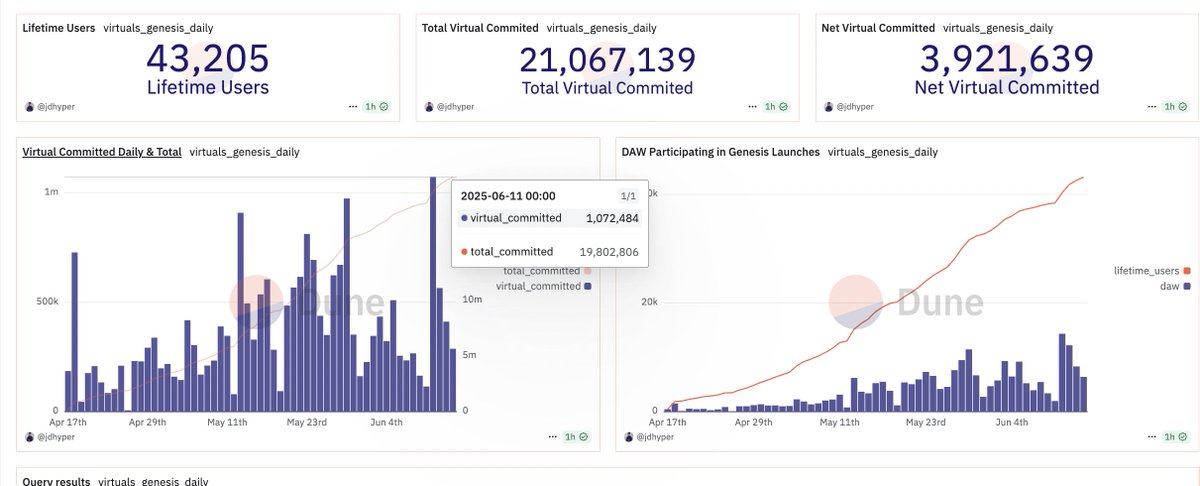

💡 Currently, @virtuals_io's DAW (daily active wallets) is maintaining a level of 4-5K, with a peak of 14K on the 11th, which is a good sign for me, as there are no signs of a continuous decline in DAW.

For the ecosystem to be vibrant, it really needs to pull up the market.

Virtual also posted a monthly update yesterday, sharing a few interesting points.

💡 Axelrod $AXR previously became the first airdrop token in the Genesis series.

💡 When @Bizzy_agent launched, the request volume on the base network surged 7 times, reaching a peak of 500,000.

💡 From an initial user cap of 2,500, it expanded to 20,000, and in 4 weeks, 16 updates were released. I can only say that the Virtual team is indeed very competitive.

----

Last week's hot topic $IRIS data:

2,450 wallets ultimately became Jeet Jail status,

78% of wallets still hold $IRIS 👀 occupying 70% of the total token supply.

source @JDHyper

----

Next, $ROOM @usebackroom should also be one of the most关注的 recently, and now the official team has launched a Yap plan, where anyone who binds X and interacts in the comments will become a referral.

1.5% of the total token supply will be distributed to the referral part.

---

Future outlook: I agree with @rich_adul's earlier tweet and several key points discussed in the recent Virtual community.

1️⃣ Currently, there are indeed not many distinctive agents. Even the recently popular hackathon project @solacelaunch hasn't updated its tweets for 4 days, and the last tweet was about the roadmap, which really shouldn't be the standard for a hackathon champion. 😅

2️⃣ The incentive for new token launches is far from enough to motivate the entire ecosystem; secondary effects are also very important. Currently, we can see significant daily point differences among different groups of virgins. Besides continuously bringing good teams into the Virtual ecosystem for issuance, perhaps the secondary market also needs some attention; we can't just let most tokens be issued poorly.

Look at today's DYOR token... the rewards are even higher than many locked green tokens, which is also a way to make money.

The DYOR token can be sold directly upon opening, with no penalties.

Of course, I still hope to see tokens with clearer empowerment bring wealth effects, allowing the team to succeed in breaking out, which will continue to attract more new players into this game.

Simple sharing of the recent data you need to know about @virtuals_io Genesis

Let's start with the conclusion: there's no need to worry too much right now 👀

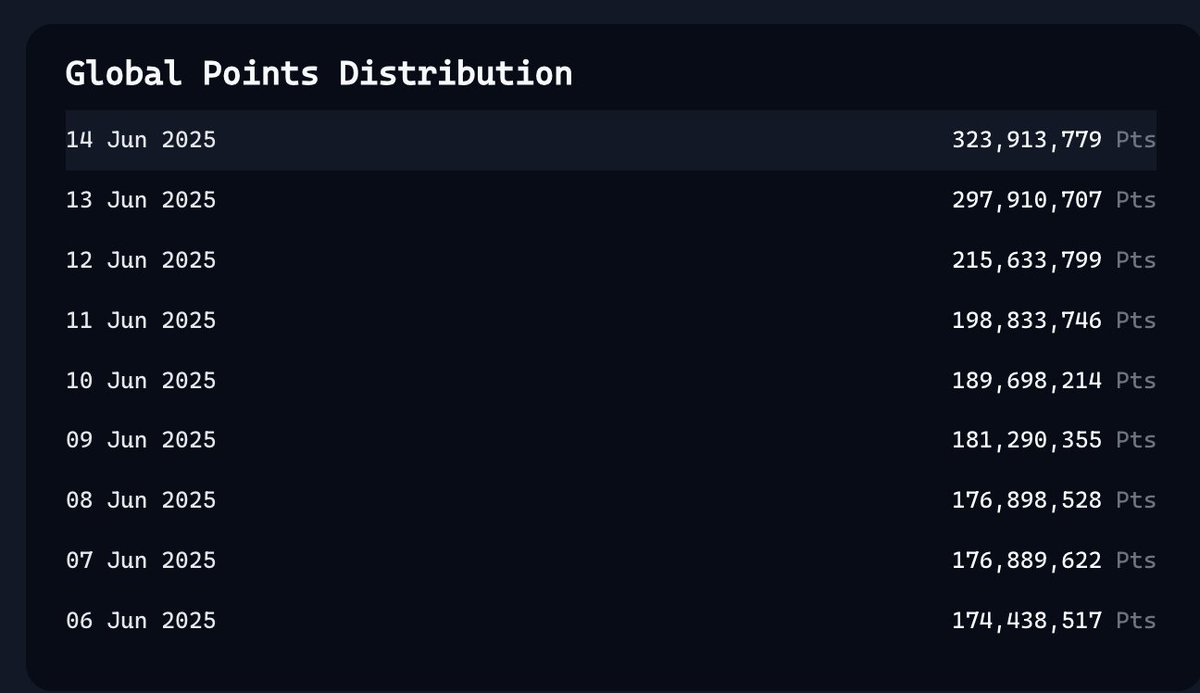

💡 From June 10 to now, the daily total points issued have increased from 190M to 324M, a growth of 70.5%.

This means that if your score growth in the past few days hasn't exceeded this ratio, then it's a decline. My personal score growth is 60.7% 🥶

------

$VIRTUAL related data

Currently, the committed Virtual participating in the launchpad has exceeded 20M, with a current circulation of 654M.

Here we can also see that the sale of $IRIS on June 11 indeed saw the largest amount of investment, with a single investment exceeding 1M virtual.

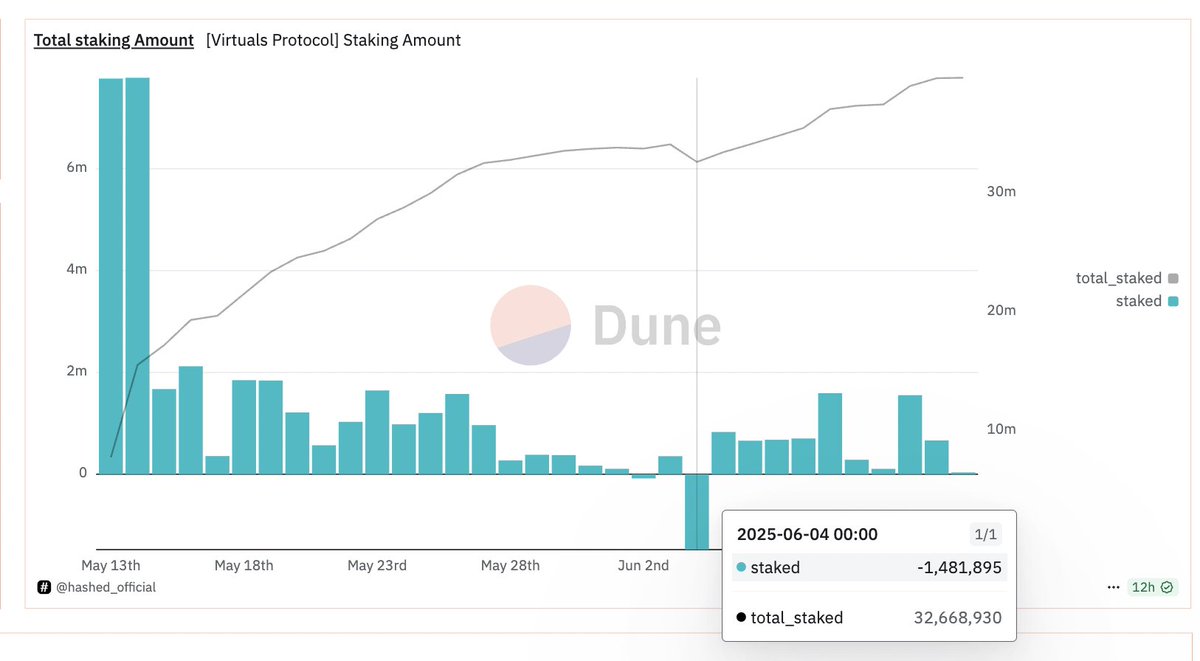

Several larger withdrawal days (VIRTUAL unstaking) since May 21:

Including:

May 21: 1.1M (staked amount on that day 1.7M)

June 4: 2.3M (staked amount on that day 860K)

This day was the largest withdrawal day recently 🩸

June 9: 1.3M (staked amount on that day 2.9M 💥)

June 11: 1.4M (staked amount on that day 1.1M)

We can see it more clearly using another Dune made by @hashed_official.

----

The number of daily active wallets has started to decline since June 11.

June 11: 14K -> June 14: 6.4K (-55% 📉)

I will put the links to several Dune in the comments, feel free to check them out if you're interested.

s/t to @JDHyper @hashed_official

-----

Based on the current data, there's no need to be overly concerned, as there hasn't been a large-scale exit. Of course, the active index needs to be monitored.

The first point to watch may be the end of June, to see if the wealth effect of IRIS has been fully digested (I expect that some will exit).

If we can get through this current phase, the subsequent test will be whether the Virtual ecosystem can continue to find good teams to keep the flywheel turning.

I also found several reasonable points in @Metabape's earlier sharing.

1️⃣ We should significantly increase the weight of secondary trading, which means the real buying part, to stimulate revenue and trading volume, as this is the most basic for the ecosystem.

2️⃣ Trading behavior itself is unrelated to the project's fundamentals; the current quality is still not enough. It cannot be denied that Virtual is indeed the best-performing AI agent launchpad on the entire network (almost all others have died).

However, we still need to bring more players into this game, aiming for "protocol revenue," "incentivizing token holders," and even the emergence of "new narratives" would definitely be good for everyone.

So far, I think the ecological positions of @aixbt_agent and @VaderResearch are indeed stable, but we need more roles like this!

Only then can we go further like other DeFi Cash Cows in the Ethereum ecosystem, such as @pendle_fi, @0xfluid, and @MorphoLabs, whose teams generally earn over 1M in a month.

At the same time, echoing @S4mmyEth's earlier tweet,

Opensea led the NFT boom in 2021.

Virtual, on the other hand, is allowing more players and teams to see the potential with the AI agent boom, and there’s still a big move with ACP (Agent Commerce Protocol) yet to be released. The AI agent track is still growing.

That's the multi-million dollar asymmetric opportunity.

Keep going

☑️ Look for potential teams

☑️ Look for fundamentally strong ecosystem tokens

☑️ Position for the next 5-10x token.

53

20.86K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.