After Hyperliquid came out, there are really many projects doing Perps and challenging Hyperliquid, with an estimated 20+ Perps based on incomplete statistics. I noticed that one of the few that has launched on Kaito's chain is the perpetual contract Paradex, so I wrote down some data to take a look:

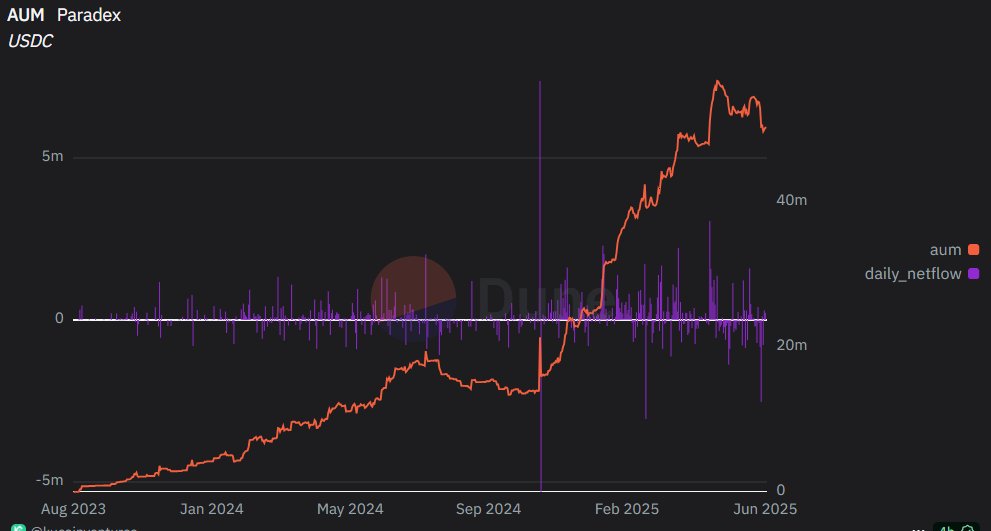

- Paradex has a total value locked slightly above 50 million USDC, which is similar to Ostium, which does perpetual contracts for US stocks next door.

- There are 4.78k depositors, but since Paradex supports third-party bridges like Layerswap and Rhino in addition to the official bridge, and some of these bridges use EOA addresses for intermediary deposits, the actual number of depositors/users is likely higher.

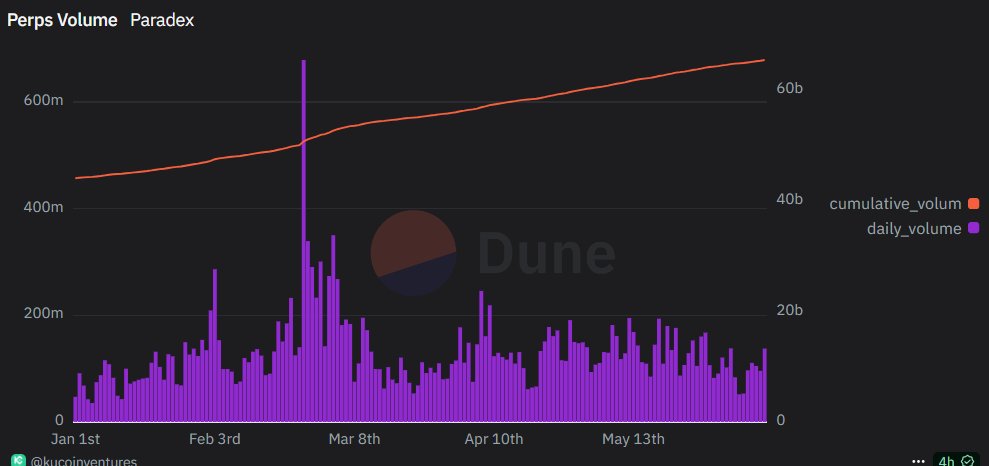

- The historical accumulated trading volume for Perps is 65.48 billion USD, with recent daily trading volume around 100-150 million USD.

- The path is similar to Hyperliquid, doing Perp DEX -> Chain/Appchain -> Eco, which seems to have become a common template for derivatives protocols. Paradex is built on Starknet and will later launch a yield-bearing stablecoin XUSD as collateral.

Paradex is launched by TradeParadigm, which specializes in institutional-grade derivatives trading, and it seems to be a version aimed at retail investors, making it easier to issue tokens. It appears to have started in 2023, but the main growth has been since this year, likely having changed its approach after referencing Hyperliquid. Overall, there's not much to say, so let's continue to observe. I'll write more data in the coming days to see the actual situation of Lighter.

For exchanges, whether on-chain or off-chain, trading volume and liquidity determine the lower limit, while total value locked determines the upper limit.

Paradex Dashboard:

Show original

11

7.59K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.